Feeling lost in a sea of interview questions? Landed that dream interview for Financier but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Financier interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

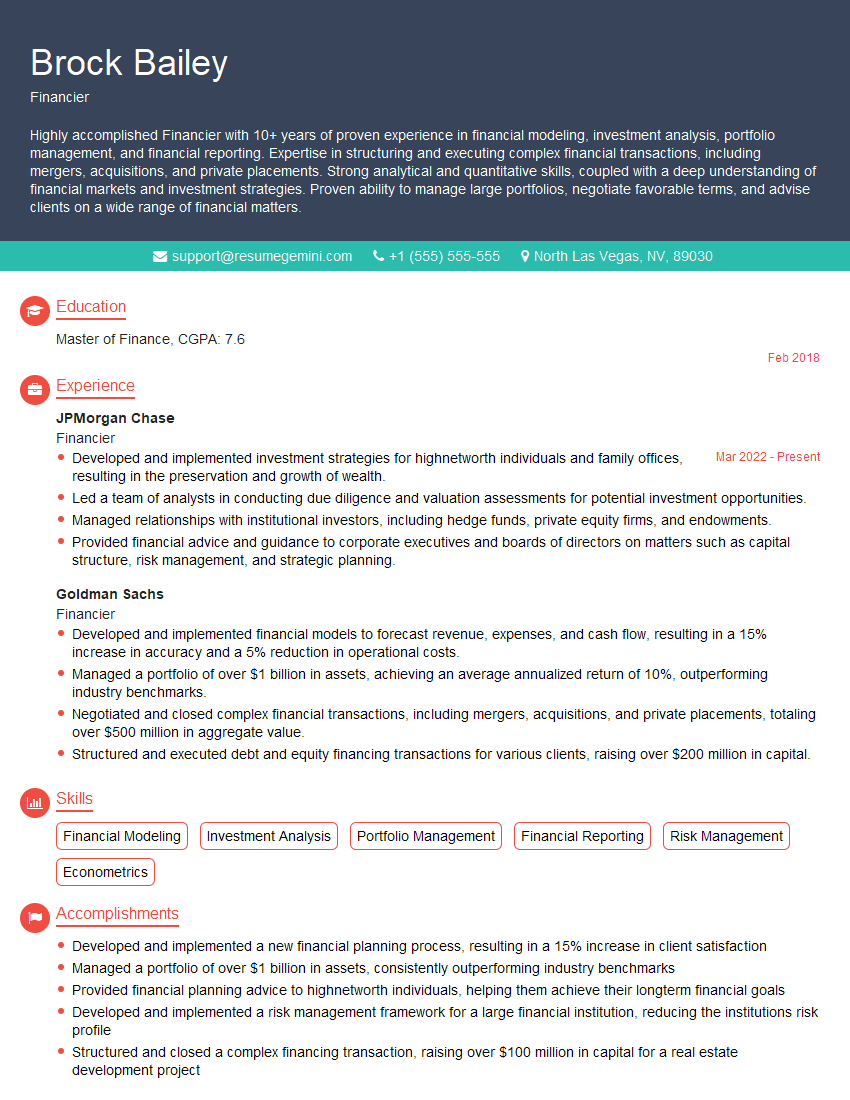

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financier

1. Walk me through the steps involved in financial modeling for a new project.

- Define the project’s financial objectives and scope.

- Gather and analyze relevant financial data.

- Create a financial model that incorporates assumptions and projections.

- Validate and refine the model to ensure its accuracy.

- Use the model to forecast financial performance and assess risks.

2. How do you approach the valuation of a company using different methods?

DCF Analysis

- Project future cash flows.

- Discount cash flows to present value using an appropriate discount rate.

- Sum discounted cash flows to arrive at the company’s value.

Comparable Company Analysis

- Identify comparable companies in the same industry and size range.

- Compare financial metrics (e.g., revenue, EBITDA) to derive a valuation multiple.

- Apply the multiple to the target company’s financial metrics to estimate its value.

3. Explain how you would evaluate the creditworthiness of a potential borrower.

- Analyze the borrower’s financial statements for indicators of financial strength.

- Review credit reports and other sources of credit history.

- Assess the borrower’s management team and industry outlook.

- Determine the appropriate loan terms and collateral requirements.

4. Describe the key principles of portfolio management and how you would apply them to a given portfolio.

- Diversification: Spread investments across different asset classes to reduce risk.

- Asset Allocation: Determine the optimal mix of assets based on risk tolerance and investment goals.

- Rebalancing: Periodically adjust the portfolio to maintain the desired asset allocation.

- Risk Management: Implement strategies to mitigate portfolio risk, such as hedging or limiting exposure.

5. How do you stay up-to-date on the latest financial trends and developments?

- Read industry publications and reports.

- Attend industry conferences and seminars.

- Network with other professionals in the field.

- Participate in continuing education programs.

6. Describe a successful financial deal that you have worked on.

- Provide an overview of the deal, including the parties involved and the objectives.

- Discuss your role in the deal and the challenges you faced.

- Explain how you contributed to the success of the deal.

7. What are your strengths and weaknesses as a financier?

- Strengths: Strong analytical and modeling skills, in-depth knowledge of financial markets, ability to identify investment opportunities, exceptional communication and interpersonal skills.

- Weaknesses: Limited experience in certain specialized areas of finance, such as private equity or venture capital, could be addressed through further training or professional development.

8. Why are you interested in working for our company specifically?

- Research the company’s history, values, and industry reputation.

- Highlight your alignment with the company’s goals and objectives.

- Explain how your skills and experience can contribute to the company’s success.

9. What is your salary expectation?

- Research industry benchmarks for similar positions.

- Consider your experience, skills, and value to the company.

- Be prepared to negotiate and justify your salary request.

10. Do you have any questions for me?

- Ask thoughtful questions that demonstrate your interest in the position and the company.

- Prepare questions that will help you assess the company’s culture, goals, and opportunities for growth.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financier.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financier‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Financier

A financier is a key financial professional who oversees the financial planning, investment, and fundraising activities of an organization. They are responsible for making strategic decisions that impact the organization’s financial health and stability.

1. Financial Planning and Budgeting

Financiers develop and implement financial plans that outline the organization’s financial goals, objectives, and strategies.

- Create financial projections and models to forecast future financial performance.

- Develop strategies to optimize capital allocation and minimize financial risk.

2. Investment Management

Financiers manage the organization’s investment portfolio to maximize returns and minimize risk.

- Conduct market research and analysis to identify and evaluate investment opportunities.

- Monitor investment performance and make necessary adjustments to the portfolio.

3. Fundraising

Financiers raise funds from various sources to finance the organization’s operations and growth.

- Develop and implement fundraising strategies to attract investors and donors.

- Negotiate with potential investors and finalize fundraising agreements.

4. Financial Risk Management

Financiers assess and manage financial risks to protect the organization’s assets and reputation.

- Identify and analyze potential financial risks, such as market fluctuations and credit risk.

- Develop and implement strategies to mitigate financial risks and ensure financial stability.

Interview Tips for Aceing a Financier Interview

Preparing for a financier interview is crucial to showcasing your skills and making a strong impression. Here are some valuable tips to help you ace the interview:

1. Research the Role and Company

Thoroughly research the financier role and the company you’re interviewing with.

- Understand the key responsibilities of the position.

- Learn about the company’s financial performance, industry, and competitive landscape.

2. Practice Your Answers

Prepare thoughtful responses to common interview questions related to your skills and experience.

- Highlight your ability to analyze financial data, develop investment strategies, and manage risk.

- Provide specific examples to demonstrate your practical knowledge and expertise.

3. Emphasize Your Financial Acumen

Quantify your accomplishments and use data to demonstrate your impact on the organization.

- Showcase your ability to create and implement successful financial plans.

- Quantify the return on investment from your investment decisions.

4. Soft Skills and Communication

Remember that financiers often collaborate with various stakeholders.

- Highlight your strong communication and interpersonal skills.

- Demonstrate your ability to explain complex financial concepts clearly and effectively.

5. Prepare Questions for the Interviewer

Ask thoughtful questions during the interview to show your interest and engagement.

- Inquire about the company’s financial goals and challenges.

- Ask about the key responsibilities and career growth opportunities within the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financier interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!