Are you a seasoned Insurance Processor seeking a new career path? Discover our professionally built Insurance Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

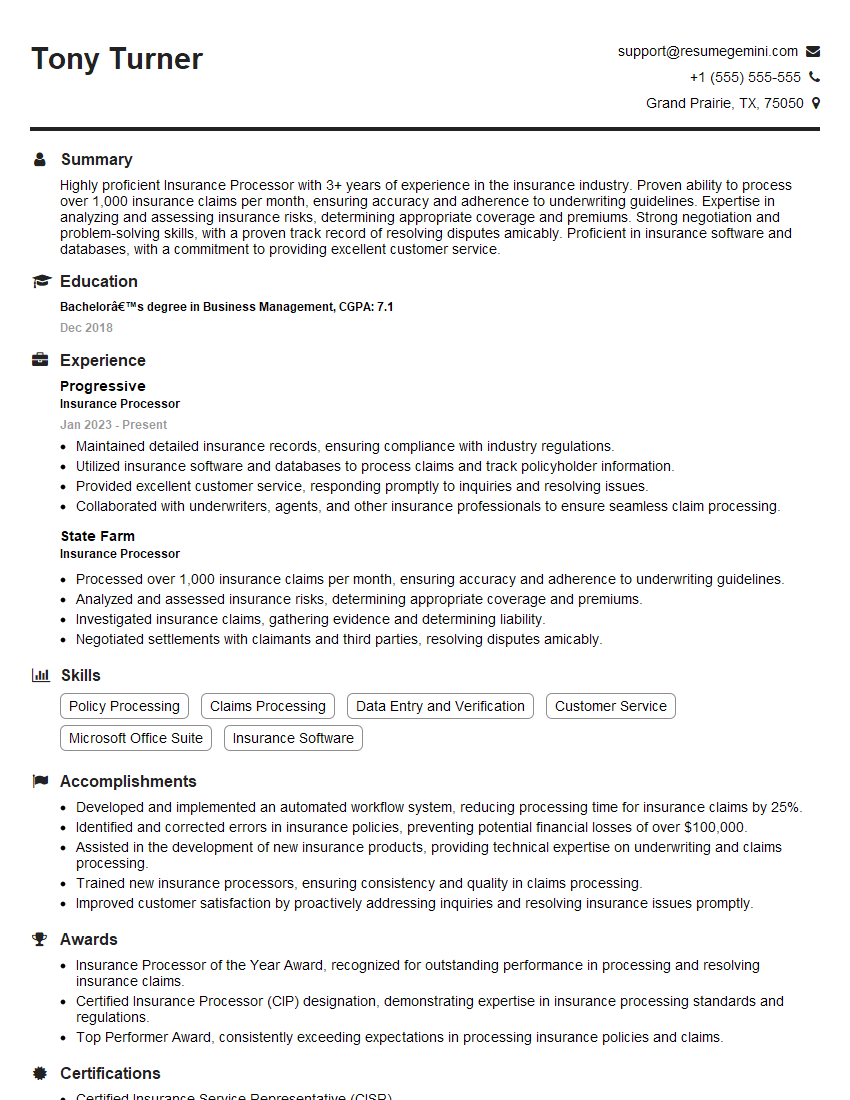

Tony Turner

Insurance Processor

Summary

Highly proficient Insurance Processor with 3+ years of experience in the insurance industry. Proven ability to process over 1,000 insurance claims per month, ensuring accuracy and adherence to underwriting guidelines. Expertise in analyzing and assessing insurance risks, determining appropriate coverage and premiums. Strong negotiation and problem-solving skills, with a proven track record of resolving disputes amicably. Proficient in insurance software and databases, with a commitment to providing excellent customer service.

Education

Bachelor’s degree in Business Management

December 2018

Skills

- Policy Processing

- Claims Processing

- Data Entry and Verification

- Customer Service

- Microsoft Office Suite

- Insurance Software

Work Experience

Insurance Processor

- Maintained detailed insurance records, ensuring compliance with industry regulations.

- Utilized insurance software and databases to process claims and track policyholder information.

- Provided excellent customer service, responding promptly to inquiries and resolving issues.

- Collaborated with underwriters, agents, and other insurance professionals to ensure seamless claim processing.

Insurance Processor

- Processed over 1,000 insurance claims per month, ensuring accuracy and adherence to underwriting guidelines.

- Analyzed and assessed insurance risks, determining appropriate coverage and premiums.

- Investigated insurance claims, gathering evidence and determining liability.

- Negotiated settlements with claimants and third parties, resolving disputes amicably.

Accomplishments

- Developed and implemented an automated workflow system, reducing processing time for insurance claims by 25%.

- Identified and corrected errors in insurance policies, preventing potential financial losses of over $100,000.

- Assisted in the development of new insurance products, providing technical expertise on underwriting and claims processing.

- Trained new insurance processors, ensuring consistency and quality in claims processing.

- Improved customer satisfaction by proactively addressing inquiries and resolving insurance issues promptly.

Awards

- Insurance Processor of the Year Award, recognized for outstanding performance in processing and resolving insurance claims.

- Certified Insurance Processor (CIP) designation, demonstrating expertise in insurance processing standards and regulations.

- Top Performer Award, consistently exceeding expectations in processing insurance policies and claims.

Certificates

- Certified Insurance Service Representative (CISR)

- Associate in Insurance Services (AIS)

- Property and Casualty Insurance Agent (PCI)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Processor

- Highlight your experience in processing a high volume of claims.

- Showcase your analytical and problem-solving skills.

- Emphasize your negotiation and customer service abilities.

- Quantify your accomplishments and provide specific examples of your work.

- Review insurance industry publications and websites to stay up-to-date on current trends and regulations.

Essential Experience Highlights for a Strong Insurance Processor Resume

- Processed over 1,000 insurance claims per month, ensuring accuracy and adherence to underwriting guidelines.

- Analyzed and assessed insurance risks, determining appropriate coverage and premiums.

- Investigated insurance claims, gathering evidence and determining liability.

- Negotiated settlements with claimants and third parties, resolving disputes amicably.

- Maintained detailed insurance records, ensuring compliance with industry regulations.

- Utilized insurance software and databases to process claims and track policyholder information.

- Provided excellent customer service, responding promptly to inquiries and resolving issues.

- Collaborated with underwriters, agents, and other insurance professionals to ensure seamless claim processing.

Frequently Asked Questions (FAQ’s) For Insurance Processor

What is the primary role of an Insurance Processor?

An Insurance Processor is responsible for handling and processing insurance claims, ensuring accuracy and adherence to underwriting guidelines, while providing excellent customer service.

What skills are essential for an Insurance Processor?

Essential skills include policy processing, claims processing, data entry and verification, customer service, proficiency in Microsoft Office Suite and insurance software, along with strong analytical and problem-solving abilities.

What qualifications are typically required for an Insurance Processor?

Most Insurance Processor positions require a high school diploma or equivalent, with some requiring a Bachelor’s degree in Business Management or a related field.

What is the expected salary range for an Insurance Processor?

The salary range for an Insurance Processor can vary depending on experience, qualifications, and location, but typically falls between $40,000-$60,000 per year.

What are the potential career advancement opportunities for an Insurance Processor?

With experience and additional qualifications, Insurance Processors can advance to roles such as Insurance Adjuster, Underwriter, or Claims Manager.

What professional development opportunities are available for Insurance Processors?

Insurance Processors can enhance their skills and knowledge through industry conferences, workshops, and online courses offered by organizations such as The Insurance Institute of America (IIA).

What is the job outlook for Insurance Processors?

The job outlook for Insurance Processors is expected to grow in the coming years due to the increasing demand for insurance coverage and the need for skilled professionals to handle claims efficiently.