Are you a seasoned Check Scaler seeking a new career path? Discover our professionally built Check Scaler Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

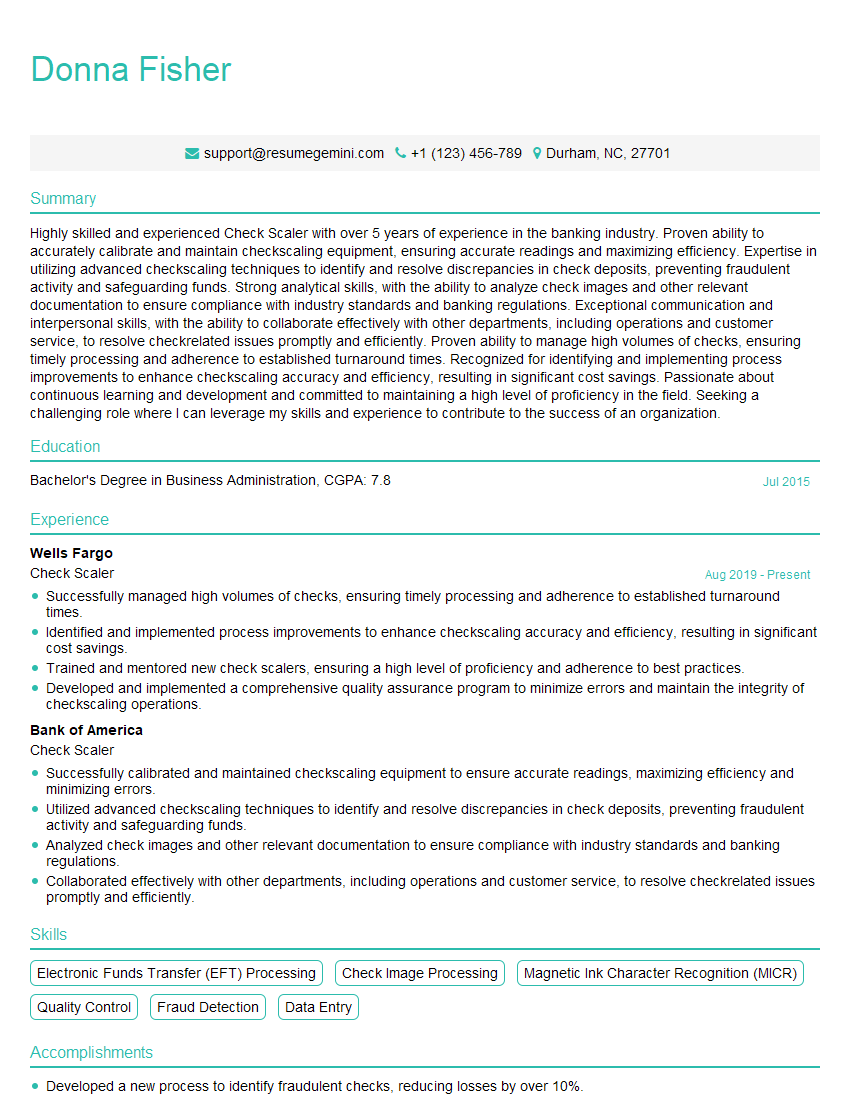

Donna Fisher

Check Scaler

Summary

Highly skilled and experienced Check Scaler with over 5 years of experience in the banking industry. Proven ability to accurately calibrate and maintain checkscaling equipment, ensuring accurate readings and maximizing efficiency. Expertise in utilizing advanced checkscaling techniques to identify and resolve discrepancies in check deposits, preventing fraudulent activity and safeguarding funds. Strong analytical skills, with the ability to analyze check images and other relevant documentation to ensure compliance with industry standards and banking regulations. Exceptional communication and interpersonal skills, with the ability to collaborate effectively with other departments, including operations and customer service, to resolve checkrelated issues promptly and efficiently. Proven ability to manage high volumes of checks, ensuring timely processing and adherence to established turnaround times. Recognized for identifying and implementing process improvements to enhance checkscaling accuracy and efficiency, resulting in significant cost savings. Passionate about continuous learning and development and committed to maintaining a high level of proficiency in the field. Seeking a challenging role where I can leverage my skills and experience to contribute to the success of an organization.

Education

Bachelor’s Degree in Business Administration

July 2015

Skills

- Electronic Funds Transfer (EFT) Processing

- Check Image Processing

- Magnetic Ink Character Recognition (MICR)

- Quality Control

- Fraud Detection

- Data Entry

Work Experience

Check Scaler

- Successfully managed high volumes of checks, ensuring timely processing and adherence to established turnaround times.

