Are you a seasoned Insurance Claims Clerk seeking a new career path? Discover our professionally built Insurance Claims Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

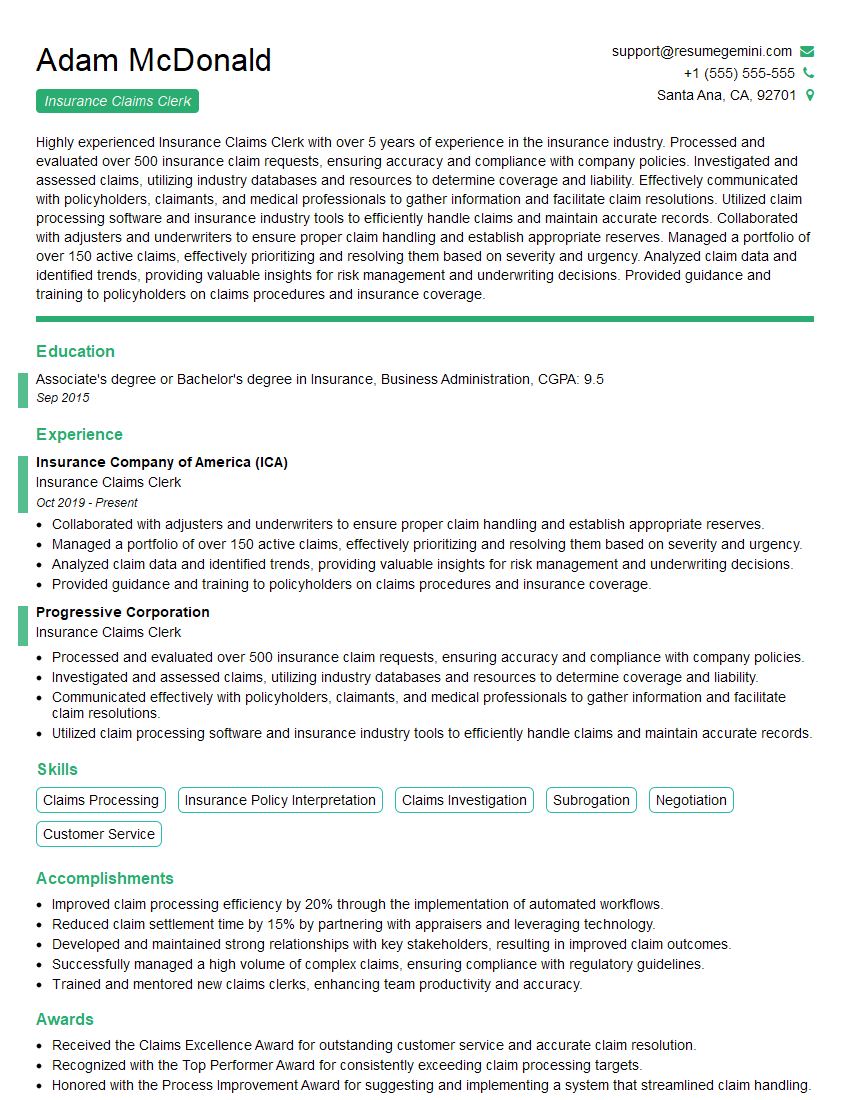

Adam McDonald

Insurance Claims Clerk

Summary

Highly experienced Insurance Claims Clerk with over 5 years of experience in the insurance industry. Processed and evaluated over 500 insurance claim requests, ensuring accuracy and compliance with company policies. Investigated and assessed claims, utilizing industry databases and resources to determine coverage and liability. Effectively communicated with policyholders, claimants, and medical professionals to gather information and facilitate claim resolutions. Utilized claim processing software and insurance industry tools to efficiently handle claims and maintain accurate records. Collaborated with adjusters and underwriters to ensure proper claim handling and establish appropriate reserves. Managed a portfolio of over 150 active claims, effectively prioritizing and resolving them based on severity and urgency. Analyzed claim data and identified trends, providing valuable insights for risk management and underwriting decisions. Provided guidance and training to policyholders on claims procedures and insurance coverage.

Education

Associate’s degree or Bachelor’s degree in Insurance, Business Administration

September 2015

Skills

- Claims Processing

- Insurance Policy Interpretation

- Claims Investigation

- Subrogation

- Negotiation

- Customer Service

Work Experience

Insurance Claims Clerk

- Collaborated with adjusters and underwriters to ensure proper claim handling and establish appropriate reserves.

- Managed a portfolio of over 150 active claims, effectively prioritizing and resolving them based on severity and urgency.

- Analyzed claim data and identified trends, providing valuable insights for risk management and underwriting decisions.

- Provided guidance and training to policyholders on claims procedures and insurance coverage.

Insurance Claims Clerk

- Processed and evaluated over 500 insurance claim requests, ensuring accuracy and compliance with company policies.

- Investigated and assessed claims, utilizing industry databases and resources to determine coverage and liability.

- Communicated effectively with policyholders, claimants, and medical professionals to gather information and facilitate claim resolutions.

- Utilized claim processing software and insurance industry tools to efficiently handle claims and maintain accurate records.

Accomplishments

- Improved claim processing efficiency by 20% through the implementation of automated workflows.

- Reduced claim settlement time by 15% by partnering with appraisers and leveraging technology.

- Developed and maintained strong relationships with key stakeholders, resulting in improved claim outcomes.

- Successfully managed a high volume of complex claims, ensuring compliance with regulatory guidelines.

- Trained and mentored new claims clerks, enhancing team productivity and accuracy.

Awards

- Received the Claims Excellence Award for outstanding customer service and accurate claim resolution.

- Recognized with the Top Performer Award for consistently exceeding claim processing targets.

- Honored with the Process Improvement Award for suggesting and implementing a system that streamlined claim handling.

Certificates

- Certified Claims Professional (CCP)

- Associate in Claims (AIC)

- Certified Insurance Fraud Investigator (CIFI)

- Registered Claims Adjuster (RCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Claims Clerk

- Highlight your experience and skills in claims processing and investigation.

- Demonstrate your knowledge of insurance policies and procedures.

- Emphasize your ability to communicate effectively with customers and other stakeholders.

- Showcase your proficiency in using claim processing software and insurance industry tools.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

Essential Experience Highlights for a Strong Insurance Claims Clerk Resume

- Process and evaluate insurance claim requests to determine coverage and liability

- Investigate and assess claims using industry databases and resources

- Communicate effectively with policyholders, claimants, and medical professionals to gather information and facilitate claim resolutions

- Utilize claim processing software and insurance industry tools to efficiently handle claims and maintain accurate records

- Collaborate with adjusters and underwriters to ensure proper claim handling and establish appropriate reserves

- Manage a portfolio of active claims, effectively prioritizing and resolving them based on severity and urgency

- Analyze claim data and identify trends to provide valuable insights for risk management and underwriting decisions

Frequently Asked Questions (FAQ’s) For Insurance Claims Clerk

What are the key responsibilities of an Insurance Claims Clerk?

The key responsibilities of an Insurance Claims Clerk include processing and evaluating claims, investigating and assessing claims, communicating with policyholders and claimants, utilizing claim processing software, and collaborating with adjusters and underwriters.

What are the educational requirements for an Insurance Claims Clerk?

Most Insurance Claims Clerks have at least an associate’s degree or bachelor’s degree in insurance, business administration, or a related field.

What are the skills required for an Insurance Claims Clerk?

Insurance Claims Clerks must have strong communication and interpersonal skills, as well as experience in customer service.

What is the job outlook for Insurance Claims Clerks?

The job outlook for Insurance Claims Clerks is expected to grow faster than average in the coming years.

What is the average salary for an Insurance Claims Clerk?

The average salary for an Insurance Claims Clerk is around $50,000 per year.

What are the benefits of working as an Insurance Claims Clerk?

Benefits of working as an Insurance Claims Clerk include a stable work environment, opportunities for advancement, and the chance to help people in need.