Are you gearing up for a career in Account Receivable Associate? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Account Receivable Associate and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

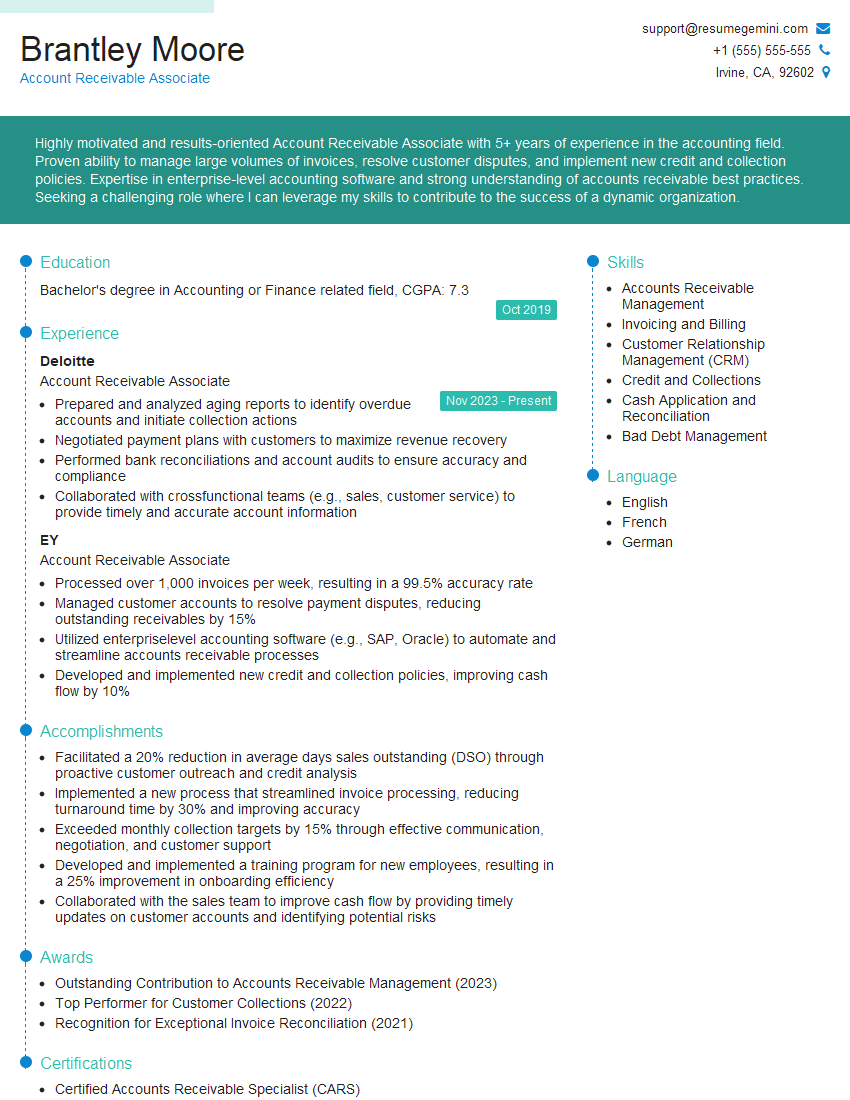

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Receivable Associate

1. Explain the process of reconciling customer accounts?

Answer:

- Review customer statements and compare them to internal records.

- Investigate and resolve discrepancies, such as unpaid invoices or incorrect payments.

- Update customer accounts and records to reflect the reconciled balances.

- Document the reconciliation process and report any findings.

2. What are the key performance indicators (KPIs) you track in accounts receivable?

Answer:

- Days Sales Outstanding (DSO): Average time customers take to pay invoices.

- Allowance for Doubtful Accounts: Estimated amount of uncollectible accounts.

- Customer Churn Rate: Percentage of customers lost over a period.

- Accounts Receivable Turnover: Number of times the accounts receivable balance is collected in a year.

3. Describe the different types of aging reports and how they are used?

Answer:

- Current: Invoices due within 30 days.

