Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Branch Banker interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Branch Banker so you can tailor your answers to impress potential employers.

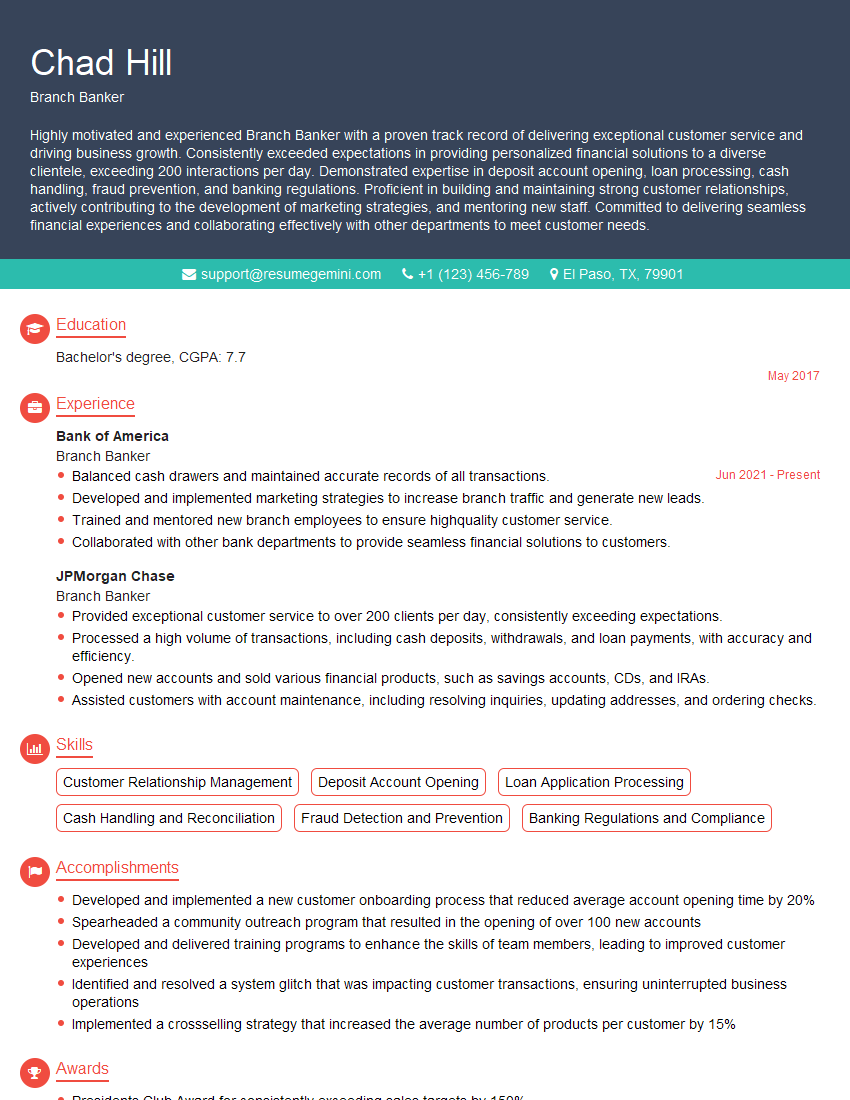

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Branch Banker

1. What are the key responsibilities of a Branch Banker?

As a Branch Banker, my key responsibilities include:

- Providing exceptional customer service to all banking clients

- Processing financial transactions such as deposits, withdrawals, and loan applications

- Maintaining accurate and up-to-date account records

- Cross-selling and promoting various financial products and services

- Ensuring compliance with all banking regulations and policies

2. How would you handle a difficult or irate customer?

Remaining Calm and empathetic

- I begin by acknowledging the customer’s frustration and validating their feelings.

- I actively listen to their concerns, asking clarifying questions to fully understand the issue.

Finding a Solution

- I explore potential solutions, explaining them clearly and patiently.

- I work collaboratively with the customer to find a mutually acceptable resolution.

3. What strategies would you use to increase sales and cross-sell products?

To increase sales and cross-sell products effectively, I would employ the following strategies:

- Identify customer needs by actively listening and building rapport.

- Recommend suitable products and services based on their financial situation and goals.

- Provide clear and concise explanations of product features and benefits.

- Offer incentives and promotions to encourage cross-selling.

- Follow up with customers regularly to ensure satisfaction and offer additional support.

4. How do you stay up-to-date on industry trends and regulations?

To stay current with industry trends and regulations, I:

- Attend industry webinars, conferences, and training sessions.

- Read financial publications and articles.

- Consult with regulatory agencies and industry experts.

- Participate in continuous professional development programs.

- Utilize online resources and platforms to access up-to-date information.

5. What are the key qualities of a successful Branch Banker?

The key qualities of a successful Branch Banker include:

- Excellent communication and interpersonal skills

- Strong financial knowledge and problem-solving abilities

- Attention to detail and accuracy

- Sales and customer service orientation

- Ability to work independently and as part of a team

- Adaptability and willingness to embrace change

6. How do you maintain a professional and ethical demeanor in the workplace?

To maintain a professional and ethical demeanor in the workplace, I:

- Adhere to all bank policies and procedures

- Respect confidentiality and protect customer information

- Treat colleagues and customers with courtesy and respect

- Avoid conflicts of interest and report any potential issues

- Uphold the highest ethical standards in all transactions

7. What is your understanding of credit risk assessment?

Credit risk assessment is the process of evaluating the likelihood that a borrower will default on their loan obligations. Key factors considered include:

- Credit history and credit score

- Debt-to-income ratio and other financial ratios

- Income stability and employment history

- Collateral and other assets

- Industry trends and economic conditions

8. How do you handle loan applications and what are the steps involved?

I handle loan applications with the utmost care and attention to detail. The steps involved typically include:

- Receiving and reviewing the application

- Verifying the applicant’s identity and financial information

- Conducting a credit risk assessment

- Obtaining necessary collateral

- Making a decision on the loan approval

- Preparing and finalizing the loan documents

9. What is your experience with using banking software and technology?

I am proficient in using various banking software and technology, including:

- Core banking systems

- Loan origination and processing software

- Customer relationship management (CRM) systems

- Online banking platforms

- Fraud detection and prevention tools

10. How do you stay motivated and maintain a positive attitude in a demanding work environment?

To stay motivated and maintain a positive attitude, I:

- Set clear goals and track my progress

- Seek support and encouragement from colleagues and managers

- Focus on the positive aspects of the job and celebrate successes

- Engage in personal and professional development

- Practice self-care and maintain a healthy work-life balance

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Branch Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Branch Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Branch Banker, you will be responsible for the day-to-day operations of a bank branch. Your key responsibilities will include:1. Providing customer service

This will involve greeting customers, answering their questions, and helping them with their banking needs.

- Opening and closing accounts

- Processing transactions

- Providing information about products and services

2. Managing accounts

This will include opening and closing accounts, maintaining account balances, and processing transactions.

- Monitoring accounts for suspicious activity

- Identifying and resolving account problems

- Providing account statements and other documentation

3. Selling products and services

This will involve promoting the bank’s products and services to customers and helping them to choose the right products for their needs.

- Identifying customer needs

- Developing and implementing sales strategies

- Tracking and measuring sales results

4. Maintaining the branch

This will include keeping the branch clean and organized, and ensuring that all equipment is in good working order.

- Ordering supplies

- Performing minor repairs

- Maintaining security

Interview Tips

1. Research the bank and position

Before your interview, take some time to research the bank and the position you are applying for. This will help you to understand the bank’s culture and values, and to tailor your answers to the interviewer’s questions.

- Visit the bank’s website

- Read articles about the bank in the news

- Talk to people who work at the bank

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is important to practice answering these questions in a clear and concise manner.

- Use the STAR method to answer questions

- Be specific and provide examples

- Practice with a friend or family member

3. Dress appropriately

First impressions matter, so it is important to dress appropriately for your interview. This means wearing business attire, such as a suit or dress. You should also make sure that your clothes are clean and pressed.

4. Be on time

Punctuality is important, so make sure that you arrive for your interview on time. If you are running late, be sure to call the interviewer and let them know.

- Plan your route ahead of time

- Leave yourself plenty of time to get to the interview

- If you are running late, call the interviewer and let them know

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Branch Banker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!