Are you a seasoned Commercial Loan Reviewer seeking a new career path? Discover our professionally built Commercial Loan Reviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

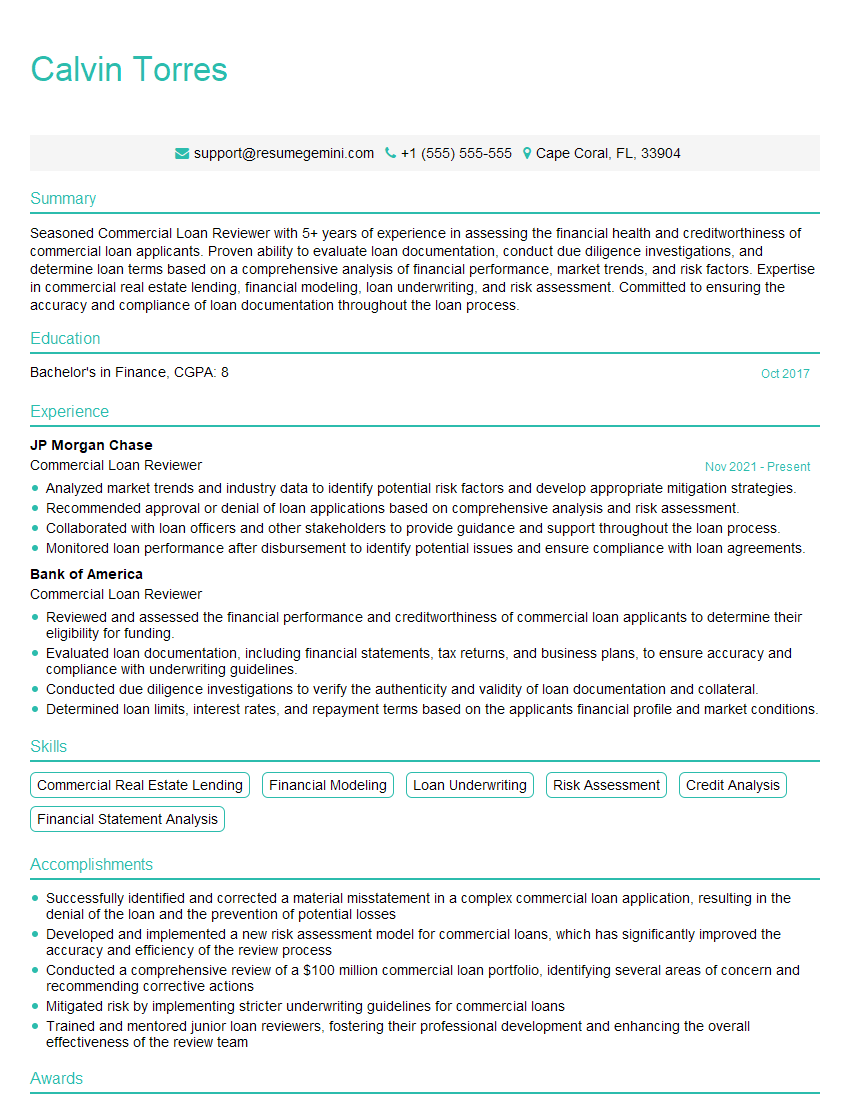

Calvin Torres

Commercial Loan Reviewer

Summary

Seasoned Commercial Loan Reviewer with 5+ years of experience in assessing the financial health and creditworthiness of commercial loan applicants. Proven ability to evaluate loan documentation, conduct due diligence investigations, and determine loan terms based on a comprehensive analysis of financial performance, market trends, and risk factors. Expertise in commercial real estate lending, financial modeling, loan underwriting, and risk assessment. Committed to ensuring the accuracy and compliance of loan documentation throughout the loan process.

Education

Bachelor’s in Finance

October 2017

Skills

- Commercial Real Estate Lending

- Financial Modeling

- Loan Underwriting

- Risk Assessment

- Credit Analysis

- Financial Statement Analysis

Work Experience

Commercial Loan Reviewer

- Analyzed market trends and industry data to identify potential risk factors and develop appropriate mitigation strategies.

