Are you a seasoned Loan Documentation Specialist seeking a new career path? Discover our professionally built Loan Documentation Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

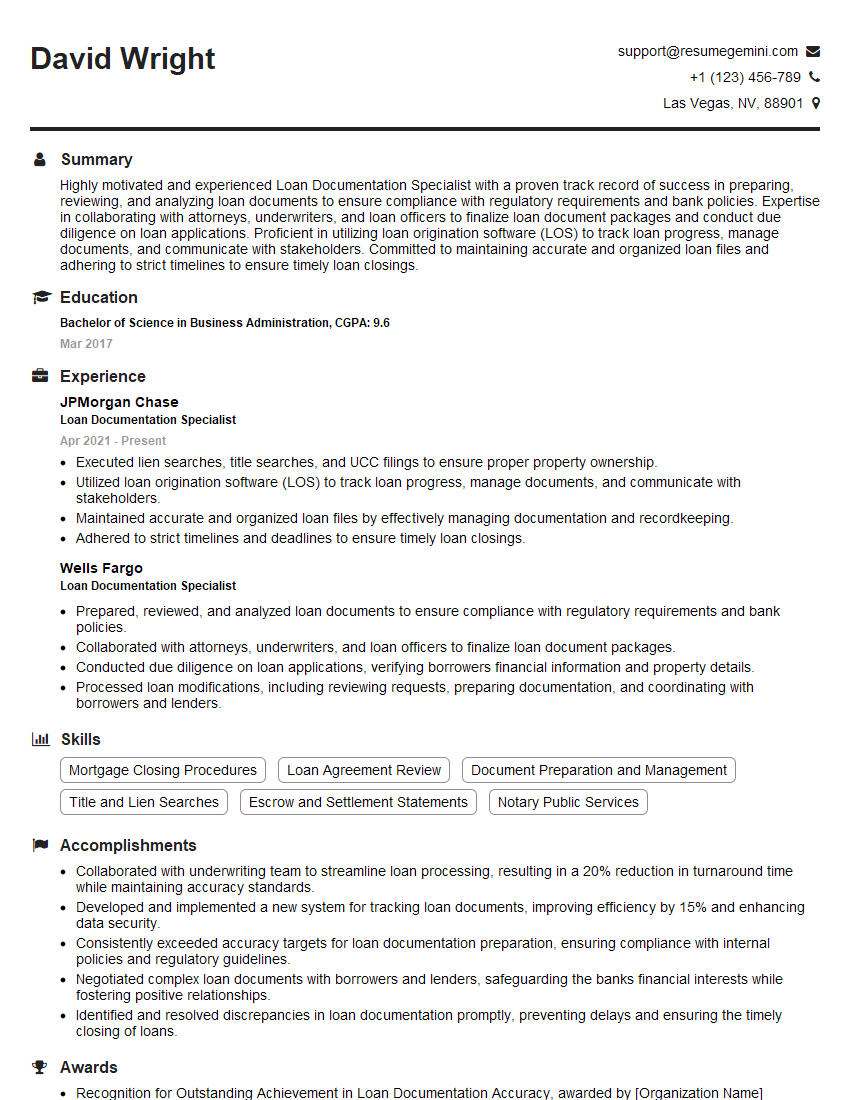

David Wright

Loan Documentation Specialist

Summary

Highly motivated and experienced Loan Documentation Specialist with a proven track record of success in preparing, reviewing, and analyzing loan documents to ensure compliance with regulatory requirements and bank policies. Expertise in collaborating with attorneys, underwriters, and loan officers to finalize loan document packages and conduct due diligence on loan applications. Proficient in utilizing loan origination software (LOS) to track loan progress, manage documents, and communicate with stakeholders. Committed to maintaining accurate and organized loan files and adhering to strict timelines to ensure timely loan closings.

Education

Bachelor of Science in Business Administration

March 2017

Skills

- Mortgage Closing Procedures

- Loan Agreement Review

- Document Preparation and Management

- Title and Lien Searches

- Escrow and Settlement Statements

- Notary Public Services

Work Experience

Loan Documentation Specialist

- Executed lien searches, title searches, and UCC filings to ensure proper property ownership.

- Utilized loan origination software (LOS) to track loan progress, manage documents, and communicate with stakeholders.

- Maintained accurate and organized loan files by effectively managing documentation and recordkeeping.

- Adhered to strict timelines and deadlines to ensure timely loan closings.

Loan Documentation Specialist

- Prepared, reviewed, and analyzed loan documents to ensure compliance with regulatory requirements and bank policies.

- Collaborated with attorneys, underwriters, and loan officers to finalize loan document packages.

- Conducted due diligence on loan applications, verifying borrowers financial information and property details.

- Processed loan modifications, including reviewing requests, preparing documentation, and coordinating with borrowers and lenders.

Accomplishments

- Collaborated with underwriting team to streamline loan processing, resulting in a 20% reduction in turnaround time while maintaining accuracy standards.

- Developed and implemented a new system for tracking loan documents, improving efficiency by 15% and enhancing data security.

- Consistently exceeded accuracy targets for loan documentation preparation, ensuring compliance with internal policies and regulatory guidelines.

- Negotiated complex loan documents with borrowers and lenders, safeguarding the banks financial interests while fostering positive relationships.

- Identified and resolved discrepancies in loan documentation promptly, preventing delays and ensuring the timely closing of loans.

Awards

- Recognition for Outstanding Achievement in Loan Documentation Accuracy, awarded by [Organization Name]

- Received Top Performer Award for consistently exceeding loan documentation quality standards

- Honored with the Presidents Award for Excellence in Loan Documentation

- Recognized by the industry association for Best Practices in Loan Documentation

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Loan Documentation Specialist (CLDS)

- Certified Reverse Mortgage Specialist (CRMS)

- Notary Public Commission

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Documentation Specialist

- Highlight your experience in preparing, reviewing, and analyzing loan documents to ensure compliance with regulatory requirements and bank policies.

- Demonstrate your ability to collaborate with attorneys, underwriters, and loan officers to finalize loan document packages.

- Emphasize your skills in conducting due diligence on loan applications and processing loan modifications.

- Showcase your proficiency in utilizing loan origination software (LOS) to track loan progress and manage documents.

- Provide specific examples of how you have maintained accurate and organized loan files, ensuring timely loan closings.

Essential Experience Highlights for a Strong Loan Documentation Specialist Resume

- Prepared, reviewed, and analyzed loan documents to ensure compliance with regulatory requirements and bank policies.

- Collaborated with attorneys, underwriters, and loan officers to finalize loan document packages.

- Conducted due diligence on loan applications, verifying borrowers financial information and property details.

- Processed loan modifications, including reviewing requests, preparing documentation, and coordinating with borrowers and lenders.

- Executed lien searches, title searches, and UCC filings to ensure proper property ownership.

- Utilized loan origination software (LOS) to track loan progress, manage documents, and communicate with stakeholders.

- Maintained accurate and organized loan files by effectively managing documentation and recordkeeping.

Frequently Asked Questions (FAQ’s) For Loan Documentation Specialist

What is the primary role of a Loan Documentation Specialist?

A Loan Documentation Specialist is responsible for preparing, reviewing, and analyzing loan documents to ensure compliance with regulatory requirements and bank policies. They collaborate with attorneys, underwriters, and loan officers to finalize loan document packages and conduct due diligence on loan applications.

What are the key skills required for a Loan Documentation Specialist?

Loan Documentation Specialists should have a strong understanding of mortgage closing procedures, loan agreement review, document preparation and management, title and lien searches, escrow and settlement statements, and notary public services.

What is the educational qualification required to become a Loan Documentation Specialist?

A Bachelor’s degree in Business Administration or a related field is typically required to become a Loan Documentation Specialist.

What are the career prospects for Loan Documentation Specialists?

Loan Documentation Specialists can advance to roles such as Loan Officers, Underwriters, or Credit Analysts with experience and further education.

What are the typical salary expectations for Loan Documentation Specialists?

The salary expectations for Loan Documentation Specialists vary depending on experience, location, and company size. According to Salary.com, the average salary for a Loan Documentation Specialist in the United States is around $60,000 per year.

What are the key challenges faced by Loan Documentation Specialists?

Loan Documentation Specialists may face challenges in managing a high volume of loan applications, ensuring timely loan closings, and keeping up with regulatory changes.