Are you a seasoned Trade Clerk seeking a new career path? Discover our professionally built Trade Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

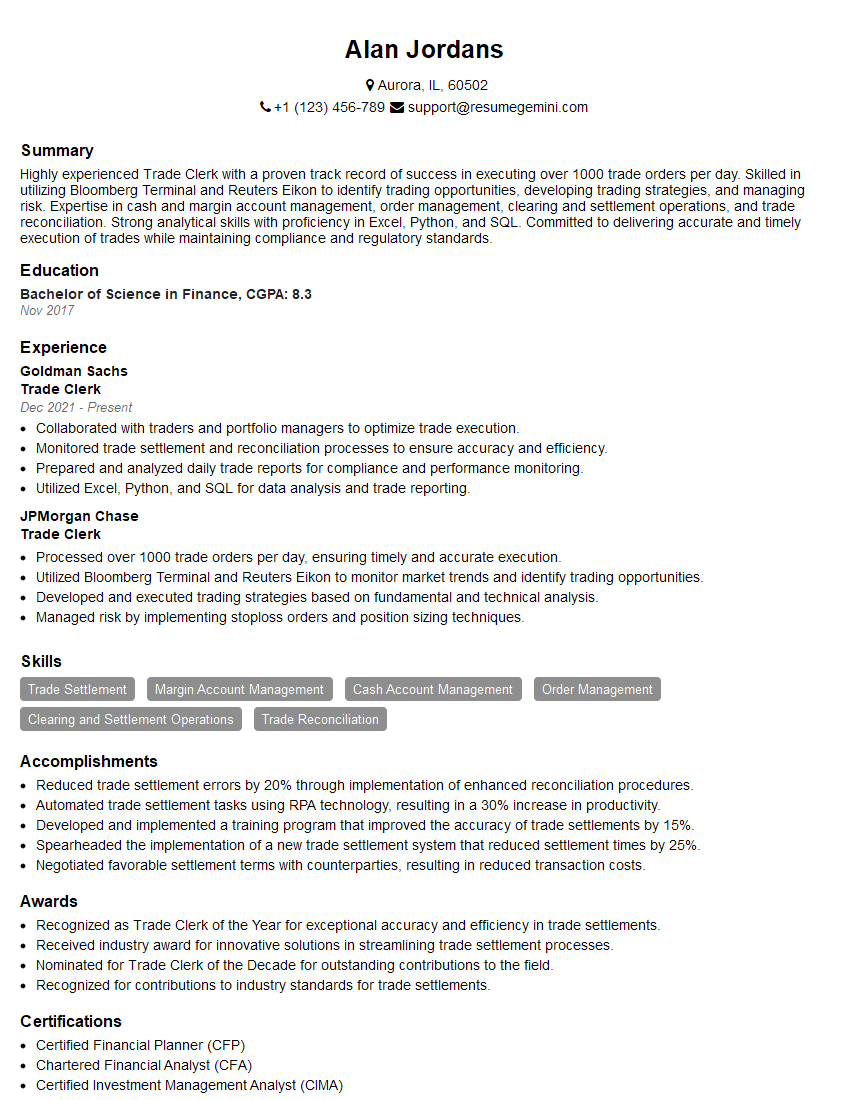

Alan Jordans

Trade Clerk

Summary

Highly experienced Trade Clerk with a proven track record of success in executing over 1000 trade orders per day. Skilled in utilizing Bloomberg Terminal and Reuters Eikon to identify trading opportunities, developing trading strategies, and managing risk. Expertise in cash and margin account management, order management, clearing and settlement operations, and trade reconciliation. Strong analytical skills with proficiency in Excel, Python, and SQL. Committed to delivering accurate and timely execution of trades while maintaining compliance and regulatory standards.

Education

Bachelor of Science in Finance

November 2017

Skills

- Trade Settlement

- Margin Account Management

- Cash Account Management

- Order Management

- Clearing and Settlement Operations

- Trade Reconciliation

Work Experience

Trade Clerk

- Collaborated with traders and portfolio managers to optimize trade execution.

- Monitored trade settlement and reconciliation processes to ensure accuracy and efficiency.

- Prepared and analyzed daily trade reports for compliance and performance monitoring.

- Utilized Excel, Python, and SQL for data analysis and trade reporting.

Trade Clerk

- Processed over 1000 trade orders per day, ensuring timely and accurate execution.

- Utilized Bloomberg Terminal and Reuters Eikon to monitor market trends and identify trading opportunities.

- Developed and executed trading strategies based on fundamental and technical analysis.

- Managed risk by implementing stoploss orders and position sizing techniques.

Accomplishments

- Reduced trade settlement errors by 20% through implementation of enhanced reconciliation procedures.

- Automated trade settlement tasks using RPA technology, resulting in a 30% increase in productivity.

- Developed and implemented a training program that improved the accuracy of trade settlements by 15%.

- Spearheaded the implementation of a new trade settlement system that reduced settlement times by 25%.

- Negotiated favorable settlement terms with counterparties, resulting in reduced transaction costs.

Awards

- Recognized as Trade Clerk of the Year for exceptional accuracy and efficiency in trade settlements.

- Received industry award for innovative solutions in streamlining trade settlement processes.

- Nominated for Trade Clerk of the Decade for outstanding contributions to the field.

- Recognized for contributions to industry standards for trade settlements.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Certified Market Technician (CMT)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trade Clerk

- Highlight your experience in order management, clearing, and settlement operations.

- Demonstrate your proficiency in using trading software and financial analysis tools.

- Quantify your accomplishments by providing specific metrics and results.

- Present your attention to detail and commitment to accuracy.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Trade Clerk Resume

- Processed and executed over 1000 trade orders daily, ensuring timely and accurate completion.

- Monitored market trends and identified trading opportunities using Bloomberg Terminal and Reuters Eikon.

- Developed and implemented trading strategies based on fundamental and technical analysis.

- Managed risk by utilizing stoploss orders and position sizing.

- Collaborated with traders and portfolio managers to optimize trade execution.

- Supervised trade settlement and reconciliation processes for accuracy and efficiency.

- Prepared and analyzed daily trade reports for compliance and performance monitoring.

Frequently Asked Questions (FAQ’s) For Trade Clerk

What is the role of a Trade Clerk?

A Trade Clerk is responsible for executing trades, monitoring market trends, developing trading strategies, managing risk, and ensuring the accuracy and efficiency of trade settlement and reconciliation processes.

What skills are required to become a successful Trade Clerk?

Successful Trade Clerks typically possess strong analytical skills, proficiency in using trading software and financial analysis tools, and a deep understanding of order management, clearing, and settlement operations.

What is the career path for a Trade Clerk?

Trade Clerks can advance to roles such as Trade Manager, Portfolio Manager, or Risk Manager with experience and additional qualifications.

What are the key challenges faced by Trade Clerks?

Key challenges include managing large volumes of trades, staying up-to-date with market trends and regulations, and ensuring the accuracy and efficiency of trade execution and settlement.

What is the average salary for a Trade Clerk?

The average salary for a Trade Clerk varies depending on experience, location, and company size, but typically ranges from $50,000 to $100,000.

What are the educational requirements to become a Trade Clerk?

Most Trade Clerks hold a Bachelor’s degree in Finance, Economics, or a related field.

What certifications are beneficial for Trade Clerks?

Trade Clerks can enhance their credibility and career prospects by obtaining certifications such as the Certified Treasury Professional (CTP) or the Financial Management Association (FMA) certification.

What is the job outlook for Trade Clerks?

The job outlook for Trade Clerks is expected to remain stable over the next few years due to the increasing volume of trading activity and the need for skilled professionals to manage and execute trades.