Are you gearing up for an interview for a Financial Supervisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Financial Supervisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

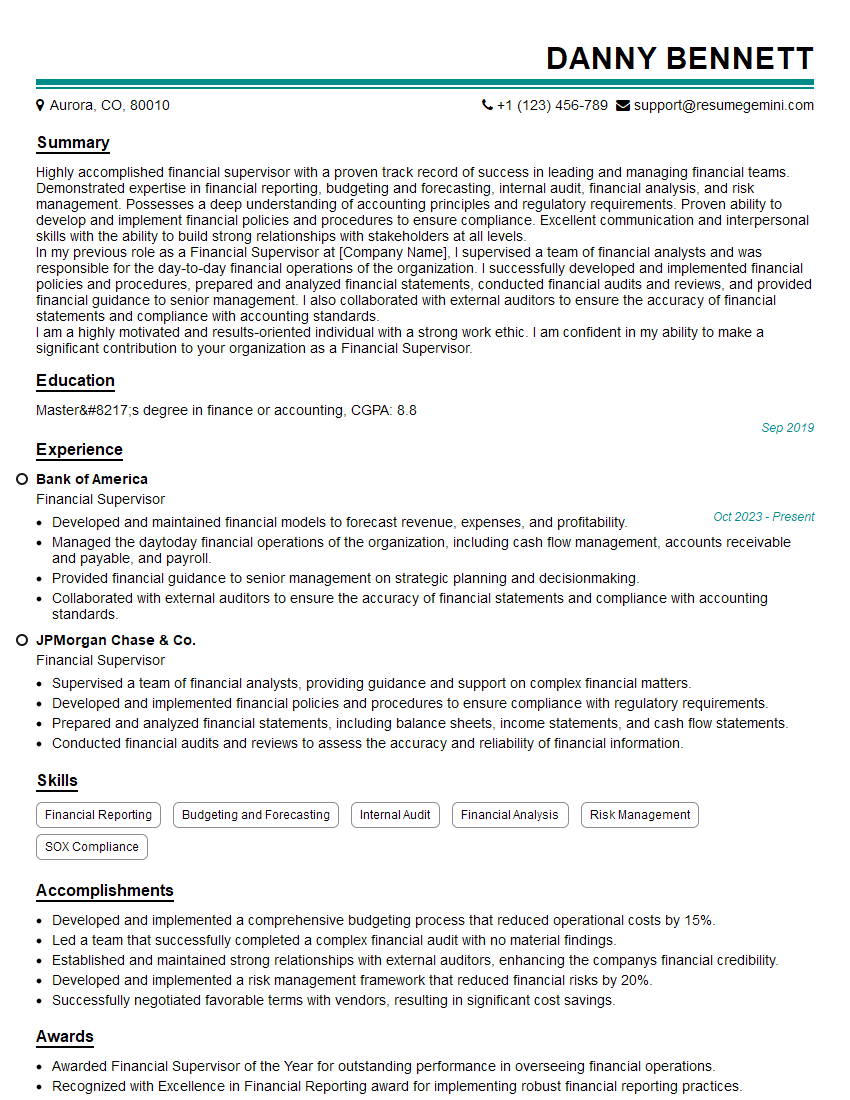

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Supervisor

1. What are the key responsibilities of a Financial Supervisor?

- Oversee financial institutions to ensure compliance with regulations

- Review financial statements, accounting records, and internal controls

- Identify and mitigate financial risks

- Provide guidance and support to financial institutions on best practices

- Enforce regulations and impose penalties for non-compliance

2. What are the different types of financial institutions that you have supervised?

Commercial banks

- Monitored credit risk, market risk, and operational risk

- Ensured compliance with capital adequacy requirements and other regulations

Investment banks

- Evaluated underwriting practices and risk management systems

- Reviewed financial models and analyzed financial projections

3. What are some of the most common issues that you have identified during your supervisions?

- Inadequate risk management practices

- Weak internal controls

- Misleading financial reporting

- Conflicts of interest

- Non-compliance with regulations

4. How do you prioritize your supervisions?

- Identify high-risk institutions based on factors such as size, complexity, and financial performance

