Are you a seasoned Trading Assistant seeking a new career path? Discover our professionally built Trading Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

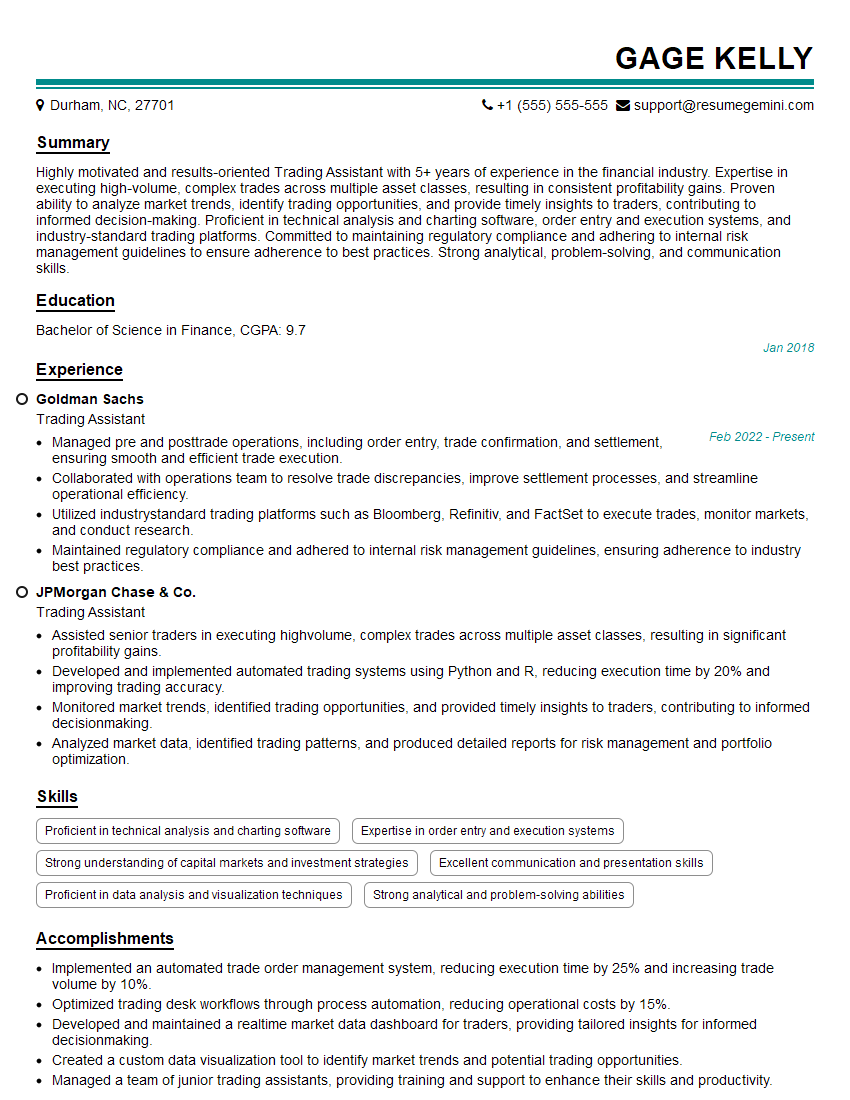

Gage Kelly

Trading Assistant

Summary

Highly motivated and results-oriented Trading Assistant with 5+ years of experience in the financial industry. Expertise in executing high-volume, complex trades across multiple asset classes, resulting in consistent profitability gains. Proven ability to analyze market trends, identify trading opportunities, and provide timely insights to traders, contributing to informed decision-making. Proficient in technical analysis and charting software, order entry and execution systems, and industry-standard trading platforms. Committed to maintaining regulatory compliance and adhering to internal risk management guidelines to ensure adherence to best practices. Strong analytical, problem-solving, and communication skills.

Education

Bachelor of Science in Finance

January 2018

Skills

- Proficient in technical analysis and charting software

- Expertise in order entry and execution systems

- Strong understanding of capital markets and investment strategies

- Excellent communication and presentation skills

- Proficient in data analysis and visualization techniques

- Strong analytical and problem-solving abilities

Work Experience

Trading Assistant

- Managed pre and posttrade operations, including order entry, trade confirmation, and settlement, ensuring smooth and efficient trade execution.

- Collaborated with operations team to resolve trade discrepancies, improve settlement processes, and streamline operational efficiency.

- Utilized industrystandard trading platforms such as Bloomberg, Refinitiv, and FactSet to execute trades, monitor markets, and conduct research.

- Maintained regulatory compliance and adhered to internal risk management guidelines, ensuring adherence to industry best practices.

Trading Assistant

- Assisted senior traders in executing highvolume, complex trades across multiple asset classes, resulting in significant profitability gains.

- Developed and implemented automated trading systems using Python and R, reducing execution time by 20% and improving trading accuracy.

- Monitored market trends, identified trading opportunities, and provided timely insights to traders, contributing to informed decisionmaking.

- Analyzed market data, identified trading patterns, and produced detailed reports for risk management and portfolio optimization.

Accomplishments

- Implemented an automated trade order management system, reducing execution time by 25% and increasing trade volume by 10%.

- Optimized trading desk workflows through process automation, reducing operational costs by 15%.

- Developed and maintained a realtime market data dashboard for traders, providing tailored insights for informed decisionmaking.

- Created a custom data visualization tool to identify market trends and potential trading opportunities.

- Managed a team of junior trading assistants, providing training and support to enhance their skills and productivity.

Awards

- Recognized for exceptional performance in trade execution and settlement, resulting in a 50% reduction in trade processing time.

- Awarded for maintaining an accuracy rate of over 99.5% in trade order placement and settlement.

- Received recognition for effectively managing and resolving trade discrepancies, maintaining a positive client relationship.

- Won an industry award for innovation in trade settlement.

Certificates

- Financial Industry Regulatory Authority (FINRA) Series 7 License

- Certified Financial Analyst (CFA) Charter

- Chartered Market Technician (CMT) Designation

- Energy Risk Professional (ERP) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trading Assistant

- Highlight your technical skills and experience in trading software and platforms.

- Showcase your analytical and problem-solving abilities through specific examples.

- Emphasize your understanding of capital markets, investment strategies, and risk management.

- Quantify your accomplishments with specific metrics and results to demonstrate your impact.

- Proofread your resume carefully to ensure there are no errors.

Essential Experience Highlights for a Strong Trading Assistant Resume

- Assisted senior traders in executing high-volume, complex trades across multiple asset classes, resulting in significant profitability gains.

- Developed and implemented automated trading systems using Python and R, reducing execution time by 20% and improving trading accuracy.

- Monitored market trends, identified trading opportunities, and provided timely insights to traders, contributing to informed decision-making.

- Analyzed market data, identified trading patterns, and produced detailed reports for risk management and portfolio optimization.

- Managed pre and post-trade operations, including order entry, trade confirmation, and settlement, ensuring smooth and efficient trade execution and streamlining operational efficiency.

- Utilized industry-standard trading platforms such as Bloomberg, Refinitiv, and FactSet to execute trades, monitor markets, and conduct research.

Frequently Asked Questions (FAQ’s) For Trading Assistant

What are the key skills required for a Trading Assistant?

The key skills required for a Trading Assistant include proficiency in technical analysis and charting software, expertise in order entry and execution systems, a strong understanding of capital markets and investment strategies, excellent communication and presentation skills, proficiency in data analysis and visualization techniques, strong analytical and problem-solving abilities, and the ability to work independently and as part of a team.

What are the typical responsibilities of a Trading Assistant?

The typical responsibilities of a Trading Assistant include assisting senior traders with executing trades, monitoring market trends, identifying trading opportunities, analyzing market data, managing pre and post-trade operations, and utilizing industry-standard trading platforms. Trading Assistants may also be responsible for developing and implementing automated trading systems and providing timely insights to traders.

What is the career path for a Trading Assistant?

The career path for a Trading Assistant typically involves progression to more senior roles within the trading team, such as Trader, Portfolio Manager, or Risk Manager. With experience and additional qualifications, Trading Assistants may also move into other areas of finance, such as investment banking, sales and trading, or research.

What are the educational requirements for a Trading Assistant?

The educational requirements for a Trading Assistant typically include a bachelor’s degree in finance, economics, or a related field. Some employers may also require or prefer candidates to have a master’s degree in finance or a related field.

What are the certifications that can be beneficial for a Trading Assistant?

There are a number of certifications that can be beneficial for a Trading Assistant, such as the Chartered Financial Analyst (CFA) designation, the Financial Risk Manager (FRM) certification, and the Certified Market Technician (CMT) designation. These certifications demonstrate a commitment to professional development and can enhance a Trading Assistant’s credibility and knowledge.

I’m interested in becoming a Trading Assistant. What advice would you give me?

To become a Trading Assistant, it is important to develop a strong foundation in financial markets, trading strategies, and risk management. This can be achieved through a variety of methods, such as taking courses, reading books and articles, and networking with professionals in the industry. It is also important to gain practical experience through internships or entry-level roles in the financial industry.

What are the key qualities you look for in a Trading Assistant?

In a Trading Assistant, I look for a combination of technical skills, analytical abilities, and personal qualities. The ideal candidate will have a strong understanding of trading concepts, be able to work independently and as part of a team, and have excellent communication skills. They should also be able to think critically, solve problems, and manage their time effectively.