Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Payroll Administrator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Payroll Administrator so you can tailor your answers to impress potential employers.

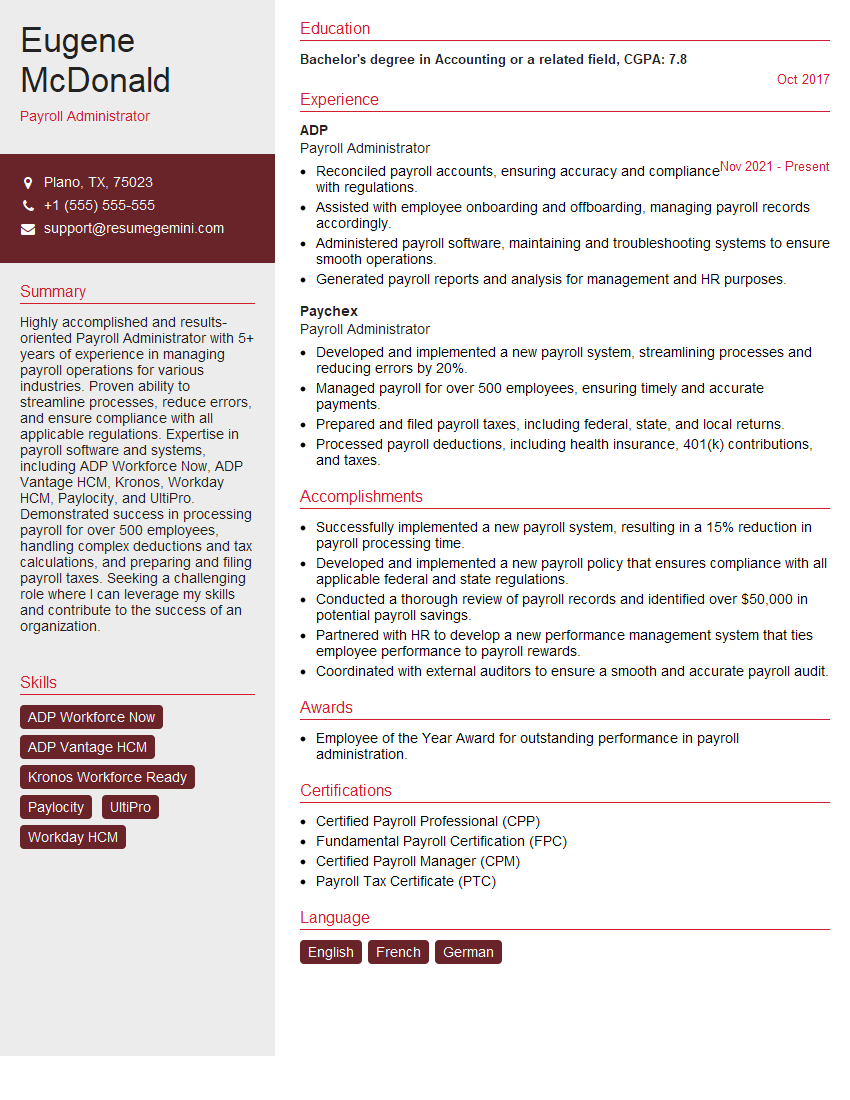

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Administrator

1. Describe the payroll process from start to finish.

The payroll process typically involves the following steps:

- Collecting employee time and attendance information

- Calculating gross pay, including regular pay, overtime, bonuses, and commissions

- Withholding taxes and other deductions, such as health insurance, retirement contributions, and garnishments

- Calculating net pay

- Distributing paychecks or direct deposits

- Filing payroll tax returns

2. What are the most common payroll errors and how can they be avoided?

Incorrect employee information

- Ensure that employee information is accurate and up-to-date

- Double-check employee names, addresses, Social Security numbers, and tax information

Incorrect timekeeping

- Implement a clear and consistent timekeeping system

- Train employees on how to properly track their time

- Review timecards for errors before processing payroll

Miscalculations

- Use payroll software to automate calculations

- Double-check calculations before submitting payroll

3. What are the different types of payroll taxes and how are they calculated?

The main types of payroll taxes are:

- Federal income tax

- Federal Social Security tax

- Federal Medicare tax

- State income tax (if applicable)

- Local income tax (if applicable)

The amount of payroll taxes withheld from an employee’s paycheck depends on their income, filing status, and other factors. Tax rates and withholding formulas vary by tax type and jurisdiction.

4. What are the different types of payroll deductions and how are they processed?

Common types of payroll deductions include:

- Health insurance premiums

- Retirement contributions

- Dental and vision insurance premiums

- Garnishments for child support or other debts

Deductions are typically processed by subtracting the amount of the deduction from the employee’s gross pay before calculating net pay. The amount of the deduction may vary depending on the employee’s election or the terms of the garnishment.

5. What is the difference between gross pay and net pay?

Gross pay is the total amount of compensation earned by an employee before any deductions are taken out. Net pay is the amount of money that an employee receives after all deductions have been taken out.

Gross pay – Deductions = Net pay

6. What are the different methods of paying employees?

The most common methods of paying employees are:

- Paychecks

- Direct deposit

- Payroll cards

- Cash

The method of payment used will depend on the employer’s policies and the employee’s preference.

7. What are the legal requirements for payroll?

Payroll is subject to a number of legal requirements, including:

- The Fair Labor Standards Act (FLSA)

- The Social Security Act

- The Medicare Act

- The Unemployment Insurance Act

- State and local laws

Payroll administrators must be familiar with these laws and ensure that payroll is processed in compliance with all applicable requirements.

8. What software do you have experience using for payroll processing?

I have experience using a variety of payroll software, including:

- ADP Workforce Now

- Paychex Flex

- Sage 50cloud Payroll

- QuickBooks Payroll

I am also proficient in using Microsoft Excel and other spreadsheet software for payroll-related tasks.

9. What are your strengths and weaknesses as a Payroll Administrator?

Strengths

- Strong attention to detail

- Excellent communication skills

- Proficient in payroll software

- Up-to-date on payroll laws and regulations

Weaknesses

- I sometimes have difficulty delegating tasks

- I can be a bit of a perfectionist

10. Why are you interested in this position?

I am interested in this position because I am passionate about payroll and I believe that I have the skills and experience necessary to be successful in this role. I am also excited about the opportunity to work with your team and contribute to the success of your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Administrator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Administrator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Payroll Administrator is an essential member of the finance team, responsible for ensuring the timely and accurate payment of employee salaries and benefits. Key responsibilities include:

1. Payroll Processing

Process payroll on a regular basis, including calculating salaries, deductions, and net pay.

2. Payroll Compliance

Ensure compliance with all applicable payroll regulations and laws.

3. Payroll Taxes

Calculate and remit payroll taxes to the proper authorities.

4. Employee Benefits

Administer employee benefits, such as health insurance and retirement plans.

5. Payroll Reconciliation

Reconcile payroll records with bank statements and other financial records.

6. Reporting

Generate payroll reports for management and external stakeholders.

7. Employee Queries

Respond to employee inquiries regarding payroll and benefits.

8. System Management

Maintain and update payroll systems to ensure efficiency and accuracy.

Interview Tips

Preparing thoroughly for a Payroll Administrator interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company

Research the company’s industry, size, and culture to gain insights into their payroll practices.

2. Practice Your Answers

Anticipate common payroll administrator interview questions and practice your answers to deliver clear and concise responses.

3. Highlight Your Experience

Quantify your experience by providing specific examples of your accomplishments in previous payroll roles.

4. Be Punctual and Professional

Arrive on time for your interview and dress professionally to make a positive first impression.

5. Ask Informed Questions

Prepare thoughtful questions to ask the interviewer, demonstrating your interest and engagement in the role and company.

6. Follow Up

After the interview, send a thank-you note to the interviewer reiterating your interest and addressing any outstanding questions.

7. Be Enthusiastic

Show your passion for payroll administration and your eagerness to contribute to the company’s success.

Next Step:

Now that you’re armed with the knowledge of Payroll Administrator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Payroll Administrator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini