Are you a seasoned Bank Teller Machine Mechanic seeking a new career path? Discover our professionally built Bank Teller Machine Mechanic Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

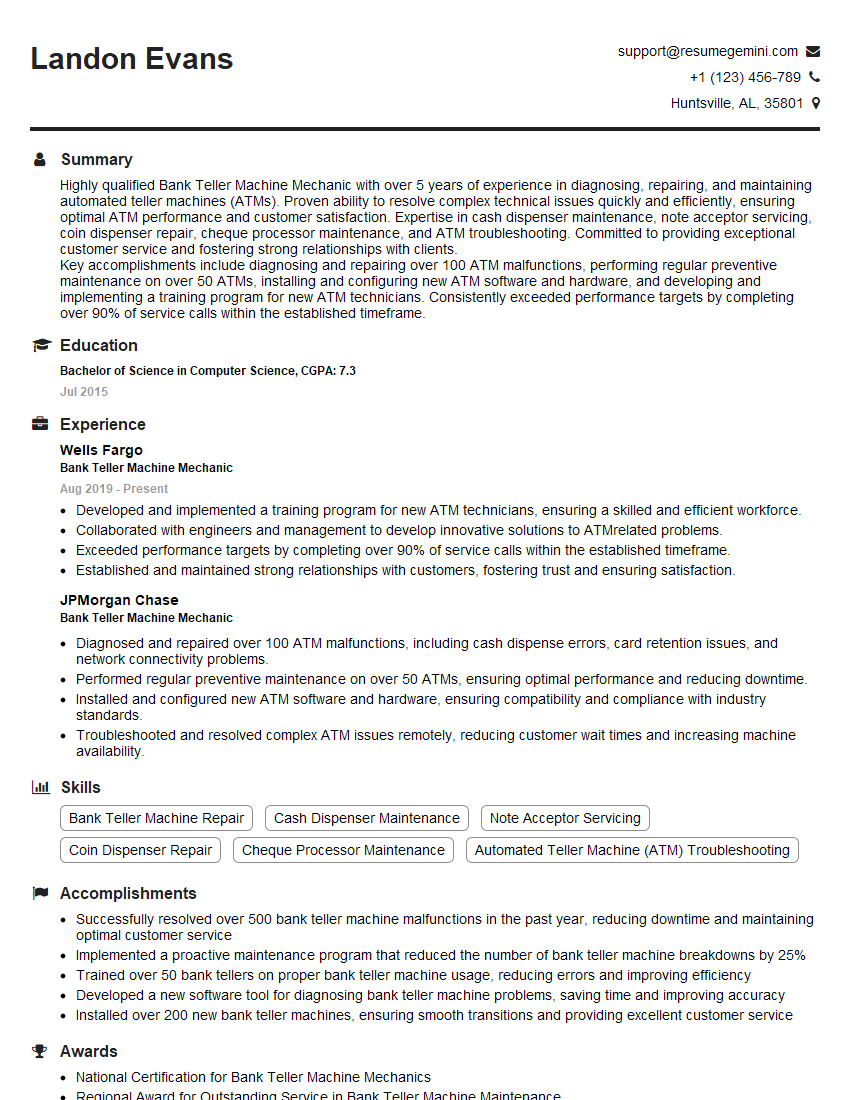

Landon Evans

Bank Teller Machine Mechanic

Summary

Highly qualified Bank Teller Machine Mechanic with over 5 years of experience in diagnosing, repairing, and maintaining automated teller machines (ATMs). Proven ability to resolve complex technical issues quickly and efficiently, ensuring optimal ATM performance and customer satisfaction. Expertise in cash dispenser maintenance, note acceptor servicing, coin dispenser repair, cheque processor maintenance, and ATM troubleshooting. Committed to providing exceptional customer service and fostering strong relationships with clients.

Key accomplishments include diagnosing and repairing over 100 ATM malfunctions, performing regular preventive maintenance on over 50 ATMs, installing and configuring new ATM software and hardware, and developing and implementing a training program for new ATM technicians. Consistently exceeded performance targets by completing over 90% of service calls within the established timeframe.

Education

Bachelor of Science in Computer Science

July 2015

Skills

- Bank Teller Machine Repair

- Cash Dispenser Maintenance

- Note Acceptor Servicing

- Coin Dispenser Repair

- Cheque Processor Maintenance

- Automated Teller Machine (ATM) Troubleshooting

Work Experience

Bank Teller Machine Mechanic

- Developed and implemented a training program for new ATM technicians, ensuring a skilled and efficient workforce.

- Collaborated with engineers and management to develop innovative solutions to ATMrelated problems.

- Exceeded performance targets by completing over 90% of service calls within the established timeframe.