- Consider industry trends and emerging risks

- Focus on areas where there is potential for significant financial impact

- Coordinate with other regulators and law enforcement agencies

5. What are the most important qualities of a successful Financial Supervisor?

- Strong technical knowledge of financial accounting, auditing, and regulations

- Analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- High ethical standards and integrity

6. How do you stay up-to-date on the latest financial regulations and industry best practices?

- Attend conferences and seminars

- Read industry publications and research papers

- Network with other financial professionals

- Participate in continuing education programs

7. What are the challenges that you face in your role as a Financial Supervisor?

- Keeping up with the evolving financial landscape

- Balancing the need for regulation with the need to promote economic growth

- Maintaining independence and objectivity

- Dealing with high-stakes situations

8. What are your career goals?

I aspire to continue my career as a Financial Supervisor and eventually move into a leadership role. I believe that my technical expertise, analytical skills, and commitment to financial stability make me well-suited for this path. I am eager to take on new challenges and contribute to the safety and soundness of the financial system.

9. What are your strengths and weaknesses?

Strengths:

- Strong understanding of financial regulations and accounting principles

- Excellent analytical and problem-solving skills

- Effective communication and interpersonal skills

- Ability to work independently and as part of a team

- High ethical standards and integrity

Weaknesses:

- Need to improve my ability to prioritize tasks and manage my time effectively

- Can be overly critical of myself and others at times

10. Why are you interested in working for our organization?

I am very impressed with your organization’s reputation for excellence in financial supervision. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to your mission of protecting the financial system and promoting financial stability. I am also drawn to your organization’s commitment to employee development, and I am confident that I would have the opportunity to grow and learn in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Financial Supervisor is responsible for overseeing and managing the financial operations of an organization. They ensure that financial policies and procedures are followed, and that financial records are accurate and complete.

1. Financial Planning and Analysis

The Financial Supervisor develops and implements financial plans and budgets. They analyze financial data to identify trends and make recommendations for improvement.

- Develop and implement financial plans and budgets

- Analyze financial data to identify trends and make recommendations for improvement

- Forecast financial performance and develop contingency plans

2. Financial Reporting and Compliance

The Financial Supervisor prepares and submits financial reports to management and external stakeholders. They also ensure that the organization complies with all applicable financial regulations.

- Prepare and submit financial reports to management and external stakeholders

- Ensure that the organization complies with all applicable financial regulations

- Maintain accurate and complete financial records

3. Internal Control and Risk Management

The Financial Supervisor establishes and maintains internal controls to safeguard the organization’s financial assets. They also identify and assess financial risks.

- Establish and maintain internal controls to safeguard the organization’s financial assets

- Identify and assess financial risks

- Develop and implement risk management strategies

4. Team Management and Development

The Financial Supervisor leads and develops a team of financial professionals. They provide training and guidance to ensure that the team is meeting the organization’s financial goals.

- Lead and develop a team of financial professionals

- Provide training and guidance to ensure that the team is meeting the organization’s financial goals

- Motivate and inspire the team to achieve their full potential

Interview Tips

Preparing for an interview for a Financial Supervisor position can be daunting, but with the right preparation, you can increase your chances of success.

1. Research the company and the position

Before you go to the interview, it is important to do your research on the company and the position you are applying for. This will help you to understand the company’s culture, values, and financial goals. You should also take some time to learn about the specific responsibilities of the Financial Supervisor position.

- Visit the company’s website

- Read the job description carefully

- Talk to people in your network who work for the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Use the STAR method to answer interview questions

- Prepare specific examples of your work experience

- Get feedback from a friend or family member

3. Be prepared to talk about your financial knowledge and experience

The interviewer will want to know about your financial knowledge and experience. Be prepared to talk about your educational background, your work experience, and your skills. You should also be able to discuss your understanding of financial concepts and principles.

- Highlight your education in finance or accounting

- Emphasize your experience in financial planning, analysis, or reporting

- Discuss your knowledge of financial concepts and principles

4. Be confident and enthusiastic

The interviewer will be looking for someone who is confident and enthusiastic about the position. Be yourself and let your personality shine through. Show the interviewer that you are passionate about finance and that you are eager to learn and grow in the role.

- Make eye contact with the interviewer

- Speak clearly and confidently

- Smile and be enthusiastic

Next Step:

Now that you’re armed with the knowledge of Financial Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Financial Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini