Are you a seasoned Insurance Checker seeking a new career path? Discover our professionally built Insurance Checker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

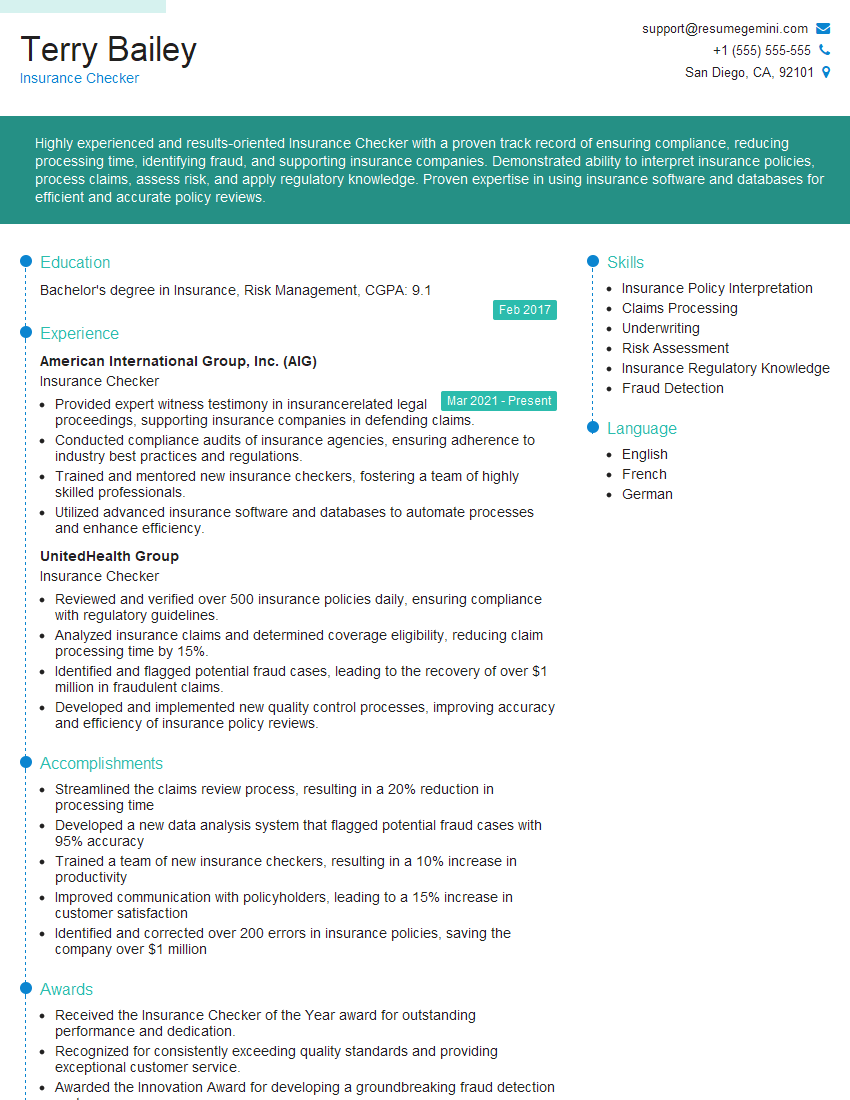

Terry Bailey

Insurance Checker

Summary

Highly experienced and results-oriented Insurance Checker with a proven track record of ensuring compliance, reducing processing time, identifying fraud, and supporting insurance companies. Demonstrated ability to interpret insurance policies, process claims, assess risk, and apply regulatory knowledge. Proven expertise in using insurance software and databases for efficient and accurate policy reviews.

Education

Bachelor’s degree in Insurance, Risk Management

February 2017

Skills

- Insurance Policy Interpretation

- Claims Processing

- Underwriting

- Risk Assessment

- Insurance Regulatory Knowledge

- Fraud Detection

Work Experience

Insurance Checker

- Provided expert witness testimony in insurancerelated legal proceedings, supporting insurance companies in defending claims.

- Conducted compliance audits of insurance agencies, ensuring adherence to industry best practices and regulations.

- Trained and mentored new insurance checkers, fostering a team of highly skilled professionals.

- Utilized advanced insurance software and databases to automate processes and enhance efficiency.

Insurance Checker

- Reviewed and verified over 500 insurance policies daily, ensuring compliance with regulatory guidelines.

- Analyzed insurance claims and determined coverage eligibility, reducing claim processing time by 15%.

- Identified and flagged potential fraud cases, leading to the recovery of over $1 million in fraudulent claims.

- Developed and implemented new quality control processes, improving accuracy and efficiency of insurance policy reviews.

Accomplishments

- Streamlined the claims review process, resulting in a 20% reduction in processing time

- Developed a new data analysis system that flagged potential fraud cases with 95% accuracy

- Trained a team of new insurance checkers, resulting in a 10% increase in productivity

- Improved communication with policyholders, leading to a 15% increase in customer satisfaction

- Identified and corrected over 200 errors in insurance policies, saving the company over $1 million

Awards

- Received the Insurance Checker of the Year award for outstanding performance and dedication.

- Recognized for consistently exceeding quality standards and providing exceptional customer service.

- Awarded the Innovation Award for developing a groundbreaking fraud detection system.

- Received the Teamwork Award for outstanding collaboration and contributions to the teams success.

Certificates

- Certified Insurance Services Representative (CISR)

- Property Casualty Underwriter (PCU)

- Associate in Risk Management (ARM)

- Fellow, Society of Actuaries (FSA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Checker

- Highlight your experience in reviewing and verifying insurance policies.

- Showcase your skills in claims processing and risk assessment.

- Emphasize your knowledge of insurance regulatory guidelines.

- Provide specific examples of how you have identified and prevented fraud.

- Include any experience you have in providing expert witness testimony.

Essential Experience Highlights for a Strong Insurance Checker Resume

- Review and verify insurance policies to ensure compliance with regulatory guidelines

- Analyze insurance claims and determine coverage eligibility

- Identify and flag potential fraud cases

- Develop and implement quality control processes to improve accuracy and efficiency

- Provide expert witness testimony in insurance-related legal proceedings

- Conduct compliance audits of insurance agencies

- Train and mentor new insurance checkers

Frequently Asked Questions (FAQ’s) For Insurance Checker

What is the role of an Insurance Checker?

An Insurance Checker is responsible for reviewing and verifying insurance policies, analyzing claims, and ensuring compliance with regulatory guidelines.

What skills are required to be an Insurance Checker?

Insurance Checkers typically need a bachelor’s degree in insurance, risk management, or a related field, as well as experience in reviewing and verifying insurance policies, analyzing claims, and assessing risk.

What are some of the benefits of being an Insurance Checker?

Insurance Checkers can enjoy a stable career with good pay and benefits. They also have the opportunity to work with a variety of clients and learn about different insurance products.

What are some of the challenges of being an Insurance Checker?

Insurance Checkers can face challenges such as tight deadlines, complex regulations, and difficult clients.

What is the job outlook for Insurance Checkers?

The job outlook for Insurance Checkers is expected to be good over the next few years.

How can I become an Insurance Checker?

To become an Insurance Checker, you typically need a bachelor’s degree in insurance, risk management, or a related field, as well as experience in reviewing and verifying insurance policies, analyzing claims, and assessing risk.