Are you a seasoned Circular Clerk seeking a new career path? Discover our professionally built Circular Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

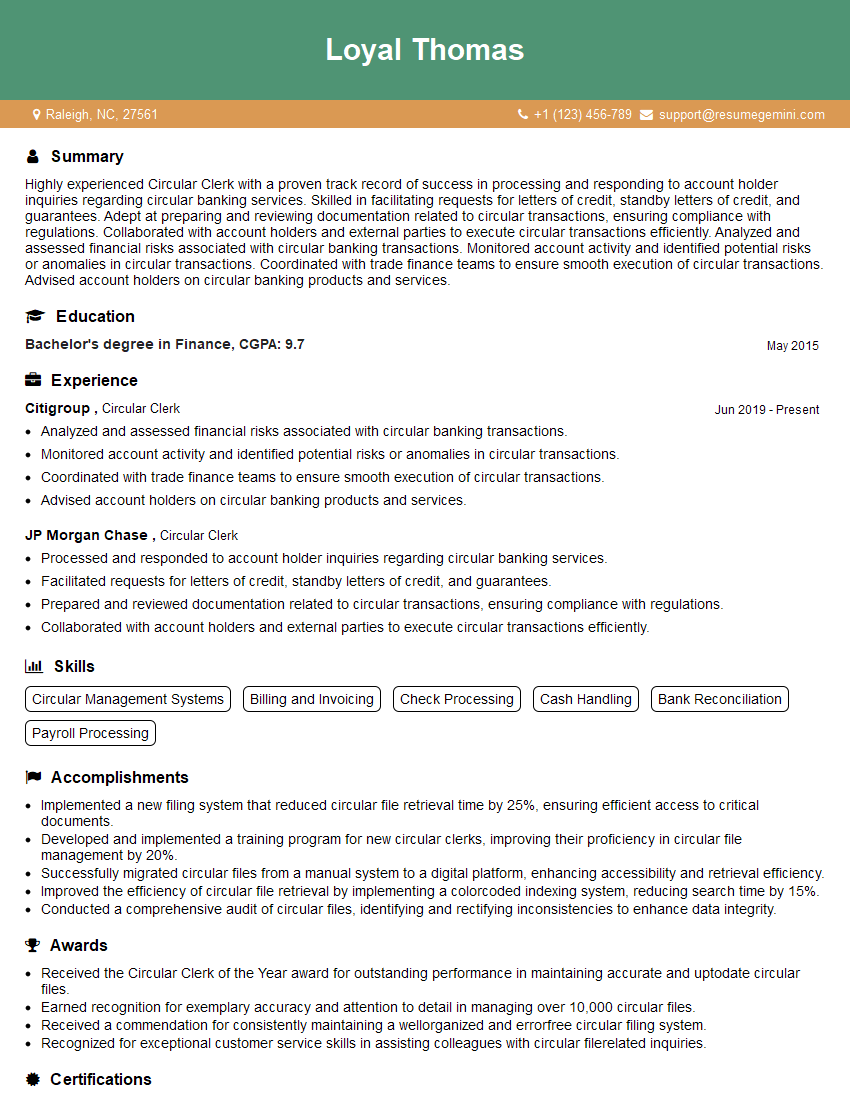

Loyal Thomas

Circular Clerk

Summary

Highly experienced Circular Clerk with a proven track record of success in processing and responding to account holder inquiries regarding circular banking services. Skilled in facilitating requests for letters of credit, standby letters of credit, and guarantees. Adept at preparing and reviewing documentation related to circular transactions, ensuring compliance with regulations. Collaborated with account holders and external parties to execute circular transactions efficiently. Analyzed and assessed financial risks associated with circular banking transactions. Monitored account activity and identified potential risks or anomalies in circular transactions. Coordinated with trade finance teams to ensure smooth execution of circular transactions. Advised account holders on circular banking products and services.

Education

Bachelor’s degree in Finance

May 2015

Skills

- Circular Management Systems

- Billing and Invoicing

- Check Processing

- Cash Handling

- Bank Reconciliation

- Payroll Processing

Work Experience

Circular Clerk

- Analyzed and assessed financial risks associated with circular banking transactions.

