Are you gearing up for a career in Bank Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bank Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

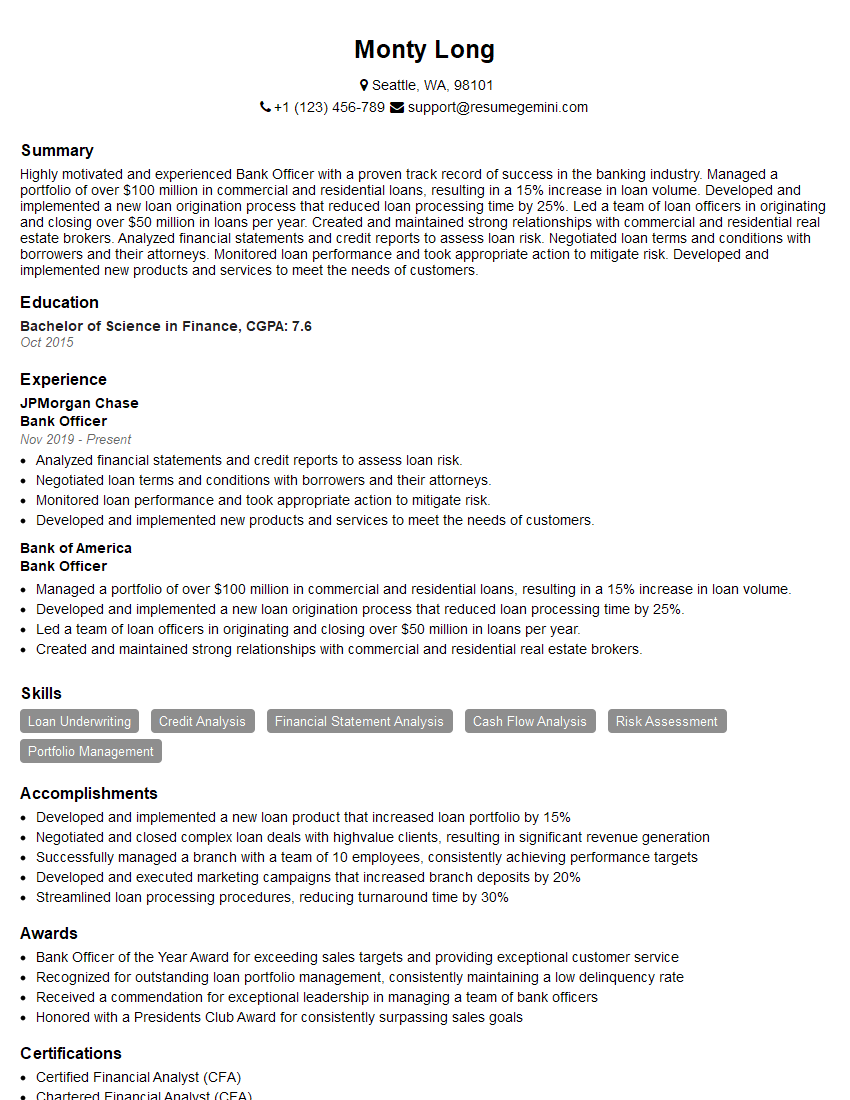

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Officer

1. Explain the key responsibilities of a Bank Officer.

As a Bank Officer, I am responsible for a wide range of duties, including:

- Providing exceptional customer service to individuals and businesses

- Processing financial transactions, such as deposits, withdrawals, and loans

- Maintaining accurate and up-to-date records

- Cross-selling bank products and services

- Monitoring and managing accounts

- Identifying and mitigating financial risks

- Complying with all relevant banking regulations

2. Describe the different types of financial products and services that banks offer.

Banks offer a diverse range of financial products and services to meet the needs of their customers. These include:

- Personal products, such as checking and savings accounts, credit cards, and personal loans

- Business products, such as business loans, lines of credit, and merchant services

- Investment products, such as mutual funds, stocks, and bonds

- Insurance products, such as life insurance, health insurance, and homeowners insurance

- Financial planning services, such as retirement planning and estate planning

3. How do you stay up-to-date on the latest changes in the banking industry?

I stay up-to-date on the latest changes in the banking industry by:

- Reading industry publications

- Attending conferences and webinars

- Taking continuing education courses

- Networking with other professionals in the field

- Monitoring regulatory announcements

4. What is your understanding of the Basel Accords?

The Basel Accords are a set of international banking regulations that aim to strengthen the safety and soundness of banks. The most recent accord, Basel III, includes measures to increase capital requirements, improve risk management, and enhance liquidity. I have a strong understanding of the Basel Accords and their implications for banks.

5. Describe the different types of financial risks that banks face.

Banks face a variety of financial risks, including:

- Credit risk

- Market risk

- Operational risk

- Liquidity risk

- Compliance risk

I am well-versed in the different types of financial risks that banks face and have experience in developing and implementing strategies to mitigate these risks.

6. How do you assess the creditworthiness of a loan applicant?

When assessing the creditworthiness of a loan applicant, I consider a variety of factors, including:

- Credit history

- Debt-to-income ratio

- Employment history

- Income stability

- Collateral

I use this information to make a judgment about the applicant’s ability to repay the loan and determine the appropriate loan terms.

7. What is your experience with financial modeling?

I have experience with a variety of financial modeling techniques, including:

- Discounted cash flow analysis

- Scenario analysis

- Sensitivity analysis

- Monte Carlo simulation

I use financial modeling to evaluate the financial performance of businesses and to make investment decisions.

8. How do you handle difficult customers?

When dealing with difficult customers, I remain calm and professional. I listen to their concerns and try to understand their perspective. I then work to find a solution that is satisfactory to both parties. I have found that this approach is effective in resolving customer issues and building strong relationships.

9. What is your experience with managing a team?

I have experience managing teams of up to 10 people. I have a proven track record of motivating and developing my team members and achieving results. I am also skilled in conflict resolution and team building.

10. Why do you want to work as a Bank Officer?

I am passionate about the banking industry and the role that banks play in the economy. I believe that I have the skills and experience to be a successful Bank Officer. I am confident that I can make a positive contribution to your bank and to the community.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Officers are responsible for providing a wide range of financial services to customers. Their key job responsibilities include:

1. Customer Service

Bank Officers are the face of the bank and interact with customers on a daily basis. They provide excellent customer service by answering questions, resolving complaints, and processing transactions.

2. Cash Management

Bank Officers handle cash transactions, such as deposits, withdrawals, and currency exchange. They also manage ATMs and cash vaults.

3. Loan Processing

Bank Officers process loan applications, evaluate creditworthiness, and issue loans to customers. They also manage loan accounts and collect payments.

4. Investment Services

Bank Officers provide investment advice and sell investment products to customers. They also manage investment portfolios and monitor financial markets.

5. Operations and Compliance

Bank Officers ensure that the bank operates in accordance with all applicable laws and regulations. They also conduct audits and risk assessments.

Interview Tips

To ace an interview for a Bank Officer position, follow these tips:

1. Research the Bank

Before the interview, research the bank and its products and services. This will help you understand the bank’s culture and business goals.

2. Prepare for Common Interview Questions

Practice answering common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”.

3. Dress Professionally

First impressions matter. Dress professionally for the interview. This means wearing a suit or business casual attire.

4. Be Punctual

Arrive on time for the interview. Being punctual shows that you are respectful of the interviewer’s time.

5. Be Enthusiastic

Show the interviewer that you are enthusiastic about the position and the banking industry. This will make you more memorable and increase your chances of getting the job.

Next Step:

Now that you’re armed with the knowledge of Bank Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bank Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini