Are you a seasoned Credit Review Officer seeking a new career path? Discover our professionally built Credit Review Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

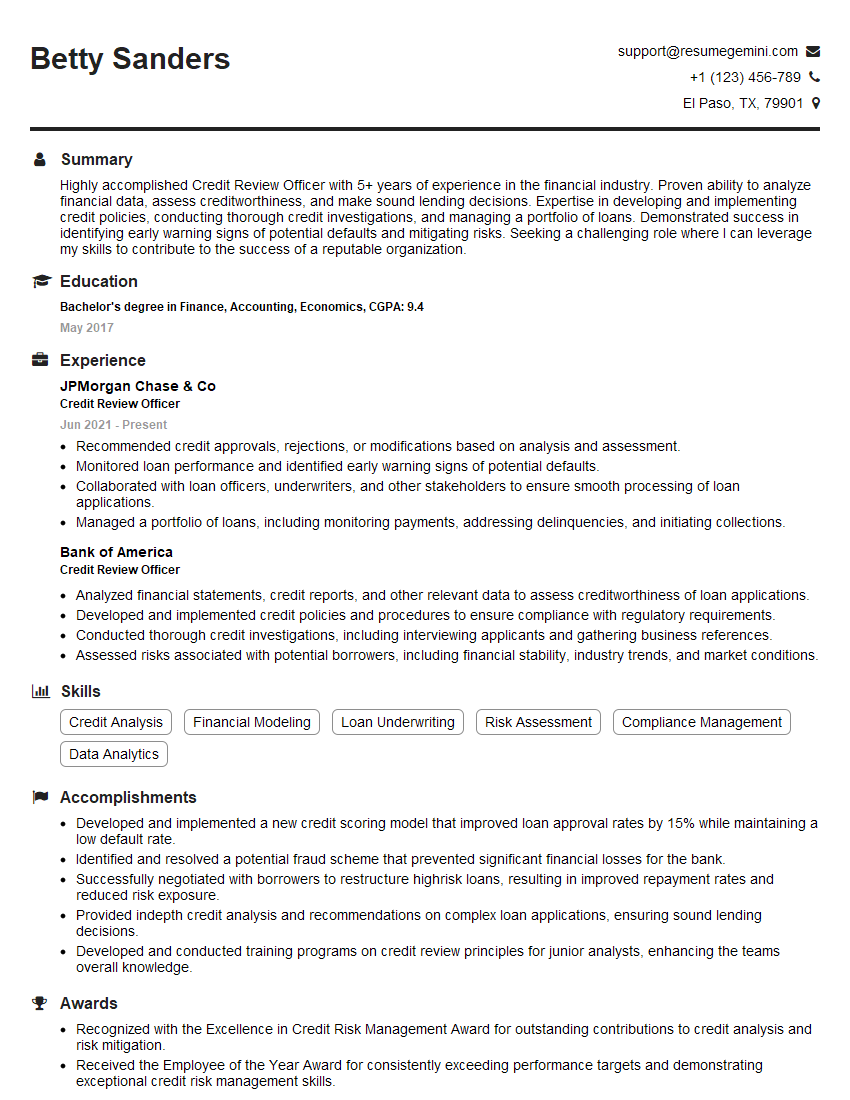

Betty Sanders

Credit Review Officer

Summary

Highly accomplished Credit Review Officer with 5+ years of experience in the financial industry. Proven ability to analyze financial data, assess creditworthiness, and make sound lending decisions. Expertise in developing and implementing credit policies, conducting thorough credit investigations, and managing a portfolio of loans. Demonstrated success in identifying early warning signs of potential defaults and mitigating risks. Seeking a challenging role where I can leverage my skills to contribute to the success of a reputable organization.

Education

Bachelor’s degree in Finance, Accounting, Economics

May 2017

Skills

- Credit Analysis

- Financial Modeling

- Loan Underwriting

- Risk Assessment

- Compliance Management

- Data Analytics

Work Experience

Credit Review Officer

- Recommended credit approvals, rejections, or modifications based on analysis and assessment.

- Monitored loan performance and identified early warning signs of potential defaults.

- Collaborated with loan officers, underwriters, and other stakeholders to ensure smooth processing of loan applications.

- Managed a portfolio of loans, including monitoring payments, addressing delinquencies, and initiating collections.

Credit Review Officer

- Analyzed financial statements, credit reports, and other relevant data to assess creditworthiness of loan applications.

- Developed and implemented credit policies and procedures to ensure compliance with regulatory requirements.

- Conducted thorough credit investigations, including interviewing applicants and gathering business references.

- Assessed risks associated with potential borrowers, including financial stability, industry trends, and market conditions.

Accomplishments

- Developed and implemented a new credit scoring model that improved loan approval rates by 15% while maintaining a low default rate.

- Identified and resolved a potential fraud scheme that prevented significant financial losses for the bank.

- Successfully negotiated with borrowers to restructure highrisk loans, resulting in improved repayment rates and reduced risk exposure.

- Provided indepth credit analysis and recommendations on complex loan applications, ensuring sound lending decisions.

- Developed and conducted training programs on credit review principles for junior analysts, enhancing the teams overall knowledge.

Awards

- Recognized with the Excellence in Credit Risk Management Award for outstanding contributions to credit analysis and risk mitigation.

- Received the Employee of the Year Award for consistently exceeding performance targets and demonstrating exceptional credit risk management skills.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Credit Analyst (CCA)

- Certified Risk Analyst (CRA)

- Certified Credit Risk Professional (CCRP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Review Officer

Quantify your accomplishments

. Use specific numbers and metrics to demonstrate the impact of your work.Highlight your analytical skills

. Showcase your ability to analyze complex financial data and make sound judgments.Emphasize your industry knowledge

. Demonstrate your understanding of the credit industry and relevant regulations.Tailor your resume to the specific job description

. Highlight the skills and experience that are most relevant to the position you are applying for.

Essential Experience Highlights for a Strong Credit Review Officer Resume

- Analyze financial statements, credit reports, and other relevant data to assess the creditworthiness of loan applications.

- Develop and implement credit policies and procedures to ensure compliance with regulatory requirements.

- Conduct thorough credit investigations, including interviewing applicants and gathering business references.

- Assess risks associated with potential borrowers, including financial stability, industry trends, and market conditions.

- Recommend credit approvals, rejections, or modifications based on analysis and assessment.

- Monitor loan performance and identify early warning signs of potential defaults.

- Collaborate with loan officers, underwriters, and other stakeholders to ensure smooth processing of loan applications.

- Manage a portfolio of loans, including monitoring payments, addressing delinquencies, and initiating collections.

Frequently Asked Questions (FAQ’s) For Credit Review Officer

What is the role of a Credit Review Officer?

A Credit Review Officer is responsible for assessing the creditworthiness of loan applicants and making recommendations on whether to approve, reject, or modify loan applications.

What are the qualifications for a Credit Review Officer?

Typically, a Credit Review Officer requires a bachelor’s degree in Finance, Accounting, Economics, or a related field, along with several years of experience in the financial industry.

What are the key skills for a Credit Review Officer?

Key skills for a Credit Review Officer include credit analysis, financial modeling, loan underwriting, risk assessment, compliance management, and data analytics.

What is the job outlook for Credit Review Officers?

The job outlook for Credit Review Officers is expected to grow faster than average in the coming years due to the increasing demand for credit in the economy.

What is the average salary for a Credit Review Officer?

The average salary for a Credit Review Officer varies depending on experience and location, but typically ranges from $60,000 to $100,000 per year.

What are the career advancement opportunities for a Credit Review Officer?

Career advancement opportunities for a Credit Review Officer include promotions to senior credit officer, credit manager, or vice president of lending.