- Recommended approval or denial of loan applications based on comprehensive analysis and risk assessment.

- Collaborated with loan officers and other stakeholders to provide guidance and support throughout the loan process.

- Monitored loan performance after disbursement to identify potential issues and ensure compliance with loan agreements.

Commercial Loan Reviewer

- Reviewed and assessed the financial performance and creditworthiness of commercial loan applicants to determine their eligibility for funding.

- Evaluated loan documentation, including financial statements, tax returns, and business plans, to ensure accuracy and compliance with underwriting guidelines.

- Conducted due diligence investigations to verify the authenticity and validity of loan documentation and collateral.

- Determined loan limits, interest rates, and repayment terms based on the applicants financial profile and market conditions.

Accomplishments

- Successfully identified and corrected a material misstatement in a complex commercial loan application, resulting in the denial of the loan and the prevention of potential losses

- Developed and implemented a new risk assessment model for commercial loans, which has significantly improved the accuracy and efficiency of the review process

- Conducted a comprehensive review of a $100 million commercial loan portfolio, identifying several areas of concern and recommending corrective actions

- Mitigated risk by implementing stricter underwriting guidelines for commercial loans

- Trained and mentored junior loan reviewers, fostering their professional development and enhancing the overall effectiveness of the review team

Awards

- Received the Presidents Award for Outstanding Performance in Commercial Loan Review

Certificates

- Certified Commercial Lending Professional (CCLP)

- Financial Risk Manager (FRM)

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Loan Reviewer

- Highlight your expertise in commercial real estate lending, financial modeling, and risk assessment.

- Showcase your experience in evaluating loan documentation and conducting due diligence investigations.

- Quantify your accomplishments whenever possible, using specific metrics and results.

- Tailor your resume to the specific job description and company you are applying to.

Essential Experience Highlights for a Strong Commercial Loan Reviewer Resume

- Review and assess the financial performance and creditworthiness of commercial loan applicants to determine their eligibility for funding.

- Evaluate loan documentation, including financial statements, tax returns, and business plans, to ensure accuracy and compliance with underwriting guidelines.

- Conduct due diligence investigations to verify the authenticity and validity of loan documentation and collateral.

- Determine loan limits, interest rates, and repayment terms based on the applicants financial profile and market conditions.

- Analyze market trends and industry data to identify potential risk factors and develop appropriate mitigation strategies.

- Recommend approval or denial of loan applications based on comprehensive analysis and risk assessment.

- Monitor loan performance after disbursement to identify potential issues and ensure compliance with loan agreements.

Frequently Asked Questions (FAQ’s) For Commercial Loan Reviewer

What are the key skills required to be a Commercial Loan Reviewer?

The key skills required to be a Commercial Loan Reviewer include commercial real estate lending, financial modeling, loan underwriting, risk assessment, credit analysis, and financial statement analysis.

What is the average salary for a Commercial Loan Reviewer?

According to Glassdoor, the average salary for a Commercial Loan Reviewer in the United States is $85,000 per year.

What are the career prospects for a Commercial Loan Reviewer?

Commercial Loan Reviewers can advance to positions such as Commercial Loan Officer, Senior Credit Analyst, or Vice President of Commercial Lending.

What are the challenges of being a Commercial Loan Reviewer?

The challenges of being a Commercial Loan Reviewer include the need to be able to analyze complex financial data, make sound judgments, and withstand pressure.

What is the job outlook for Commercial Loan Reviewers?

The job outlook for Commercial Loan Reviewers is expected to be good over the next few years.

What are the educational requirements to be a Commercial Loan Reviewer?

Most Commercial Loan Reviewers have a bachelor’s degree in finance, accounting, or a related field.

What are the certification requirements to be a Commercial Loan Reviewer?

There are no specific certification requirements to be a Commercial Loan Reviewer, but some employers may prefer candidates who have the Certified Commercial Loan Underwriter (CCLU) certification.