Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Accounts Receivable Specialist interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Accounts Receivable Specialist so you can tailor your answers to impress potential employers.

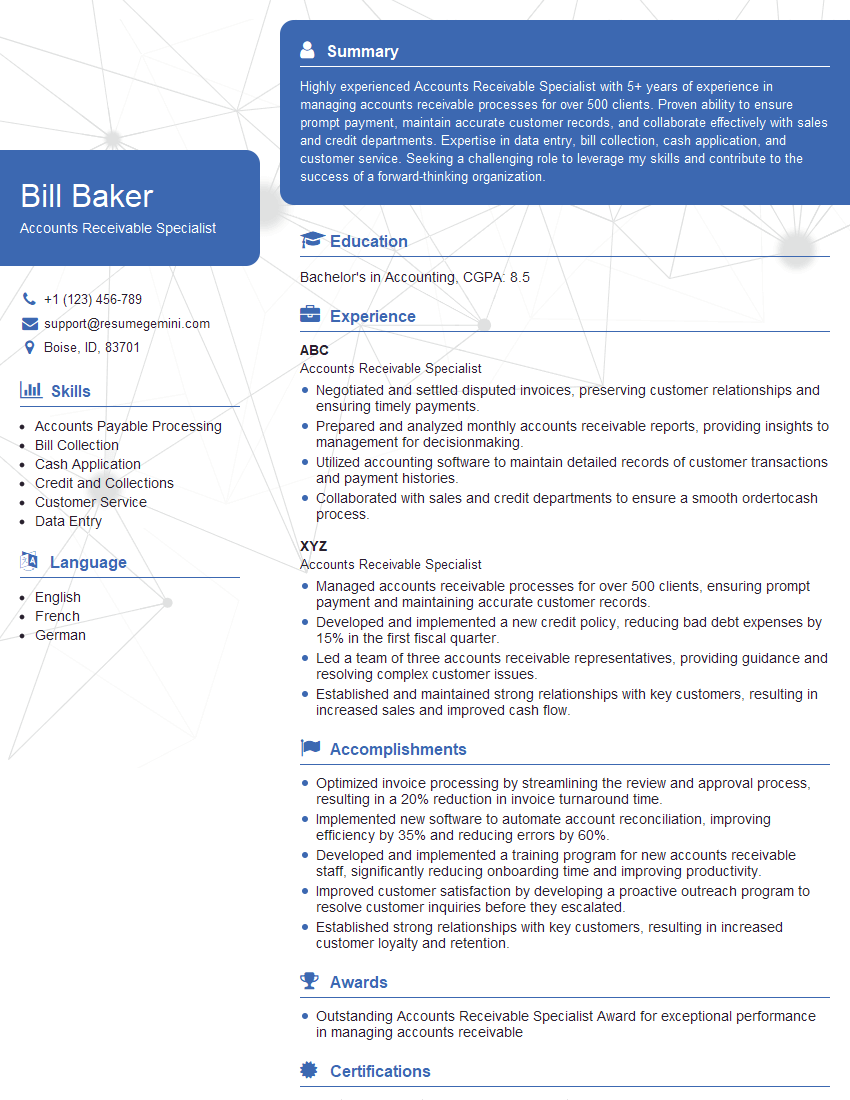

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Receivable Specialist

1. How do you handle customer inquiries related to invoices and payments?

- Greet the customer politely and identify the reason for their inquiry.

- Review the invoice or payment details to understand the issue.

- Provide clear and accurate information to the customer, including invoice terms, payment due dates, and any outstanding balances.

- Resolve any discrepancies or payment issues promptly.

- Update customer records and follow up as needed to ensure satisfaction.

2. How do you ensure the accuracy of customer invoices and statements?

- Verify all billing information, including customer details, invoice items, quantities, and unit prices.

- Conduct regular reconciliations between invoices and sales orders or other source documents.

- Review invoices for any errors or omissions before sending them to customers.

- Respond promptly to customer inquiries or disputes regarding invoice accuracy.

- Maintain a regular audit trail to track invoice changes and identify any discrepancies.

3. How do you manage customer credit limits and prevent bad debts?

- Establish credit limits for customers based on their credit history and financial stability.

- Monitor customer accounts regularly to track outstanding balances and identify potential credit risks.

- Communicate with customers who exceed their credit limits to discuss payment arrangements or adjust credit terms.

- Collaborate with the credit department to assess customer creditworthiness and make appropriate adjustments.

- Implement collection procedures to recover outstanding invoices.

4. How do you process customer payments and ensure timely deposits?

- Record customer payments promptly and accurately.

- Reconcile payments with invoices and outstanding balances.

- Process refunds or credits as necessary.

- Coordinate with the treasury department to ensure timely deposits.

- Follow up on any discrepancies or delays in payment processing.

5. How do you communicate with customers regarding payment issues and collections?

- Maintain a professional and courteous tone in all communications.

- Explain payment issues clearly and provide specific details.

- Discuss payment arrangements and negotiate payment plans as needed.

- Follow up regularly to remind customers of overdue invoices and payment deadlines.

6. How do you prioritize your workload and manage multiple tasks in a timely and efficient manner?

- Assess the urgency and importance of each task.

- Create a to-do list and prioritize tasks accordingly.

- Break down large projects into smaller, manageable tasks.

- Delegate tasks to others when appropriate.

- Use time management tools or techniques to stay organized.

7. How do you maintain a high level of accuracy and attention to detail in your work?

- Pay attention to details and double-check all work.

- Follow established procedures and guidelines.

- Review work thoroughly before finalizing.

- Use checklists or other tools to ensure accuracy.

- Seek feedback from colleagues or supervisors to identify potential errors.

8. How do you stay up-to-date on changes in accounting practices and regulations?

- Attend industry conferences and webinars.

- Read professional journals and publications.

- Take continuing education courses or workshops.

- Stay informed about regulatory updates and compliance requirements.

9. How do you handle confidential customer information and maintain data security?

- Follow company policies and procedures regarding data security.

- Use strong passwords and encryption.

- Limit access to sensitive information on a need-to-know basis.

- Dispose of confidential documents securely.

- Be aware of phishing scams and other security threats.

10. How do you handle disputes or conflicts with customers?

- Listen carefully to the customer’s concerns.

- Review the relevant documentation and evidence.

- Identify the root cause of the dispute.

- Negotiate a mutually acceptable resolution.

- Document the outcome of the dispute and follow up as needed.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Receivable Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Receivable Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounts Receivable Specialists play a crucial role in maintaining the financial health of organizations. They are responsible for managing customer accounts, collecting payments, and ensuring that accurate records are maintained. Key job responsibilities include:

1. Customer Account Management

Managing customer accounts, including opening, closing, and updating account information.

- Verifying customer information and maintaining accurate customer records

- Responding to customer inquiries and resolving account issues

2. Invoice Processing

Processing invoices, including verifying accuracy, posting to accounts, and mailing or emailing to customers.

- Ensuring invoices are issued promptly and accurately

- Reconciling invoices with supporting documentation

3. Payment Collection

Collecting payments from customers, including following up on overdue accounts and applying payments to customer accounts.

- Negotiating payment arrangements with customers

- Monitoring customer payment history and identifying potential credit risks

4. Reporting and Analysis

Preparing reports on accounts receivable activity, including aging reports, collection reports, and cash flow forecasts.

- Analyzing accounts receivable data to identify trends and areas for improvement

- Providing financial insights to management and decision-makers

Interview Tips

Preparing well for an Accounts Receivable Specialist interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Thoroughly research the company and the specific Accounts Receivable Specialist position you are applying for. This will help you understand the company’s culture, values, and the specific responsibilities of the role.

- Visit the company’s website and social media pages

- Read industry publications and articles about the company

2. Review Your Resume and Practice Answering Common Interview Questions

Review your resume and be prepared to discuss your experience and skills in detail. Practice answering common interview questions, such as “Tell me about your experience in accounts receivable,” “How do you handle difficult customers,” and “What are your strengths and weaknesses.” Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your work.

- Use the job description as a guide to identify the key skills and experience the interviewer is looking for

- Prepare examples of how you have successfully handled challenging situations

3. Demonstrate Your Soft Skills

In addition to technical skills, employers also look for soft skills, such as communication, interpersonal skills, and problem-solving abilities. Highlight these skills in your answers and provide examples of how you have used them in the workplace.

- Be enthusiastic and positive during the interview

- Show that you are a team player and can work independently

4. Ask Questions

Asking thoughtful questions is a great way to show your interest in the position and the company. Prepare a few questions to ask the interviewer about the company, the team, and the role.

- Inquire about the company’s growth plans and industry outlook

- Ask about opportunities for professional development and training

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accounts Receivable Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.