Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Paymaster position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

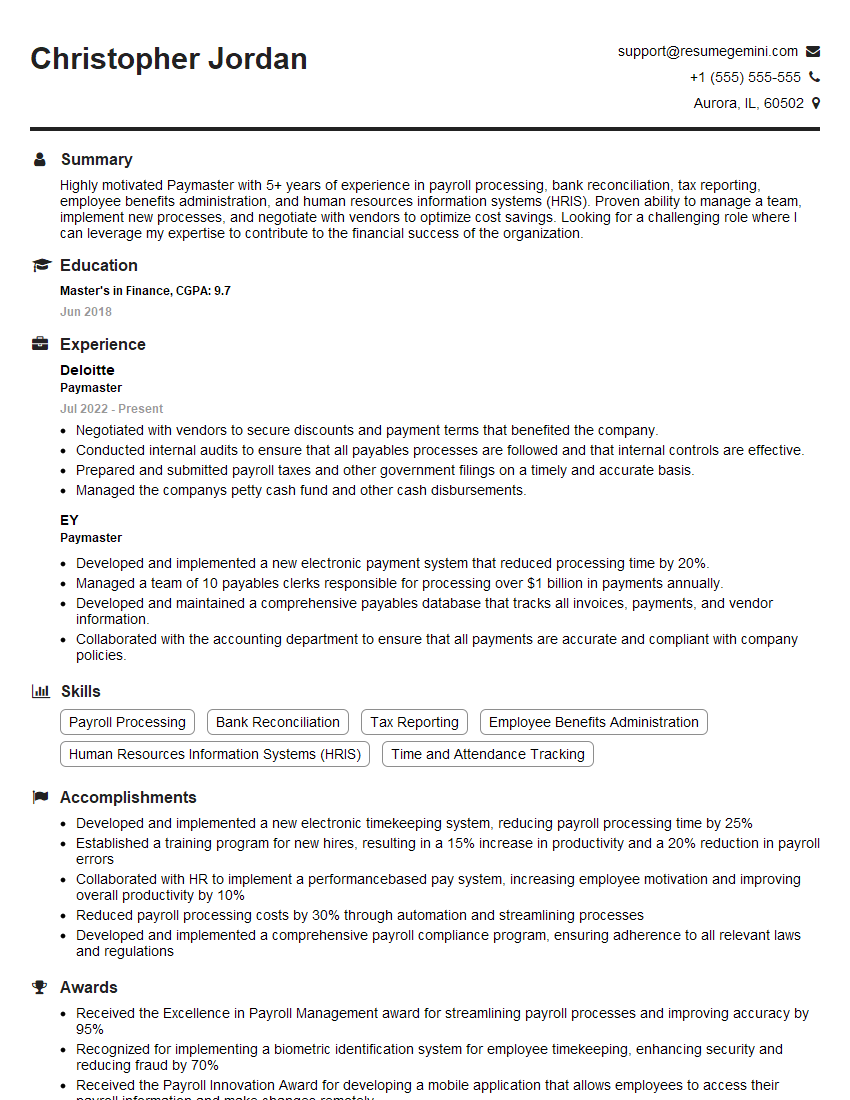

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Paymaster

1. Describe the key responsibilities of a Paymaster?

As a Paymaster, my key responsibilities include:

- Managing the entire payroll process, from data collection to distribution

- Ensuring accuracy and compliance with all relevant laws and regulations

- Maintaining payroll records and preparing financial reports

- Advising management on payroll-related matters

- Implementing and managing payroll systems

2. What are the different types of payroll systems and their advantages and disadvantages?

Batch Payroll System

- Advantages: Easy to implement, lower cost

- Disadvantages: Time-consuming, prone to errors

Real-Time Payroll System

- Advantages: Accurate, up-to-date information

- Disadvantages: Complex to implement, higher cost

Cloud-Based Payroll System

- Advantages: Accessible anywhere, reduces IT costs

- Disadvantages: Security concerns, limited customization

3. How do you ensure the accuracy and confidentiality of payroll information?

Ensuring accuracy and confidentiality is crucial in payroll. I implement several measures to achieve this:

- Double-checking all calculations and data entries

- Using encryption and secure storage for sensitive information

- Restricting access to payroll information on a need-to-know basis

- Regularly reviewing and updating security protocols

- Training staff on the importance of confidentiality

4. How do you handle payroll errors and disputes?

Payroll errors and disputes can be sensitive issues. I approach them with the following steps:

- Investigating the issue thoroughly to identify the root cause

- Communicating with the employee involved and explaining the error

- Working with the employee to resolve the issue fairly and promptly

- Documenting the error and the steps taken to resolve it

- Learning from the error to prevent similar issues in the future

5. How do you stay up-to-date with the latest payroll laws and regulations?

Staying up-to-date with payroll laws and regulations is essential. I use a combination of methods:

- Attending industry seminars and conferences

- Reading industry publications and online resources

- Consulting with legal and tax professionals

- Participating in online forums and discussion groups

6. What is your experience in using payroll software?

I have extensive experience in using various payroll software, including:

- ADP Workforce Now

- Paychex Flex

- Sage Payroll

- QuickBooks Payroll

- SAP SuccessFactors

I am proficient in these software’s features and capabilities, including payroll processing, tax calculations, and reporting.