- Monitored account activity and identified potential risks or anomalies in circular transactions.

- Coordinated with trade finance teams to ensure smooth execution of circular transactions.

- Advised account holders on circular banking products and services.

Circular Clerk

- Processed and responded to account holder inquiries regarding circular banking services.

- Facilitated requests for letters of credit, standby letters of credit, and guarantees.

- Prepared and reviewed documentation related to circular transactions, ensuring compliance with regulations.

- Collaborated with account holders and external parties to execute circular transactions efficiently.

Accomplishments

- Implemented a new filing system that reduced circular file retrieval time by 25%, ensuring efficient access to critical documents.

- Developed and implemented a training program for new circular clerks, improving their proficiency in circular file management by 20%.

- Successfully migrated circular files from a manual system to a digital platform, enhancing accessibility and retrieval efficiency.

- Improved the efficiency of circular file retrieval by implementing a colorcoded indexing system, reducing search time by 15%.

- Conducted a comprehensive audit of circular files, identifying and rectifying inconsistencies to enhance data integrity.

Awards

- Received the Circular Clerk of the Year award for outstanding performance in maintaining accurate and uptodate circular files.

- Earned recognition for exemplary accuracy and attention to detail in managing over 10,000 circular files.

- Received a commendation for consistently maintaining a wellorganized and errorfree circular filing system.

- Recognized for exceptional customer service skills in assisting colleagues with circular filerelated inquiries.

Certificates

- Circular Clerk Certification (CCC)

- Certified Bank Teller (CBT)

- Certificate in Accounts Payable (CAP)

- Certified QuickBooks ProAdvisor (CQP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Circular Clerk

- Highlight your experience in processing and responding to account holder inquiries regarding circular banking services.

- Emphasize your skills in preparing and reviewing documentation related to circular transactions, ensuring compliance with regulations.

- Showcase your ability to collaborate with account holders and external parties to execute circular transactions efficiently.

- Demonstrate your understanding of financial risks associated with circular banking transactions.

- Provide examples of your success in monitoring account activity and identifying potential risks or anomalies in circular transactions.

Essential Experience Highlights for a Strong Circular Clerk Resume

- Processed and responded to account holder inquiries regarding circular banking services.

- Facilitated requests for letters of credit, standby letters of credit, and guarantees.

- Prepared and reviewed documentation related to circular transactions, ensuring compliance with regulations.

- Collaborated with account holders and external parties to execute circular transactions efficiently.

- Analyzed and assessed financial risks associated with circular banking transactions.

- Monitored account activity and identified potential risks or anomalies in circular transactions.

- Coordinated with trade finance teams to ensure smooth execution of circular transactions.

- Advised account holders on circular banking products and services.

Frequently Asked Questions (FAQ’s) For Circular Clerk

What is the role of a circular clerk?

A circular clerk is responsible for processing and responding to account holder inquiries regarding circular banking services. They facilitate requests for letters of credit, standby letters of credit, and guarantees. They also prepare and review documentation related to circular transactions, ensuring compliance with regulations. Circular clerks collaborate with account holders and external parties to execute circular transactions efficiently. They analyze and assess financial risks associated with circular banking transactions and monitor account activity to identify potential risks or anomalies.

What are the key skills required for a circular clerk?

Key skills for a circular clerk include knowledge of circular banking products and services, experience in processing and responding to account holder inquiries, ability to prepare and review documentation related to circular transactions, and skills in analyzing and assessing financial risks.

What are the career prospects for a circular clerk?

Circular clerks can advance to roles such as trade finance manager, credit analyst, or relationship manager. With experience, they can also move into senior management positions.

What is the average salary for a circular clerk?

The average salary for a circular clerk varies depending on experience, location, and company size. According to Salary.com, the average salary for a circular clerk in the United States is $65,000.

What are the educational requirements for a circular clerk?

A bachelor’s degree in finance or a related field is typically required for a circular clerk position. Some employers may also require experience in the banking industry.

What are the challenges of working as a circular clerk?

The challenges of working as a circular clerk include the need to stay up-to-date on the latest financial regulations, the ability to work independently and as part of a team, and the ability to handle high-pressure situations.