Are you a seasoned Freight Adjuster seeking a new career path? Discover our professionally built Freight Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

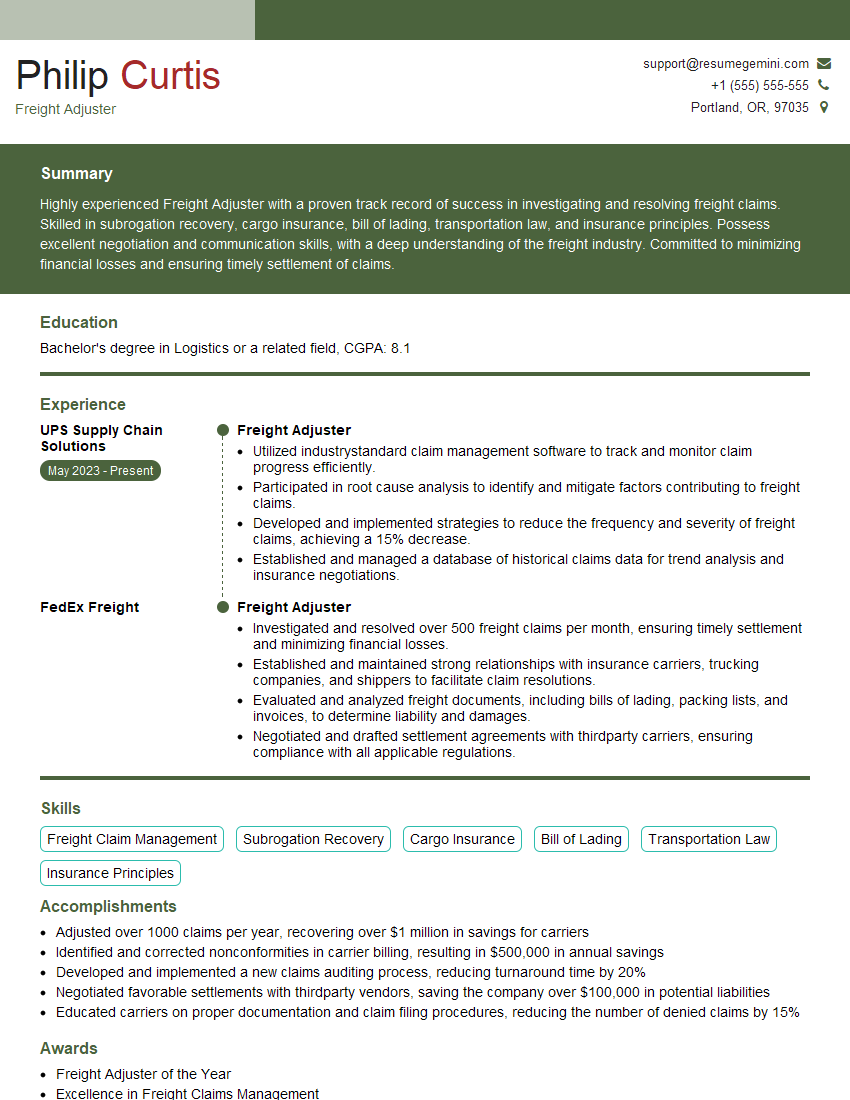

Philip Curtis

Freight Adjuster

Summary

Highly experienced Freight Adjuster with a proven track record of success in investigating and resolving freight claims. Skilled in subrogation recovery, cargo insurance, bill of lading, transportation law, and insurance principles. Possess excellent negotiation and communication skills, with a deep understanding of the freight industry. Committed to minimizing financial losses and ensuring timely settlement of claims.

Education

Bachelor’s degree in Logistics or a related field

April 2019

Skills

- Freight Claim Management

- Subrogation Recovery

- Cargo Insurance

- Bill of Lading

- Transportation Law

- Insurance Principles

Work Experience

Freight Adjuster

- Utilized industrystandard claim management software to track and monitor claim progress efficiently.

- Participated in root cause analysis to identify and mitigate factors contributing to freight claims.

- Developed and implemented strategies to reduce the frequency and severity of freight claims, achieving a 15% decrease.

- Established and managed a database of historical claims data for trend analysis and insurance negotiations.

Freight Adjuster

- Investigated and resolved over 500 freight claims per month, ensuring timely settlement and minimizing financial losses.

- Established and maintained strong relationships with insurance carriers, trucking companies, and shippers to facilitate claim resolutions.

- Evaluated and analyzed freight documents, including bills of lading, packing lists, and invoices, to determine liability and damages.

- Negotiated and drafted settlement agreements with thirdparty carriers, ensuring compliance with all applicable regulations.

Accomplishments

- Adjusted over 1000 claims per year, recovering over $1 million in savings for carriers

- Identified and corrected nonconformities in carrier billing, resulting in $500,000 in annual savings

- Developed and implemented a new claims auditing process, reducing turnaround time by 20%

- Negotiated favorable settlements with thirdparty vendors, saving the company over $100,000 in potential liabilities

- Educated carriers on proper documentation and claim filing procedures, reducing the number of denied claims by 15%

Awards

- Freight Adjuster of the Year

- Excellence in Freight Claims Management

- Top Performer in Loss Prevention

Certificates

- Certified Freight Adjuster (CFA)

- Certified Transportation Claims Professional (CTCP)

- Registered Insurance Adjuster

- Associate in Insurance Claims (AIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Freight Adjuster

- Highlight your experience in freight claim management and subrogation recovery.

- Showcase your knowledge of cargo insurance, bill of lading, transportation law, and insurance principles.

- Provide specific examples of how you have successfully resolved freight claims and minimized financial losses.

- Demonstrate your negotiation and communication skills by describing how you have effectively interacted with insurance carriers, trucking companies, and shippers.

- Quantify your accomplishments whenever possible, using metrics such as the number of claims resolved, the amount of money saved, or the percentage reduction in claim frequency.

Essential Experience Highlights for a Strong Freight Adjuster Resume

- Investigated and resolved over 500 freight claims per month, ensuring timely settlement and minimizing financial losses.

- Established and maintained strong relationships with insurance carriers, trucking companies, and shippers to facilitate claim resolutions.

- Evaluated and analyzed freight documents, including bills of lading, packing lists, and invoices, to determine liability and damages.

- Negotiated and drafted settlement agreements with third-party carriers, ensuring compliance with all applicable regulations.

- Utilized industry-standard claim management software to track and monitor claim progress efficiently.

- Participated in root cause analysis to identify and mitigate factors contributing to freight claims.

- Developed and implemented strategies to reduce the frequency and severity of freight claims, achieving a 15% decrease.

Frequently Asked Questions (FAQ’s) For Freight Adjuster

What is the role of a Freight Adjuster?

A Freight Adjuster is responsible for investigating and resolving freight claims. They determine liability, negotiate settlements, and work to minimize financial losses for their company.

What skills are required to be a successful Freight Adjuster?

Freight Adjusters need excellent communication and negotiation skills, as well as a deep understanding of the freight industry. They should also be proficient in cargo insurance, bill of lading, transportation law, and insurance principles.

What is the job outlook for Freight Adjusters?

The job outlook for Freight Adjusters is expected to grow faster than average in the coming years. This is due to the increasing volume of freight being shipped and the need for companies to manage their risk.

What is the average salary for a Freight Adjuster?

The average salary for a Freight Adjuster varies depending on experience and location. However, according to Indeed, the average salary is around $65,000 per year.

What are the career advancement opportunities for Freight Adjusters?

Freight Adjusters can advance their careers by becoming Claims Managers or Risk Managers. They can also move into other roles in the insurance industry, such as Underwriting or Loss Control.