7. How do you manage the payroll process during periods of high volume or complex transactions?

During periods of high volume or complex transactions, I implement the following strategies:

- Planning and scheduling tasks effectively

- Streamlining processes to reduce manual intervention

- Automating tasks using payroll software

- Communicating with employees and stakeholders to manage expectations

- Working overtime or bringing in additional staff as needed

8. Describe your experience in managing payroll budgets and ensuring compliance with financial regulations?

Managing payroll budgets and ensuring compliance with financial regulations is a core responsibility of a Paymaster. My experience in this area includes:

- Developing and monitoring payroll budgets

- Analyzing payroll costs and identifying areas for optimization

- Ensuring compliance with federal, state, and local payroll regulations

- Filing payroll taxes and preparing payroll reports

- Working with auditors to ensure compliance and accuracy

9. How do you ensure the smooth transition of payroll operations during mergers, acquisitions, or other organizational changes?

During organizational changes, I prioritize the following steps to ensure a smooth transition of payroll operations:

- Planning and communicating the transition plan to all stakeholders

- Evaluating and migrating payroll data into the new system

- Training employees on the new payroll system and processes

- Monitoring the transition process and making adjustments as needed

- Working closely with the HR team and other departments to minimize disruptions

10. What are your strengths and weaknesses as a Paymaster?

My key strengths as a Paymaster include:

- Strong knowledge of payroll laws and regulations

- Proven experience in managing payroll processes

- Excellent analytical and problem-solving skills

- Strong attention to detail and accuracy

- Effective communication and interpersonal skills

Areas where I would like to improve are:

- Expanding my knowledge of international payroll practices

- Gaining experience in using advanced payroll software

- Developing leadership and management skills

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Paymaster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Paymaster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Paymaster is responsible for the timely and accurate processing of payroll for all employees. This includes calculating employee pay, withholding taxes and other deductions, and issuing paychecks.

1. Calculate Employee Pay

The Paymaster is responsible for calculating employee pay based on hours worked, hourly rate, and any applicable overtime pay.

- Calculate regular pay based on hours worked

- Calculate overtime pay based on overtime hours worked

2. Withhold Taxes and Other Deductions

The Paymaster is responsible for withholding taxes from employee pay, including federal income tax, Social Security tax, and Medicare tax. The Paymaster is also responsible for withholding other deductions from employee pay, such as health insurance premiums and retirement plan contributions.

- Withhold federal income tax based on employee’s withholding allowances

- Withhold Social Security tax and Medicare tax

- Withhold other deductions based on employee’s elections

3. Issue Paychecks

The Paymaster is responsible for issuing paychecks to employees on a regular basis. The Paymaster must ensure that paychecks are accurate and that they are issued on time.

- Issue paychecks on a regular schedule

- Verify accuracy of paychecks before issuing them

- Resolve any errors or disputes related to paychecks

4. Maintain Payroll Records

The Paymaster is responsible for maintaining accurate payroll records. These records include time sheets, payroll registers, and tax returns.

- Maintain time sheets and payroll registers

- File tax returns on a regular basis

- Respond to inquiries from employees and other stakeholders regarding payroll

Interview Tips

Here are some tips to help you ace your interview for a Paymaster position:

1. Research the Company and the Position

Before you go on your interview, it is important to do your research on the company and the position. This will help you better understand the company’s culture and the specific requirements of the job.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully and identify the key skills and experience that the company is looking for.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked during your interview for a Paymaster position. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Tell me about your experience with payroll processing.

- What are your strengths and weaknesses as a Paymaster?

- Why are you interested in this position?

3. Be Prepared to Discuss Your Salary Expectations

At some point during your interview, you will likely be asked about your salary expectations. It is important to be prepared to discuss this topic in a professional and confident manner.

- Research salary ranges for Paymaster positions in your area.

- Be prepared to negotiate your salary based on your experience and qualifications.

4. Follow Up After the Interview

After your interview, it is important to follow up with the hiring manager to thank them for their time and to express your continued interest in the position.

- Send a thank-you note within 24 hours of the interview.

- Reiterate your interest in the position and highlight your qualifications.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Paymaster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!