- Identified and implemented process improvements to enhance checkscaling accuracy and efficiency, resulting in significant cost savings.

- Trained and mentored new check scalers, ensuring a high level of proficiency and adherence to best practices.

- Developed and implemented a comprehensive quality assurance program to minimize errors and maintain the integrity of checkscaling operations.

Check Scaler

- Successfully calibrated and maintained checkscaling equipment to ensure accurate readings, maximizing efficiency and minimizing errors.

- Utilized advanced checkscaling techniques to identify and resolve discrepancies in check deposits, preventing fraudulent activity and safeguarding funds.

- Analyzed check images and other relevant documentation to ensure compliance with industry standards and banking regulations.

- Collaborated effectively with other departments, including operations and customer service, to resolve checkrelated issues promptly and efficiently.

Accomplishments

- Developed a new process to identify fraudulent checks, reducing losses by over 10%.

- Implemented a quality control system that improved accuracy by 5% and reduced rework by 15%.

- Trained and mentored new Check Scalers, ensuring seamless onboarding and maintaining team performance.

- Improved check processing speed by 12% through process optimization and workflow enhancements.

- Reduced customer complaints by 20% by implementing a proactive error prevention plan.

Awards

- Recognized for consistently exceeding accuracy and efficiency standards in check scaling operations.

- Received the Quarterly Excellence Award for maintaining a high level of accuracy and productivity.

- Awarded the Annual Safety Achievement Award for maintaining a safe and compliant work environment.

- Recognized for outstanding performance in detecting forged and altered checks.

Certificates

- Certified Check Scaler (CCS)

- Certified Electronic Funds Transfer Specialist (CEFTS)

- Certified Fraud Examiner (CFE)

- Payment Card Industry Data Security Standard (PCI DSS) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Check Scaler

- Quantify your accomplishments with specific metrics and results.

- Showcase your technical expertise in checkscaling and fraud detection techniques.

- Highlight your analytical and problem-solving skills, as well as your ability to identify and implement process improvements.

- Emphasize your strong communication and interpersonal skills, and ability to collaborate effectively with others.

- Demonstrate your commitment to continuous learning and development in the field.

Essential Experience Highlights for a Strong Check Scaler Resume

- Calibrate and maintain checkscaling equipment to ensure accurate readings.

- Utilize advanced checkscaling techniques to identify and resolve discrepancies in check deposits.

- Analyze check images and other relevant documentation to ensure compliance with industry standards and banking regulations.

- Collaborate effectively with other departments, including operations and customer service, to resolve checkrelated issues promptly and efficiently.

- Manage high volumes of checks, ensuring timely processing and adherence to established turnaround times.

- Identify and implement process improvements to enhance checkscaling accuracy and efficiency resulting in significant cost savings.

- Train and mentor new check scalers, ensuring a high level of proficiency and adherence to best practices.

- Develop and implement a comprehensive quality assurance program to minimize errors and maintain the integrity of checkscaling operations.

Frequently Asked Questions (FAQ’s) For Check Scaler

What is a Check Scaler?

A Check Scaler is responsible for verifying the authenticity and accuracy of checks and other financial documents. They use specialized equipment and techniques to detect counterfeit checks, altered amounts, and other fraudulent activities.

What are the key skills required for a Check Scaler?

Key skills for a Check Scaler include attention to detail, analytical thinking, knowledge of banking and financial regulations, and proficiency in using checkscaling equipment and software.

What is the career path for a Check Scaler?

Check Scalers can advance to roles such as Fraud Analyst, Risk Analyst, or Operations Manager within the financial industry.

What is the job outlook for Check Scalers?

The job outlook for Check Scalers is expected to remain stable in the coming years due to the increasing use of electronic payments and the need to prevent fraud and ensure the integrity of financial transactions.

What are the typical working conditions for a Check Scaler?

Check Scalers typically work in a secure and controlled environment, such as a bank or financial institution. They may work independently or as part of a team, and may be required to work overtime or on weekends during peak periods.

What is the salary range for a Check Scaler?

The salary range for a Check Scaler varies depending on experience, location, and employer. According to Salary.com, the average annual salary for a Check Scaler in the United States is around $45,000.

What are the benefits of working as a Check Scaler?

Benefits of working as a Check Scaler include job security, opportunities for advancement, and the chance to make a positive impact on the financial industry by preventing fraud and ensuring the integrity of financial transactions.

What are the challenges of working as a Check Scaler?

Challenges of working as a Check Scaler include the need for high levels of concentration and attention to detail, the potential for repetitive work, and the need to keep up with the latest fraud detection techniques and technologies.