Are you gearing up for an interview for a Accounts Payable Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Accounts Payable Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

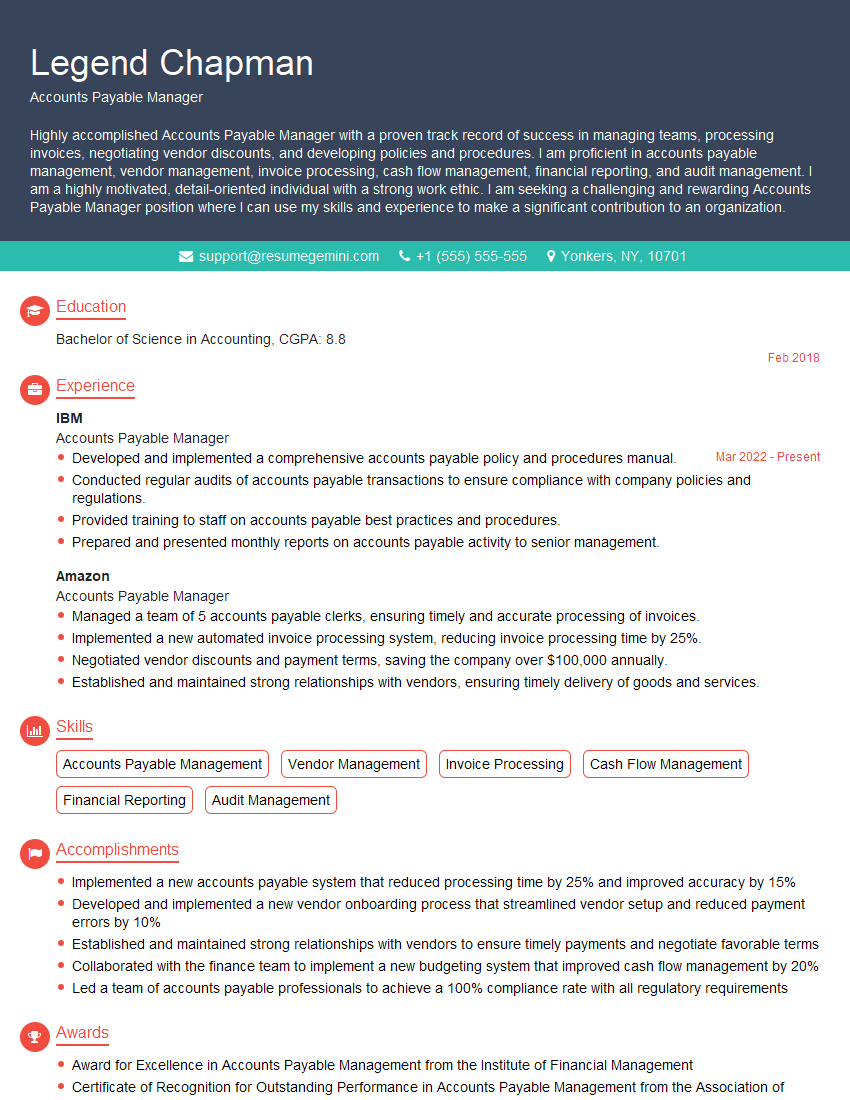

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Payable Manager

1. Describe the key responsibilities of an Accounts Payable Manager?

As an Accounts Payable Manager, my key responsibilities include:

- Overseeing the entire accounts payable process, including invoice processing, payment processing, and vendor management.

- Developing and implementing policies and procedures to streamline the accounts payable process and ensure compliance with all applicable laws and regulations.

- Managing a team of accounts payable staff and providing guidance and support to ensure efficient operations.

- Analyzing accounts payable data to identify areas for improvement and implement solutions to enhance efficiency and cost-effectiveness.

- Working closely with other departments, such as purchasing, receiving, and accounting, to ensure smooth coordination and accuracy in the payment process.

2. What are the key challenges faced by Accounts Payable Managers in today’s business environment?

Technology advancements

- Keeping up with the latest technology advancements in accounts payable automation and digital payments.

- Integrating new technologies with existing systems to improve efficiency and streamline processes.

Regulatory compliance

- Ensuring compliance with all applicable laws and regulations, including tax laws, accounting standards, and data protection regulations.

- Staying up-to-date with changes in regulations and implementing necessary adjustments to processes.

Fraud prevention

- Implementing measures to prevent and detect fraudulent activities, such as invoice fraud and payment fraud.

- Establishing clear policies and procedures for vendor onboarding and invoice approval to mitigate risks.

3. How do you stay updated on the latest trends and best practices in accounts payable?

- Attending industry conferences and webinars to learn from experts and network with peers.

- Reading industry publications, books, and online resources to stay informed about new developments.

- Participating in professional organizations, such as the Institute of Finance and Management (IOFM), to access educational materials and connect with other professionals.

- Seeking out opportunities for professional development, such as certifications and training programs, to enhance my knowledge and skills.

4. What are the key metrics used to measure the performance of an Accounts Payable department?

- Invoice processing time

- Payment accuracy

- Vendor satisfaction

- Days payable outstanding (DPO)

- Accounts payable turnover ratio

- Fraud detection rate

- Cost per invoice processed

5. How do you manage vendor relationships and ensure timely and accurate payments?

- Establishing clear communication channels with vendors and responding promptly to inquiries.

- Reviewing supplier invoices thoroughly to ensure accuracy and completeness before processing payments.

- Negotiating payment terms and discounts to optimize cash flow and improve supplier relationships.

- Implementing a vendor onboarding process to ensure that new vendors meet all necessary requirements.

- Regularly reviewing vendor performance and identifying opportunities for improvement.

6. What are the best practices for managing cash flow in the accounts payable process?

- Taking advantage of early payment discounts

- Negotiating extended payment terms with vendors

- Centralizing accounts payable operations to improve visibility and control over cash flow

- Implementing electronic payments to reduce processing time and improve efficiency

- Monitoring accounts payable balances and forecasting cash flow needs

7. How do you handle disputes with vendors and ensure timely resolution?

- Communicating with vendors promptly and professionally to understand the nature of the dispute.

- Investigating the dispute thoroughly to gather all relevant information and documentation.

- Working with the vendor to find a mutually acceptable solution that is fair and equitable.

- Documenting the dispute resolution process and maintaining a record of all communications.

- Escalating the dispute to management if necessary to seek support and ensure timely resolution.

8. What are the key elements of an effective internal control system for accounts payable?

- Segregation of duties

- Proper authorization and approval of invoices

- Regular reconciliation of accounts payable balances

- Implementation of fraud prevention measures

- Regular review and monitoring of the internal control system to ensure its effectiveness.

9. How do you motivate and develop your team to achieve high performance?

- Setting clear goals and expectations for each team member.

- Providing regular feedback and recognition for achievements.

- Creating a positive and supportive work environment.

- Offering opportunities for professional development and growth.

- Empowering team members to make decisions and take ownership of their work.

10. What is your approach to continuous improvement in the accounts payable process?

- Regularly reviewing the accounts payable process to identify areas for improvement.

- Seeking feedback from team members and vendors to gain insights into process bottlenecks and inefficiencies.

- Researching and implementing new technologies and best practices to streamline operations.

- Measuring the results of improvement initiatives and making adjustments as necessary.

- Encouraging a culture of continuous learning and innovation within the team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Payable Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Payable Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounts Payable Managers are responsible for overseeing all aspects of accounts payable, ensuring that invoices are processed accurately and on time. They also work closely with vendors and other departments to ensure that the organization’s financial obligations are met.

1. Manage Accounts Payable Team

Accounts Payable Managers are responsible for leading and motivating their team of accounts payable professionals. This includes setting goals, providing training, and ensuring that the team is meeting all deadlines.

- Set team goals and objectives

- Provide training and development for team members

- Monitor team performance and provide feedback

2. Process Invoices

Accounts Payable Managers are responsible for processing all invoices in a timely and accurate manner. This includes verifying invoices, matching them to purchase orders, and initiating payment.

- Verify invoices for accuracy

- Match invoices to purchase orders

- Initiate payment of invoices

3. Manage Vendor Relationships

Accounts Payable Managers are responsible for managing relationships with vendors. This includes negotiating payment terms, resolving disputes, and ensuring that vendors are paid on time.

- Negotiate payment terms with vendors

- Resolve disputes with vendors

- Ensure that vendors are paid on time

4. Report on Accounts Payable Activity

Accounts Payable Managers are responsible for reporting on accounts payable activity to management. This includes providing information on invoice volume, average payment time, and vendor performance.

- Provide management with reports on accounts payable activity

- Analyze accounts payable data to identify trends and make improvements

- Make recommendations to management on ways to improve accounts payable processes

Interview Tips

Here are some tips to help you ace your interview for an Accounts Payable Manager position:

1. Research the Company

Before your interview, take some time to research the company. This will help you understand the company’s culture, values, and business goals. You can find this information on the company’s website, social media pages, and news articles.

- Read about the company’s history, mission, and values

- Check out the company’s website and social media pages

- Read news articles about the company

2. Practice Your Answers

Once you know more about the company, you can start practicing your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Write down your answers to common interview questions

- Practice saying your answers out loud

- Ask a friend or family member to mock interview you

3. Demonstrate Your Skills

During your interview, be sure to demonstrate your skills and experience in accounts payable. This could include sharing examples of successful projects you’ve worked on, or discussing your knowledge of specific accounting software.

- Share examples of successful accounts payable projects you’ve worked on

- Discuss your knowledge of specific accounting software

- Explain how you would handle specific accounts payable challenges

4. Be Enthusiastic and Positive

It’s important to be enthusiastic and positive during your interview. This will show the interviewer that you’re excited about the opportunity and that you’re confident in your abilities.

- Smile and make eye contact with the interviewer

- Be positive and enthusiastic about your experience and skills

- Show that you’re excited about the opportunity to work for the company

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Payable Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!