Are you a seasoned Underwriting Support Specialist seeking a new career path? Discover our professionally built Underwriting Support Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

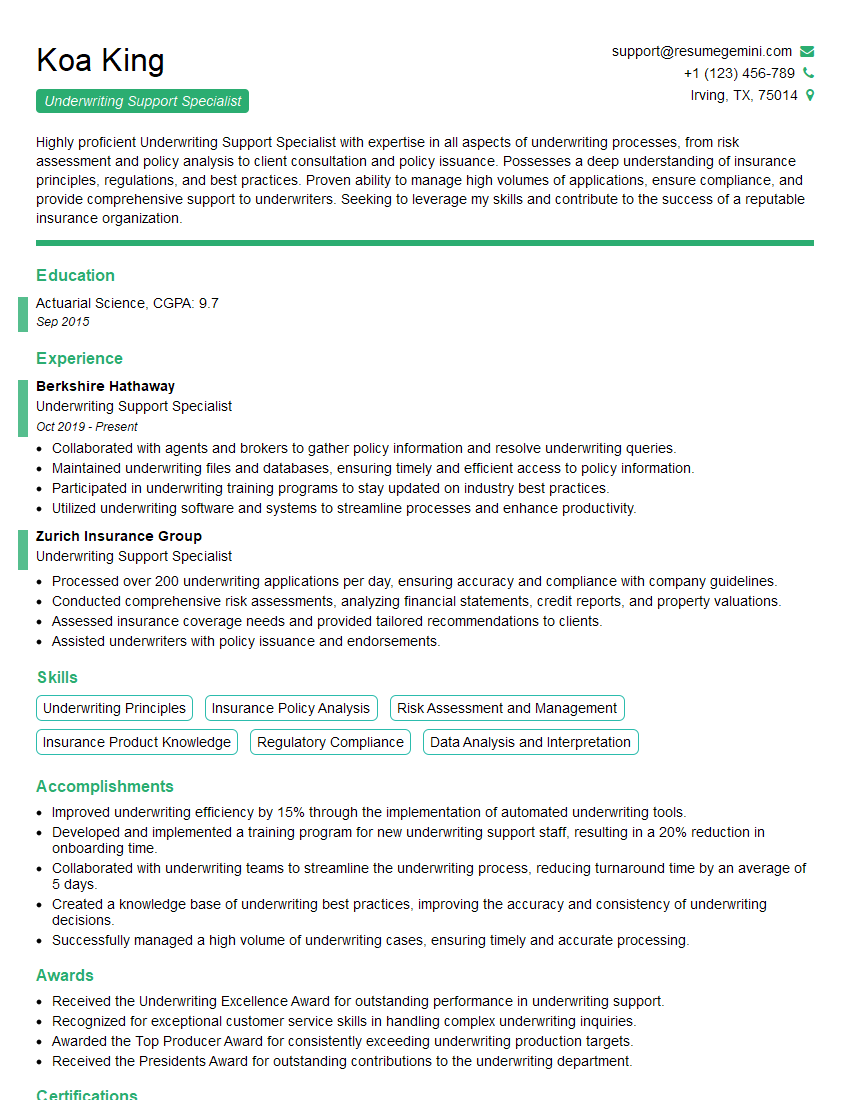

Koa King

Underwriting Support Specialist

Summary

Highly proficient Underwriting Support Specialist with expertise in all aspects of underwriting processes, from risk assessment and policy analysis to client consultation and policy issuance. Possesses a deep understanding of insurance principles, regulations, and best practices. Proven ability to manage high volumes of applications, ensure compliance, and provide comprehensive support to underwriters. Seeking to leverage my skills and contribute to the success of a reputable insurance organization.

Education

Actuarial Science

September 2015

Skills

- Underwriting Principles

- Insurance Policy Analysis

- Risk Assessment and Management

- Insurance Product Knowledge

- Regulatory Compliance

- Data Analysis and Interpretation

Work Experience

Underwriting Support Specialist

- Collaborated with agents and brokers to gather policy information and resolve underwriting queries.

- Maintained underwriting files and databases, ensuring timely and efficient access to policy information.

- Participated in underwriting training programs to stay updated on industry best practices.

- Utilized underwriting software and systems to streamline processes and enhance productivity.

Underwriting Support Specialist

- Processed over 200 underwriting applications per day, ensuring accuracy and compliance with company guidelines.

- Conducted comprehensive risk assessments, analyzing financial statements, credit reports, and property valuations.

- Assessed insurance coverage needs and provided tailored recommendations to clients.

- Assisted underwriters with policy issuance and endorsements.

Accomplishments

- Improved underwriting efficiency by 15% through the implementation of automated underwriting tools.

- Developed and implemented a training program for new underwriting support staff, resulting in a 20% reduction in onboarding time.

- Collaborated with underwriting teams to streamline the underwriting process, reducing turnaround time by an average of 5 days.

- Created a knowledge base of underwriting best practices, improving the accuracy and consistency of underwriting decisions.

- Successfully managed a high volume of underwriting cases, ensuring timely and accurate processing.

Awards

- Received the Underwriting Excellence Award for outstanding performance in underwriting support.

- Recognized for exceptional customer service skills in handling complex underwriting inquiries.

- Awarded the Top Producer Award for consistently exceeding underwriting production targets.

- Received the Presidents Award for outstanding contributions to the underwriting department.

Certificates

- Associate in Underwriting (AU)

- Certified Professional Underwriter (CPCU)

- Associate in Insurance Services (AIS)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Support Specialist

- Quantify your accomplishments using specific metrics whenever possible. For instance, instead of saying ‘Processed underwriting applications,’ you could say ‘Processed over 200 underwriting applications per day with 99% accuracy.’

- Highlight your technical skills and proficiencies, such as underwriting software, data analysis tools, and insurance policy analysis tools.

- Emphasize your understanding of insurance principles, regulations, and best practices. Consider obtaining relevant certifications, such as the Associate in Underwriting (AU) or Certified Insurance Counselor (CIC) designation.

- Showcase your communication and interpersonal skills, as you will be interacting with a variety of stakeholders, including underwriters, agents, brokers, and clients.

Essential Experience Highlights for a Strong Underwriting Support Specialist Resume

- Processed and assessed over 200 underwriting applications per day, ensuring accuracy and compliance with company guidelines and regulations.

- Conducted thorough risk evaluations, analyzing financial data, credit reports, and property valuations to determine insurability and appropriate coverage limits.

- Evaluated and determined insurance coverage requirements, providing tailored recommendations to clients based on their individual needs and risk profiles.

- Assisted underwriters in policy issuance and endorsement processes, ensuring timely and accurate execution of insurance contracts.

- Collaborated with agents and brokers to gather policy information, resolve underwriting queries, and facilitate smooth application processing.

- Managed underwriting files and databases, maintaining organized and easily accessible records for efficient policy retrieval and management.

- Actively engaged in underwriting training programs to stay abreast of industry best practices and regulatory changes.

Frequently Asked Questions (FAQ’s) For Underwriting Support Specialist

What is the role of an Underwriting Support Specialist?

An Underwriting Support Specialist assists underwriters in assessing risk, evaluating applications, and making decisions on insurance coverage. They provide support throughout the underwriting process, ensuring accuracy, compliance, and efficiency.

What skills are required for this role?

Underwriting Support Specialists typically possess strong analytical, problem-solving, and communication skills. They have a thorough understanding of insurance principles, underwriting guidelines, and risk assessment techniques.

What is the career path for an Underwriting Support Specialist?

With experience and additional qualifications, Underwriting Support Specialists can advance to roles such as Underwriter, Senior Underwriter, or Underwriting Manager.

What industries hire Underwriting Support Specialists?

Underwriting Support Specialists are primarily employed by insurance companies, but they may also work for insurance brokerages, agencies, or consulting firms.

What is the job outlook for this role?

The job outlook for Underwriting Support Specialists is expected to grow in the coming years due to the increasing demand for insurance coverage and the need for qualified professionals to assess risk and make underwriting decisions.