Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accounts Collector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

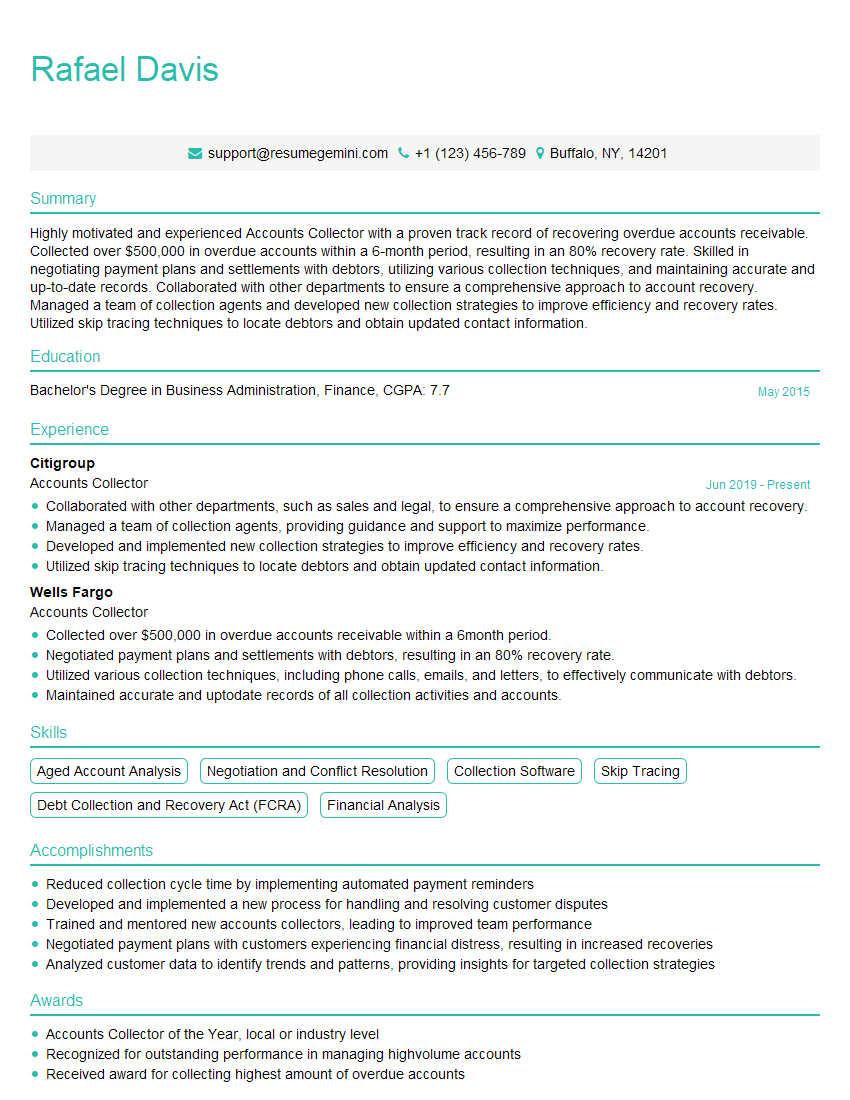

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Collector

1. How do you prioritize your collection efforts?

To prioritize my collection efforts, I follow a systematic approach that considers several key factors, including:

- Account Age: I prioritize accounts with the oldest outstanding balances as they are more likely to become uncollectible.

- Amount Owed: I prioritize accounts with larger balances as they represent a greater financial loss.

- Debtor’s Payment History: I evaluate the debtor’s past payment behaviour to determine their likelihood of making future payments.

- Financial Stability of Debtor: I assess the debtor’s financial situation to determine their ability to repay their debt.

- Legal Considerations: I consider any legal restrictions or limitations that may impact my collection efforts.

2. What techniques do you use to negotiate payment arrangements with customers?

Establishing Rapport:

- Build a positive and respectful relationship with the customer.

- Listen attentively to their concerns and financial situation.

Understanding Customer Constraints:

- Identify the customer’s financial limitations and negotiate a realistic payment plan.

- Explore alternative payment options, such as installment plans or partial payments.

Exploring Solutions:

- Present the customer with clear and concise options that meet their needs.

- Be willing to negotiate and find a solution that benefits both parties.

Documentation and Follow-up:

- Document all payment arrangements in writing and obtain the customer’s signature.

- Follow up regularly to ensure compliance and provide support if needed.

3. How do you handle difficult or hostile customers?

When dealing with difficult or hostile customers, I remain professional and empathetic while assertively maintaining my position. I employ the following strategies:

- Active Listening: I actively listen to the customer’s concerns without interrupting.

- Empathy and Respect: I show empathy for their situation while maintaining respect for their position.

- Clear Communication: I clearly and concisely explain the situation and my expectations.

- Negotiation and Compromise: I am willing to negotiate and compromise within reasonable limits to find a mutually acceptable solution.

- Professional Demeanor: I remain calm and professional, even in challenging situations.

- Documentation: I document all interactions and agreements to protect both parties.

4. What is your experience with using collection software?

I have extensive experience using collection software, including [specific software names]. I am proficient in:

- Managing customer accounts and tracking payment status

- Automating collection tasks, such as sending payment reminders and generating collection letters

- Customizing collection strategies and generating customized reports

- Integrating the software with other accounting and CRM systems

- Maintaining accurate and up-to-date customer data

5. How do you stay up-to-date on industry best practices and regulations?

To stay up-to-date on industry best practices and regulations, I engage in the following activities:

- Continuing Education: I attend industry workshops, conferences, and online courses.

