Are you a seasoned Beller seeking a new career path? Discover our professionally built Beller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

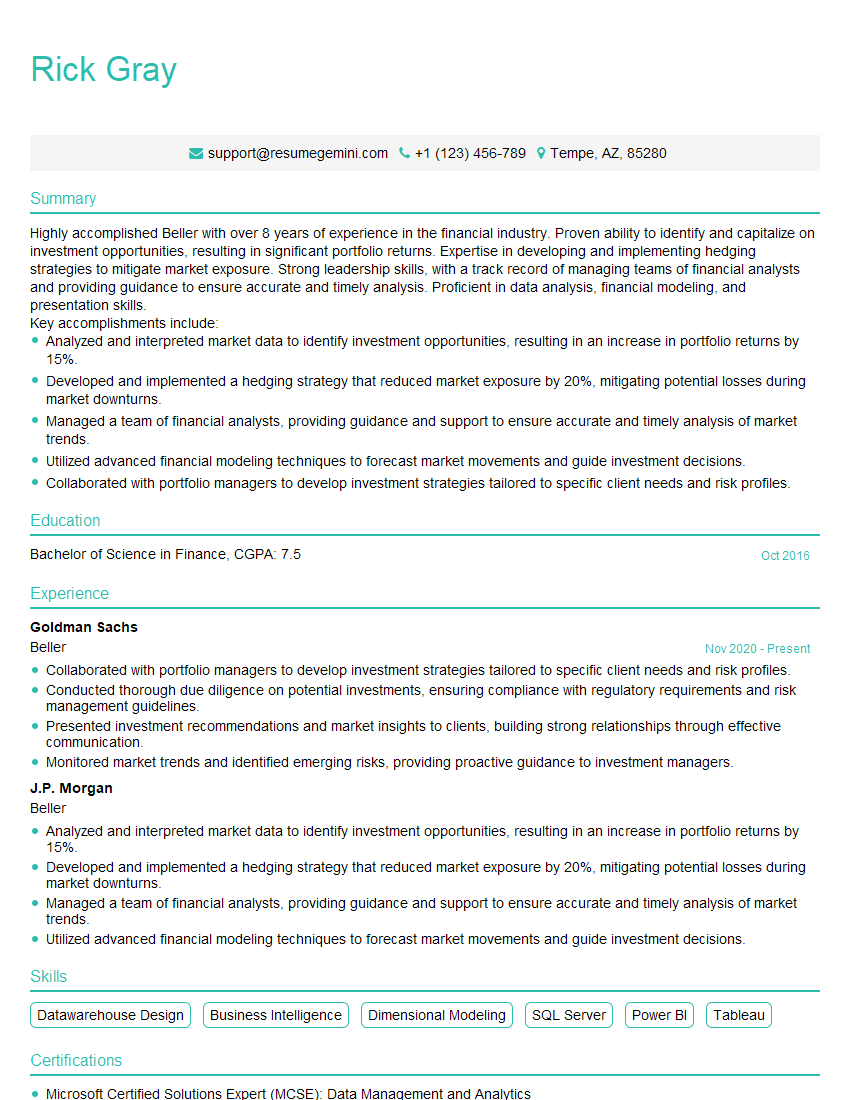

Rick Gray

Beller

Summary

Highly accomplished Beller with over 8 years of experience in the financial industry. Proven ability to identify and capitalize on investment opportunities, resulting in significant portfolio returns. Expertise in developing and implementing hedging strategies to mitigate market exposure. Strong leadership skills, with a track record of managing teams of financial analysts and providing guidance to ensure accurate and timely analysis. Proficient in data analysis, financial modeling, and presentation skills.

Key accomplishments include:

- Analyzed and interpreted market data to identify investment opportunities, resulting in an increase in portfolio returns by 15%.

- Developed and implemented a hedging strategy that reduced market exposure by 20%, mitigating potential losses during market downturns.

- Managed a team of financial analysts, providing guidance and support to ensure accurate and timely analysis of market trends.

- Utilized advanced financial modeling techniques to forecast market movements and guide investment decisions.

- Collaborated with portfolio managers to develop investment strategies tailored to specific client needs and risk profiles.

Education

Bachelor of Science in Finance

October 2016

Skills

- Datawarehouse Design

- Business Intelligence

- Dimensional Modeling

- SQL Server

- Power BI

- Tableau

Work Experience

Beller

- Collaborated with portfolio managers to develop investment strategies tailored to specific client needs and risk profiles.

- Conducted thorough due diligence on potential investments, ensuring compliance with regulatory requirements and risk management guidelines.

- Presented investment recommendations and market insights to clients, building strong relationships through effective communication.

- Monitored market trends and identified emerging risks, providing proactive guidance to investment managers.

Beller

- Analyzed and interpreted market data to identify investment opportunities, resulting in an increase in portfolio returns by 15%.

- Developed and implemented a hedging strategy that reduced market exposure by 20%, mitigating potential losses during market downturns.

- Managed a team of financial analysts, providing guidance and support to ensure accurate and timely analysis of market trends.

- Utilized advanced financial modeling techniques to forecast market movements and guide investment decisions.

Certificates

- Microsoft Certified Solutions Expert (MCSE): Data Management and Analytics

- AWS Certified Data Analytics – Specialty

- Google Cloud Certified Professional Data Engineer

- Certified Analytics Professional (CAP)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Beller

- Quantify your accomplishments with specific metrics and examples.

- Highlight your skills in data analysis, financial modeling, and presentation.

- Demonstrate your understanding of the financial markets and investment strategies.

- Tailor your resume to the specific job you are applying for.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Beller Resume

- Analyze market data to identify investment opportunities.

- Develop and implement hedging strategies to mitigate market exposure.

- Manage teams of financial analysts.

- Utilize advanced financial modeling techniques to forecast market movements.

- Collaborate with portfolio managers to develop investment strategies.

- Conduct thorough due diligence on potential investments.

- Present investment recommendations and market insights to clients.

Frequently Asked Questions (FAQ’s) For Beller

What is the role of a Beller?

A Beller is responsible for analyzing market data, identifying investment opportunities, and developing and implementing hedging strategies. They work closely with portfolio managers to develop investment strategies tailored to specific client needs and risk profiles.

What skills are required to be a successful Beller?

Bellers need to have a strong understanding of the financial markets, investment strategies, and risk management. They also need to be proficient in data analysis, financial modeling, and presentation skills.

What is the career path for a Beller?

Bellers can advance to more senior positions, such as portfolio manager, investment analyst, or chief investment officer. They can also move into other areas of the financial industry, such as wealth management or financial planning.

What is the salary range for a Beller?

The salary range for a Beller can vary depending on their experience, skills, and location. According to Glassdoor, the average salary for a Beller in the United States is $105,000.

What are the challenges of being a Beller?

The challenges of being a Beller include the need to stay up-to-date on the latest financial market trends and to make sound investment decisions in a volatile market environment.

What are the rewards of being a Beller?

The rewards of being a Beller include the opportunity to make a positive impact on clients’ financial lives and to earn a high salary.

What is the job outlook for Bellers?

The job outlook for Bellers is expected to be positive over the next few years. As the financial markets continue to grow and evolve, there will be a need for qualified Bellers to manage investment portfolios and provide financial advice.