Feeling lost in a sea of interview questions? Landed that dream interview for Residential Mortgage Manager but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Residential Mortgage Manager interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

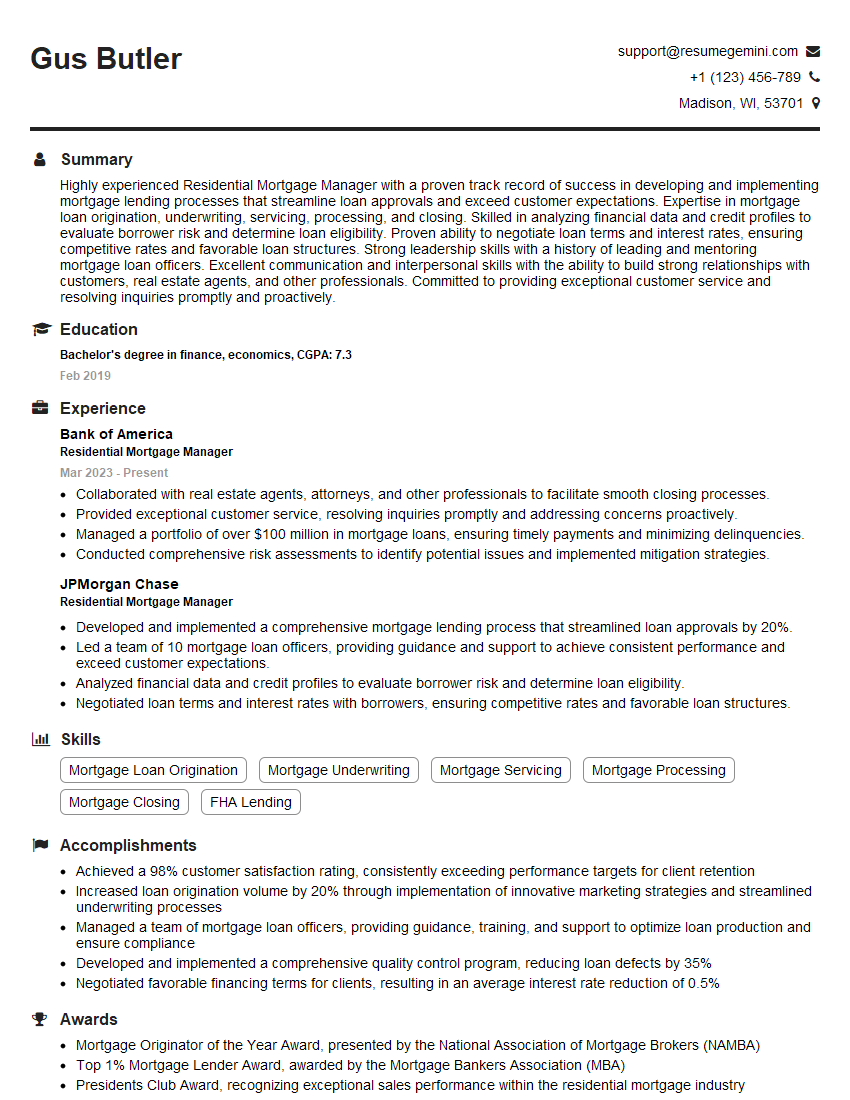

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Residential Mortgage Manager

1. Describe the key responsibilities of a Residential Mortgage Manager?

- Leading and managing a team of mortgage loan officers and support staff

- Developing and implementing sales and marketing strategies to generate new mortgage loan business

- Maintaining relationships with referral partners, such as real estate agents, financial advisors, and home builders

- Ensuring that all mortgage loans meet underwriting guidelines and regulatory requirements

- Providing excellent customer service to borrowers throughout the mortgage process

2. What are the key financial metrics that you track as a Residential Mortgage Manager?

Gross loan volume

- Total dollar amount of mortgages originated in a given period

- Used to measure the overall productivity of the mortgage team

Average loan size

- Average dollar amount of mortgages originated in a given period

- Used to assess the risk profile of the mortgage portfolio

Delinquency rate

- Percentage of mortgages that are past due on payments

- Used to measure the credit quality of the mortgage portfolio

3. What are the key regulatory requirements that a Residential Mortgage Manager must be aware of?

- The Truth in Lending Act (TILA)

- The Real Estate Settlement Procedures Act (RESPA)

- The Fair Housing Act (FHA)

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

- The Home Mortgage Disclosure Act (HMDA)

4. What are the most common challenges that you face as a Residential Mortgage Manager?

- Managing risk

- Meeting regulatory requirements

- Attracting and retaining top talent

- Keeping up with the latest changes in the mortgage industry

- Meeting the demands of borrowers

5. What are the key qualities of a successful Residential Mortgage Manager?

- Strong leadership and management skills

- Excellent communication and interpersonal skills

- In-depth knowledge of the mortgage industry

- Proven track record of success in managing mortgage loan teams

- Ability to work independently and as part of a team

6. What is your approach to managing risk in a mortgage portfolio?

My approach to managing risk in a mortgage portfolio is to:

- Identify and assess the risks associated with each mortgage loan

- Develop and implement strategies to mitigate those risks

- Monitor the performance of the mortgage portfolio on a regular basis

- Take corrective action when necessary

7. What are the latest trends in the mortgage industry?

- The rise of online mortgage lending

- The increased use of technology in the mortgage process

- The growing demand for affordable housing

- The impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act

- The aging of the population

8. What are your goals for the next 12 months as a Residential Mortgage Manager?

- Increase the gross loan volume by 10%

- Reduce the average loan size by 5%

- Improve the delinquency rate by 2%

- Attract and retain top talent

- Implement a new technology platform to streamline the mortgage process

9. What is your management style?

My management style is collaborative and empowering. I believe that the best way to achieve success is to work together as a team. I am always willing to listen to the ideas of my team members and I value their input. I am also a strong believer in providing my team with the resources and support they need to be successful.

10. Why should we hire you as our Residential Mortgage Manager?

I am a highly qualified and experienced Residential Mortgage Manager with a proven track record of success. I have a deep understanding of the mortgage industry and I am committed to providing excellent customer service. I am also a strong leader and I am confident that I can lead your team to success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Residential Mortgage Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Residential Mortgage Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Residential Mortgage Manager is a crucial member of the mortgage lending team, responsible for managing all aspects of the residential mortgage lending process.

1. Relationship Management

The manager is responsible for developing and maintaining relationships with borrowers, real estate agents, and other key stakeholders

- Conducting loan consultations

- Providing personalized mortgage solutions

2. Underwriting and Loan Processing

The manager is responsible for underwriting and processing loan applications, ensuring compliance with regulations and guidelines.

- Analyzing borrower’s financial information

- Assessing property value and marketability

3. Loan Closing and Post-Closing

The manager is responsible for coordinating the loan closing and ensuring the timely and smooth disbursement of funds.

- Preparing loan documents and disclosures

- Coordinating closing with borrowers and title companies

4. Risk Management

The manager is responsible for identifying and mitigating risks throughout the lending process.

- Implementing quality control measures

- Reviewing and approving loan applications

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace your upcoming interview for a Residential Mortgage Manager position.

1. Research the Company and Position

Before the interview, take the time to learn about the company’s history, values, and mortgage lending products.

- Review the company website

- Read industry news and articles

2. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers out loud. This will help you feel more confident and articulate during the interview.

- Tell me about your experience in residential mortgage lending.

- How do you manage risk in the mortgage lending process?

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience in your resume and during the interview. Quantify your accomplishments whenever possible and provide specific examples.

- Example: “Developed and implemented a new underwriting process that reduced loan processing time by 20%.”

- Example: “Managed a portfolio of over $100 million in residential mortgages, achieving a 99% loan approval rate.”

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the company. Prepare questions that are specific to the role and the company’s business.

- Example: “What are the company’s goals for the next year in terms of mortgage lending volume?”

- Example: “How does the company support professional development for its employees?”

5. Be Professional and Enthusiastic

Dress professionally, arrive on time, and maintain a positive and enthusiastic demeanor throughout the interview. Your professionalism and enthusiasm will reflect well on your abilities and commitment to the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Residential Mortgage Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!