- Professional Development: I am a member of professional organizations, such as the Association of Credit and Collection Professionals (ACA International).

- Research and Reading: I regularly read industry publications, articles, and case studies.

- Collaboration with Peers: I network with other professionals and share knowledge and experiences.

- Legal Updates: I monitor changes in laws and regulations that impact collection practices.

6. What are the ethical considerations involved in accounts collection?

When engaging in accounts collection, I adhere to the following ethical principles:

- Fairness and Impartiality: I treat all customers with respect and fairness, regardless of their situation.

- Confidentiality: I maintain the confidentiality of customer information.

- Compliance with Laws and Regulations: I follow all applicable laws and regulations governing collection practices.

- Respect for Customer Dignity: I treat customers with empathy and respect, even in difficult situations.

- Transparency and Disclosure: I clearly communicate the terms of payment arrangements and any potential consequences.

7. How do you manage multiple accounts and prioritize your workload?

To effectively manage multiple accounts and prioritize my workload, I implement the following strategies:

- Prioritization: I use a system to prioritize accounts based on factors such as account age, balance, and payment history.

- Time Management: I allocate my time effectively and set deadlines to ensure timely follow-up and resolution.

- Organization: I maintain a well-organized system for tracking customer information, payment status, and communication.

- Delegation: When necessary, I delegate tasks to team members to ensure all accounts are adequately addressed.

- Automation: I utilize collection software to automate tasks such as sending payment reminders and generating collection letters, allowing me to focus on more complex accounts.

8. How do you handle customer disputes or complaints?

I approach customer disputes or complaints with the following steps:

- Active Listening: I listen attentively to the customer’s concerns and gather all relevant information.

- Investigation: I thoroughly investigate the matter and review supporting documentation.

- Communication: I communicate my findings and proposed resolution to the customer in a clear and timely manner.

- Compromise: When appropriate, I am willing to negotiate and compromise within reasonable limits to reach a mutually acceptable solution.

- Follow-up: I follow up with the customer to ensure satisfaction and address any further concerns.

9. How do you measure your success as an Accounts Collector?

I measure my success as an Accounts Collector based on the following metrics:

- Collection Rate: The percentage of outstanding accounts collected within a specific period.

- Average Days to Collect: The average number of days it takes to collect on an account.

- Customer Satisfaction: The level of satisfaction expressed by customers regarding my collection efforts.

- Legal Compliance: The extent to which I adhere to all applicable laws and regulations governing collection practices.

- Contribution to Team and Company Goals: How my performance aligns with the overall objectives and targets of the team and organization.

10. What are your strengths and weaknesses as an Accounts Collector?

Strengths:

- Exceptional communication and negotiation skills

- Strong understanding of collection principles and best practices

- Proficient in using collection software

- Ability to handle difficult customers professionally and effectively

- Attention to detail and accuracy

Weaknesses:

- Relatively new to the industry, with [number] years of experience

- Limited experience in handling high-value or complex accounts

- Still developing my knowledge of specific industry regulations

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounts Collectors play a crucial role in any organization by proactively pursuing and recovering overdue payments, preserving cash flow, and maintaining positive customer relationships. Their key responsibilities encompass:

1. Following Up on Overdue Accounts

Accounts Collectors proactively monitor accounts receivable and identify overdue invoices. They initiate contact with customers to resolve outstanding balances.

2. Negotiating Payment Arrangements

When customers face financial challenges, Collectors work with them to establish realistic payment plans that meet both the company’s and the customer’s needs. They assess the customer’s financial situation, explore payment options, and negotiate mutually acceptable terms.

3. Maintaining Customer Relationships

Collectors maintain positive and professional relationships with customers to ensure ongoing business. They handle customer inquiries, resolve disputes, and provide support to retain customers and foster trust.

4. Reporting and Analysis

Collectors provide regular reports and analysis on collection activities. They monitor key metrics such as collection rates, average days to collect, and compliance with credit policies. This data helps management assess the effectiveness of collection efforts and make informed decisions.

Interview Tips

To ace an Accounts Collector interview, consider the following preparation tips:

1. Research the Company and Position

Familiarize yourself with the company’s industry, products or services, and culture. Research the Accounts Collector role to understand its responsibilities, skills required, and career growth opportunities within the organization.

2. Practice Your Communication Skills

Accounts Collectors need excellent communication skills to effectively negotiate with customers and build relationships. Practice your ability to convey information clearly, handle objections, and maintain a positive tone, even in challenging situations.

3. Highlight Your Collection Experience

Emphasize your previous collection experience, including your success rate, methods used, and any industry-specific knowledge or techniques you applied. Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

4. Demonstrate Your Customer Service Orientation

Accounts Collectors must be customer-centric and able to balance assertiveness with empathy. Share examples or anecdotes that illustrate your ability to build rapport with customers, resolve issues, and maintain positive relationships.

5. Prepare for Behavioral Questions

Behavioral questions are commonly used in interviews to assess your skills and behaviors in real-life work scenarios. Prepare for questions like “Tell me about a time you successfully negotiated a payment arrangement with a difficult customer” or “How do you handle conflict with customers who are reluctant to pay?”

Next Step:

Now that you’re armed with the knowledge of Accounts Collector interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Accounts Collector positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini