Are you a seasoned Claims Clerk seeking a new career path? Discover our professionally built Claims Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

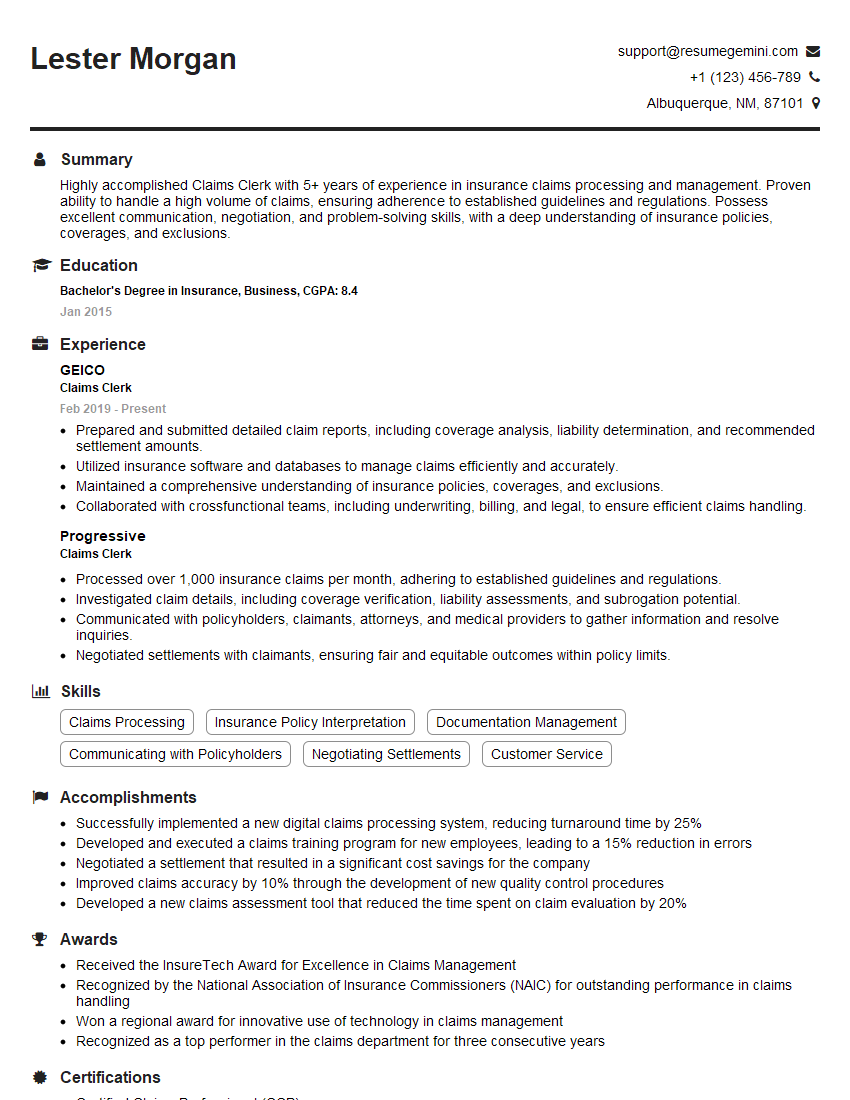

Lester Morgan

Claims Clerk

Summary

Highly accomplished Claims Clerk with 5+ years of experience in insurance claims processing and management. Proven ability to handle a high volume of claims, ensuring adherence to established guidelines and regulations. Possess excellent communication, negotiation, and problem-solving skills, with a deep understanding of insurance policies, coverages, and exclusions.

Education

Bachelor’s Degree in Insurance, Business

January 2015

Skills

- Claims Processing

- Insurance Policy Interpretation

- Documentation Management

- Communicating with Policyholders

- Negotiating Settlements

- Customer Service

Work Experience

Claims Clerk

- Prepared and submitted detailed claim reports, including coverage analysis, liability determination, and recommended settlement amounts.

- Utilized insurance software and databases to manage claims efficiently and accurately.

- Maintained a comprehensive understanding of insurance policies, coverages, and exclusions.

- Collaborated with crossfunctional teams, including underwriting, billing, and legal, to ensure efficient claims handling.

Claims Clerk

- Processed over 1,000 insurance claims per month, adhering to established guidelines and regulations.

- Investigated claim details, including coverage verification, liability assessments, and subrogation potential.

- Communicated with policyholders, claimants, attorneys, and medical providers to gather information and resolve inquiries.

- Negotiated settlements with claimants, ensuring fair and equitable outcomes within policy limits.

Accomplishments

- Successfully implemented a new digital claims processing system, reducing turnaround time by 25%

- Developed and executed a claims training program for new employees, leading to a 15% reduction in errors

- Negotiated a settlement that resulted in a significant cost savings for the company

- Improved claims accuracy by 10% through the development of new quality control procedures

- Developed a new claims assessment tool that reduced the time spent on claim evaluation by 20%

Awards

- Received the InsureTech Award for Excellence in Claims Management

- Recognized by the National Association of Insurance Commissioners (NAIC) for outstanding performance in claims handling

- Won a regional award for innovative use of technology in claims management

- Recognized as a top performer in the claims department for three consecutive years

Certificates

- Certified Claims Professional (CCP)

- Claims Adjuster License

- Associate in Claims (AIC)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Clerk

- Quantify your accomplishments using specific metrics and data whenever possible.

- Highlight your ability to handle a high volume of claims while maintaining accuracy and efficiency.

- Emphasize your strong communication and negotiation skills, as well as your ability to build relationships with claimants and other stakeholders.

- Showcase your knowledge of insurance policies, coverages, and exclusions, as well as your ability to apply them to claims processing.

Essential Experience Highlights for a Strong Claims Clerk Resume

- Process insurance claims promptly and accurately, adhering to established guidelines and regulations.

- Investigate claim details, including coverage verification, liability assessments, and subrogation potential.

- Communicate with policyholders, claimants, attorneys, and medical providers to gather information and resolve inquiries.

- Negotiate settlements with claimants, ensuring fair and equitable outcomes within policy limits.

- Prepare and submit detailed claim reports, including coverage analysis, liability determination, and recommended settlement amounts.

- Utilize insurance software and databases to manage claims efficiently and accurately.

- Maintain a comprehensive understanding of insurance policies, coverages, and exclusions.

Frequently Asked Questions (FAQ’s) For Claims Clerk

What are the key skills required to be a successful Claims Clerk?

Key skills include claims processing, insurance policy interpretation, documentation management, communicating with policyholders, negotiating settlements, and customer service.

What are the career prospects for a Claims Clerk?

With experience and additional qualifications, Claims Clerks can advance to roles such as Claims Adjuster, Claims Manager, or Insurance Underwriter.

What are the common challenges faced by Claims Clerks?

Common challenges include dealing with high claim volumes, complex claims, and difficult claimants. They also need to stay up-to-date with changes in insurance regulations and policies.

What is the average salary for a Claims Clerk?

The average salary for a Claims Clerk varies depending on factors such as experience, location, and company size. According to the U.S. Bureau of Labor Statistics, the median annual salary for Claims Adjusters, Examiners, and Investigators was $67,180 in May 2021.

What are the educational requirements to become a Claims Clerk?

While some Claims Clerk positions may require only a high school diploma or equivalent, many employers prefer candidates with a Bachelor’s degree in Insurance, Business, or a related field.

What certifications are beneficial for Claims Clerks?

Relevant certifications include the Associate in Claims (AIC), Associate in General Insurance (AINS), and Certified Insurance Claims Professional (CIC) designations offered by The National Alliance for Insurance Education & Research.

What is the job outlook for Claims Clerks?

The job outlook for Claims Clerks is expected to grow faster than average in the coming years due to the increasing demand for insurance services and the aging population.

What are the different types of insurance claims that Claims Clerks handle?

Claims Clerks handle various types of insurance claims, including auto, homeowners, health, disability, and workers’ compensation claims.