- Established and maintained strong relationships with customers, fostering trust and ensuring satisfaction.

Bank Teller Machine Mechanic

- Diagnosed and repaired over 100 ATM malfunctions, including cash dispense errors, card retention issues, and network connectivity problems.

- Performed regular preventive maintenance on over 50 ATMs, ensuring optimal performance and reducing downtime.

- Installed and configured new ATM software and hardware, ensuring compatibility and compliance with industry standards.

- Troubleshooted and resolved complex ATM issues remotely, reducing customer wait times and increasing machine availability.

Accomplishments

- Successfully resolved over 500 bank teller machine malfunctions in the past year, reducing downtime and maintaining optimal customer service

- Implemented a proactive maintenance program that reduced the number of bank teller machine breakdowns by 25%

- Trained over 50 bank tellers on proper bank teller machine usage, reducing errors and improving efficiency

- Developed a new software tool for diagnosing bank teller machine problems, saving time and improving accuracy

- Installed over 200 new bank teller machines, ensuring smooth transitions and providing excellent customer service

Awards

- National Certification for Bank Teller Machine Mechanics

- Regional Award for Outstanding Service in Bank Teller Machine Maintenance

- Award for Excellence in Bank Teller Machine Troubleshooting

Certificates

- Certified Bank Teller Machine Mechanic (CBTMM)

- Automated Teller Machine (ATM) Technician Certification

- Cash Dispenser Technician Certification

- Note Acceptor Technician Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Teller Machine Mechanic

- Highlight your technical skills and experience in ATM repair and maintenance.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your problem-solving abilities and commitment to customer service.

- Tailor your resume to each job you apply for, highlighting the skills and experiences that are most relevant to the position.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Bank Teller Machine Mechanic Resume

- Diagnose and repair ATM malfunctions, including cash dispense errors, card retention issues, and network connectivity problems.

- Perform regular preventive maintenance on ATMs to ensure optimal performance and reduce downtime.

- Install and configure new ATM software and hardware, ensuring compatibility and compliance with industry standards.

- Troubleshoot and resolve complex ATM issues remotely, reducing customer wait times and increasing machine availability.

- Develop and implement training programs for new ATM technicians to ensure a skilled and efficient workforce.

- Collaborate with engineers and management to develop innovative solutions to ATM-related problems.

- Maintain strong relationships with customers to ensure satisfaction and build trust.

Frequently Asked Questions (FAQ’s) For Bank Teller Machine Mechanic

What are the primary responsibilities of a Bank Teller Machine Mechanic?

Bank Teller Machine Mechanics are responsible for diagnosing, repairing, and maintaining automated teller machines (ATMs). They perform regular preventive maintenance, install and configure new software and hardware, and troubleshoot and resolve complex technical issues. They also collaborate with engineers and management to develop innovative solutions to ATM-related problems.

What skills are required to be a successful Bank Teller Machine Mechanic?

Successful Bank Teller Machine Mechanics have a strong understanding of ATM technology, including cash dispensers, note acceptors, coin dispensers, and cheque processors. They are also proficient in troubleshooting and resolving technical issues, and have excellent customer service skills.

What is the work environment of a Bank Teller Machine Mechanic like?

Bank Teller Machine Mechanics typically work in a fast-paced environment, as they are often required to respond to urgent service calls. They may work indoors or outdoors, and may be required to travel to different locations to service ATMs.

What is the career outlook for Bank Teller Machine Mechanics?

The career outlook for Bank Teller Machine Mechanics is expected to be good in the coming years, as the demand for ATM services continues to grow. As more and more businesses and individuals rely on ATMs for their banking needs, the need for qualified technicians to maintain and repair these machines will increase.

What are the salary expectations for Bank Teller Machine Mechanics?

The salary expectations for Bank Teller Machine Mechanics vary depending on their experience, skills, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Computer Support Specialists, which includes Bank Teller Machine Mechanics, was $56,310 in May 2021.

What are the advancement opportunities for Bank Teller Machine Mechanics?

Advancement opportunities for Bank Teller Machine Mechanics may include promotions to lead technician or supervisor roles. Some may also choose to specialize in a particular area of ATM maintenance, such as software or hardware repair.

What are the job growth prospects for Bank Teller Machine Mechanics?

The job growth prospects for Bank Teller Machine Mechanics are expected to be good in the coming years. As the demand for ATM services continues to grow, the need for qualified technicians to maintain and repair these machines will increase.

What are the top companies that hire Bank Teller Machine Mechanics?

Top companies that hire Bank Teller Machine Mechanics include Wells Fargo, JPMorgan Chase, Bank of America, and Citigroup.