- 1-30 Days: Invoices 31-60 days overdue.

- 31-60 Days: Invoices 61-90 days overdue.

- Over 90 Days: Invoices more than 90 days overdue.

Aging reports help identify overdue invoices, prioritize collection efforts, and assess credit risk.

4. What is the bad debt expense and how is it calculated?

Answer:

- Expense incurred when accounts receivable are deemed uncollectible.

- Calculated as a percentage of total sales or accounts receivable.

- Helps companies estimate and provision for potential losses on outstanding invoices.

5. How do you handle customer disputes and payment objections?

Answer:

- Investigate the dispute and gather relevant documentation.

- Communicate with the customer promptly and professionally.

- Negotiate a resolution that is fair to both parties.

- Document the resolution and update customer records.

6. What software and tools are you proficient in for accounts receivable management?

Answer:

- Enterprise Resource Planning (ERP) systems (e.g., SAP, Oracle)

- Accounts Receivable Management Systems (e.g., ARIBA, Chargify)

- Spreadsheets and database management software (e.g., Excel, Access)

7. How do you stay up-to-date with industry best practices in accounts receivable management?

Answer:

- Attend industry events and conferences.

- Read industry publications and articles.

- Participate in professional development courses and certifications.

8. Describe your experience in managing a team of accounts receivable specialists.

Answer:

- Supervised and mentored a team of 5 accounts receivable specialists.

- Developed and implemented training programs to improve team performance.

- Established clear goals and performance metrics.

9. How do you prioritize your workload and manage multiple tasks effectively?

Answer:

- Use a task management system to track priorities and deadlines.

- Break down large projects into smaller, manageable tasks.

- Delegate tasks to team members when appropriate.

10. What are the ethical considerations you encounter in accounts receivable management?

Answer:

- Protecting customer data and privacy.

- Ensuring fair and equitable treatment of customers.

- Adhering to company policies and industry regulations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Receivable Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Receivable Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Account Receivable Associate is responsible for the timely and accurate billing and collection of accounts receivable. They ensure that invoices are sent to customers on time, payments are processed correctly, and accounts are reconciled regularly. Key job responsibilities include:

1. Invoice Processing

Ensuring timely and accurate invoice generation

- Prepare and mail invoices using invoicing software

- Verify invoice accuracy against purchase orders, packing slips, and other source documents

- Communicate with customers to confirm discrepancies and resolve billing issues

2. Payment Processing

Receiving, recording, and depositing customer payments

- Process incoming payments, whether through mail, online, or bank transfers

- Match payments to invoices and allocate them accordingly

- Deposit payments into designated bank accounts and maintain accurate records

- Handle disputes and resolve payment-related inquiries

3. Account Reconciliation

Reconciling customer accounts to ensure accuracy and completeness

- Compare invoices, payments, and other documents to identify and resolve discrepancies

- Investigate and correct invoice errors and overpayments

- Provide regular reports to management on the status of accounts receivable

- Maintain aging reports to track overdue invoices and take appropriate action

4. Customer Service

Providing excellent customer support related to billing and payment

- Answer customer inquiries regarding invoices, payments, and account statements

- Resolve customer issues promptly and courteously

- Identify and escalate any issues beyond their scope of authority

Interview Tips

Preparing for an Account Receivable Associate interview requires a combination of technical knowledge and soft skills. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s industry, products or services, and culture. Research the specific position and its responsibilities thoroughly.

2. Practice Your Skills

Review your accounting principles, including invoice processing, payment handling, and account reconciliation. Practice answering interview questions that showcase your technical abilities.

3. Highlight Your Attention to Detail

Emphasize your accuracy and strong attention to detail. Provide examples demonstrating your ability to handle and track multiple transactions with precision.

4. Demonstrate Customer Service Skills

Share experiences that highlight your customer service skills, such as resolving customer inquiries effectively and maintaining a positive attitude.

5. Ask Thoughtful Questions

Prepare thoughtful and relevant questions to ask the interviewer. This shows that you’re interested in the role and have taken the time to learn about the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Account Receivable Associate interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!