Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bad Credit Collector interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bad Credit Collector so you can tailor your answers to impress potential employers.

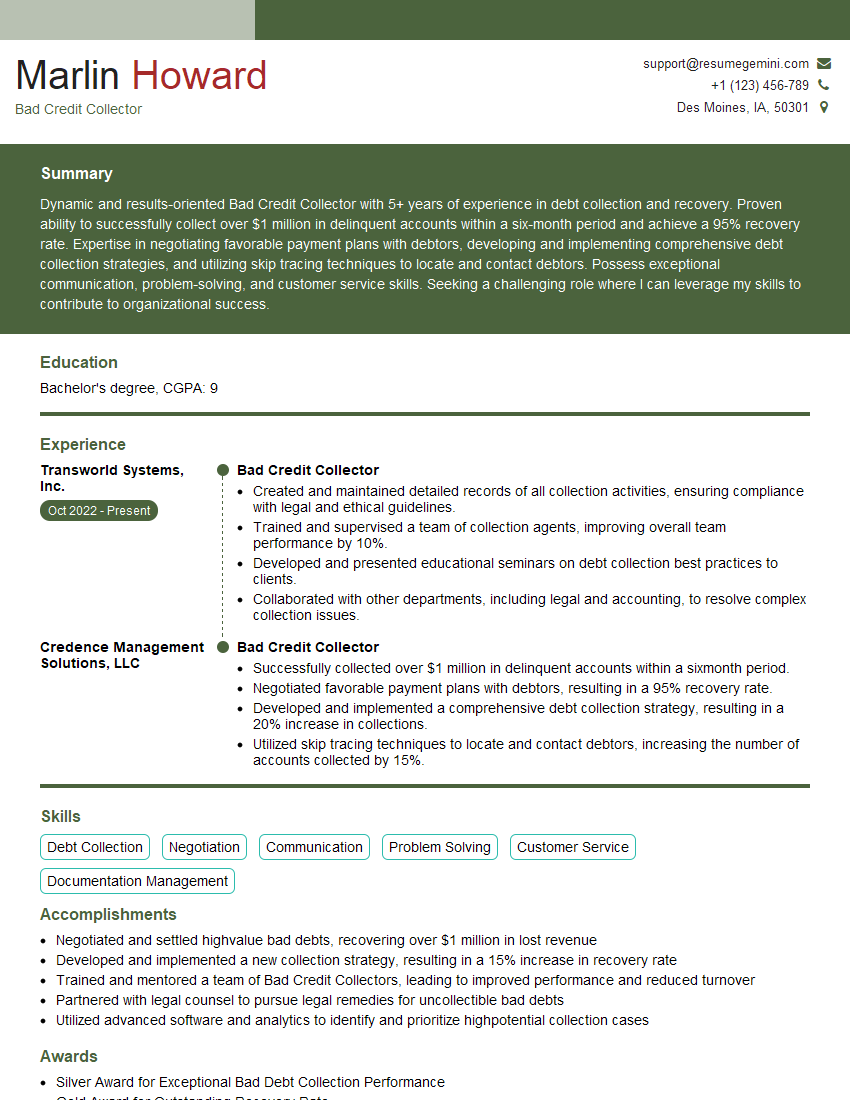

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bad Credit Collector

1. What are the key responsibilities of a Bad Credit Collector?

The key responsibilities of a Bad Credit Collector include:

- Contacting customers with overdue accounts to collect payments.

- Negotiating payment plans and settlements.

- Maintaining accurate records of all collection activities.

- Reporting to supervisors on the status of collections.

- Adhering to all applicable laws and regulations.

2. What are the different methods of contacting customers for collection?

Verbal Communication

- Phone calls

- In-person visits

Written Communication

- Letters

- Emails

- Text messages

Electronic Communication

- Online payment portals

- Automated phone calls

3. What are some of the challenges you have faced in collecting bad debts?

- Dealing with customers who are unwilling or unable to pay.

- Negotiating payment plans that are both fair to the customer and the creditor.

- Maintaining a professional and ethical demeanor.

- Staying up-to-date on the latest laws and regulations.

4. How do you stay motivated when working with difficult customers?

- Focusing on the positive aspects of the job.

- Setting realistic goals.

- Taking breaks when needed.

- Talking to a supervisor or coworker for support.

5. What are some of the ethical considerations that you must keep in mind when collecting bad debts?

- Treating customers with respect.

- Avoiding harassment or intimidation.

- Providing customers with accurate information.

- Following all applicable laws and regulations.

6. How do you handle situations where a customer is unable to pay their debt?

When a customer is unable to pay their debt, I will:

- Work with the customer to understand their financial situation.

- Explore payment options that are affordable for the customer.

- Refer the customer to a credit counseling agency or other resources that can help them improve their financial situation.

7. What are some of the best practices for negotiating payment plans?

- Be flexible and willing to negotiate.

- Consider the customer’s financial situation.

- Set realistic payment amounts and schedules.

- Get everything in writing.

8. How do you maintain accurate records of all collection activities?

I maintain accurate records of all collection activities by:

- Keeping a detailed log of all phone calls, emails, and other communications with customers.

- Documenting all payment arrangements.

- Scanning and storing all relevant documents.

9. What are some of the common mistakes that you see collectors make?

- Being too aggressive or intimidating.

- Making false promises.

- Not following up on promises.

- Not keeping accurate records.

10. What are your goals for this role?

- To collect bad debts in a professional and ethical manner.

- To help customers improve their financial situation.

- To contribute to the success of the company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bad Credit Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bad Credit Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bad credit collectors take on the challenging but important role of collecting overdue payments from individuals with poor credit histories. Their responsibilities include:

1. Initiating Contact and Communication

Initiate contact with delinquent customers via phone, email, or mail to discuss their overdue accounts and establish payment plans.

- Maintain professional and ethical communication throughout interactions.

- Negotiate payment arrangements that are reasonable for both the customer and the creditor.

2. Investigating Delinquencies

Research and analyze customer accounts to determine the reasons for non-payment, such as financial hardship or disputes.

- Identify potential solutions to address customer concerns and improve future payment habits.

- Document all interactions and findings accurately for record-keeping purposes.

3. Managing Collections Process

Develop and implement collection strategies based on the customer’s financial situation and payment history.

- Monitor customer payments and take appropriate actions, such as sending reminders or initiating legal proceedings, if necessary.

- Maintain accurate and up-to-date records of all collection activities.

4. Reporting and Compliance

Provide regular reports on collection progress and identify trends or potential issues.

- Ensure compliance with all applicable laws and regulations related to debt collection.

- Maintain confidentiality and protect customer information according to established policies.

Interview Tips

Preparing thoroughly for an interview is crucial for success. Here are some tips to help you ace your interview for a Bad Credit Collector position:

1. Research the Company and Industry

Demonstrate your interest in the company by researching their mission, values, and collection practices.

- Review industry trends and regulations to show your understanding of the field.

- Tailor your responses to the company’s specific needs and expectations.

2. Highlight Relevant Skills and Experience

Emphasize your communication, negotiation, and problem-solving abilities.

- Provide specific examples of your success in resolving customer disputes or achieving collection goals.

- Quantify your accomplishments whenever possible using metrics such as percentage of accounts collected or reduction in delinquency rates.

3. Demonstrate Empathy and Understanding

Recognize that dealing with bad credit can be a sensitive topic.

- Show empathy and understanding towards customers, even in challenging situations.

- Explain how you would approach conversations with delinquent customers in a respectful and non-confrontational manner.

4. Be Prepared for Ethical Questions

Debt collection can involve ethical considerations.

- Be ready to discuss how you would handle situations where customers are facing financial hardship or potential fraud.

- Emphasize your commitment to ethical practices and compliance with all applicable laws.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bad Credit Collector, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bad Credit Collector positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.