Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Liquidator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

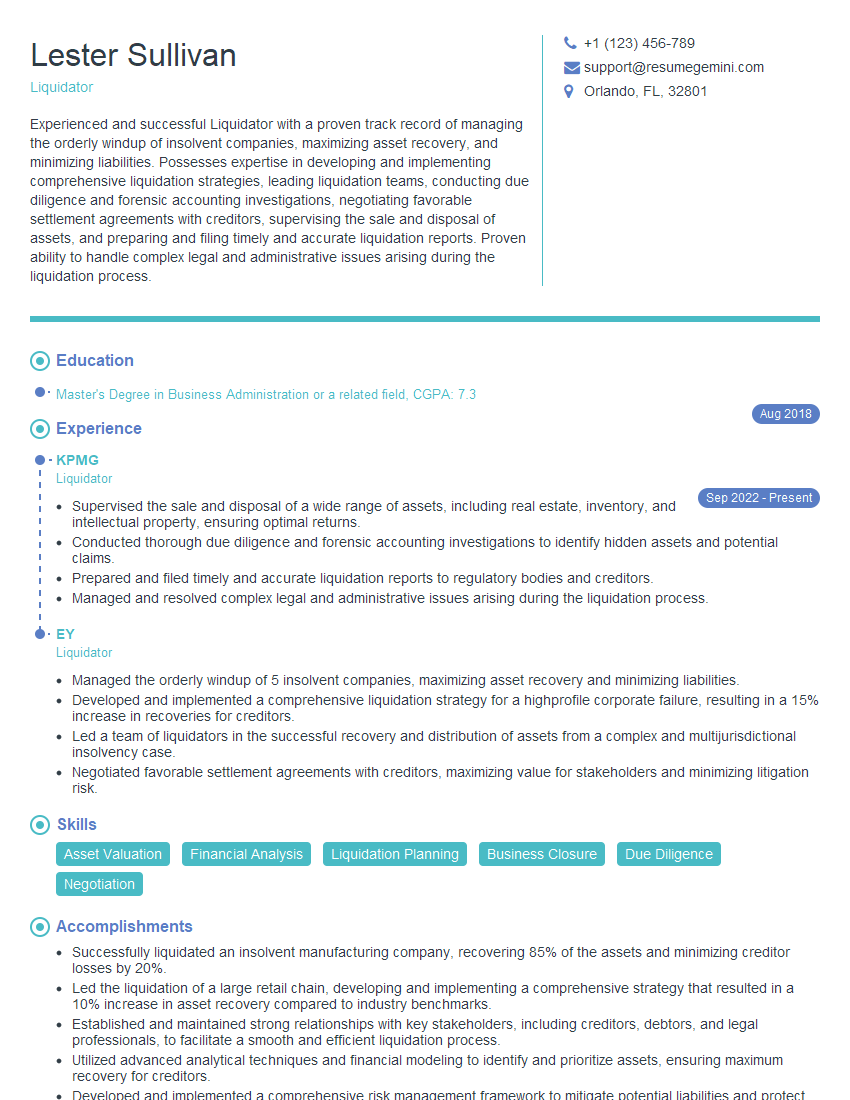

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Liquidator

1. What are the key responsibilities of a Liquidator?

As a Liquidator, my primary responsibilities involve:

- Investigating the company’s financial affairs to determine its solvency

- Negotiating with creditors on behalf of the company

- Managing the realization of the company’s assets and distributing the proceeds to creditors and shareholders

- Reporting to creditors and shareholders on the liquidation process

2. What are the different types of liquidations and when would you use each one?

Voluntary Liquidation

- Used when the company is solvent and the directors believe it is in the best interests of the shareholders to wind up the company

- Can be a members’ voluntary liquidation (shareholders vote to liquidate) or a creditors’ voluntary liquidation (creditors vote to liquidate)

Compulsory Liquidation

- Used when the company is insolvent and a creditor or shareholder applies to the court to have the company wound up

- The court will appoint a liquidator to oversee the liquidation process

3. What is the process for realising the assets of an insolvent company?

When realizing the assets of an insolvent company, I would typically follow these steps:

- Identify and value the company’s assets

- Market and sell the assets

- Distribute the proceeds of the sale to creditors and shareholders

4. How do you determine the priority of creditors when distributing the proceeds of liquidation?

The priority of creditors in liquidation is governed by the Insolvency Act. The general order of priority is as follows:

- Secured creditors

- Preferential creditors (e.g., employees, tax authorities)

- Unsecured creditors

- Shareholders

5. What are the ethical responsibilities of a Liquidator?

As a Liquidator, I am bound by a number of ethical responsibilities, including:

- Acting in the best interests of the creditors and shareholders

- Maintaining confidentiality

- Avoiding conflicts of interest

- Complying with all applicable laws and regulations

6. What are the challenges of being a Liquidator?

Being a Liquidator can present a number of challenges, such as:

- Dealing with distressed companies and their stakeholders

- Managing complex legal and financial issues

- Operating under tight deadlines and limited resources

- Facing criticism and scrutiny from various parties

7. How do you stay up-to-date on the latest developments in insolvency law?

To stay up-to-date on the latest developments in insolvency law, I regularly engage in the following activities:

- Attending industry conferences and seminars

- Reading legal journals and articles

- Consulting with other insolvency professionals

- Participating in continuing professional development courses

8. What is your experience with cross-border insolvencies?

I have experience with cross-border insolvencies in the following areas:

- Advising on the recognition and enforcement of foreign insolvency proceedings

- Coordinating with liquidators and trustees in other jurisdictions

- Managing the distribution of assets to creditors in multiple countries

9. What are your strengths and weaknesses as a Liquidator?

Strengths

- Strong understanding of insolvency law and regulations

- Proven track record of successfully liquidating insolvent companies

- Excellent communication and interpersonal skills

- Ability to work effectively under pressure and tight deadlines

Weaknesses

- Limited experience with cross-border insolvencies

- Can be difficult to remain impartial when dealing with distressed companies and their stakeholders

10. Why are you interested in this Liquidator position?

I am interested in this Liquidator position because it aligns with my skills and experience in insolvency law. I am confident that I can use my expertise to successfully liquidate insolvent companies and maximize the returns for creditors and shareholders.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Liquidator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Liquidator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Liquidator, you will be responsible for managing the orderly winding down of insolvent companies. Your key responsibilities will include:

1. Assessment and Investigation

Understanding the financial condition of the company and identifying the causes of insolvency.

- Reviewing financial records and conducting interviews with key stakeholders.

- Assessing the value of the company’s assets and liabilities.

2. Management of Assets

Taking control of the company’s assets and maximizing their value for creditors.

- Selling or disposing of assets in a timely and efficient manner.

- Collecting accounts receivable and other debts owed to the company.

3. Distribution of Proceeds

Distributing the proceeds of the liquidation to creditors in accordance with the legal and regulatory framework.

- Calculating and prioritizing claims from creditors.

- Making regular payments to creditors and providing them with updates on the liquidation process.

4. Reporting and Compliance

Meeting reporting and compliance obligations throughout the liquidation process.

- Filing regular reports to the court and other relevant authorities.

- Ensuring compliance with all applicable laws and regulations.

Interview Tips

To prepare for your interview for a Liquidator position, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the company’s financial situation and the industry in which it operates.

- Review the company’s financial statements and news articles.

- Research industry trends and recent developments.

2. Highlight Relevant Experience and Skills

Emphasize your experience in financial analysis, asset management, and insolvency law.

- Provide specific examples of how you have successfully managed liquidation processes.

- Quantify your results whenever possible.

3. Show Your Understanding of Liquidation Process

Discuss your understanding of the legal and regulatory framework governing liquidation.

- Explain the steps involved in the liquidation process.

- Describe the role and responsibilities of a Liquidator.

4. Be Prepared to Discuss Ethical Considerations

Liquidation involves dealing with sensitive financial matters and ethical dilemmas. Be prepared to discuss your approach to ethical decision-making.

- Provide examples of how you have handled ethical challenges in previous roles.

- Emphasize your commitment to transparency and accountability.

Next Step:

Now that you’re armed with the knowledge of Liquidator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Liquidator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini