Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bill Collector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

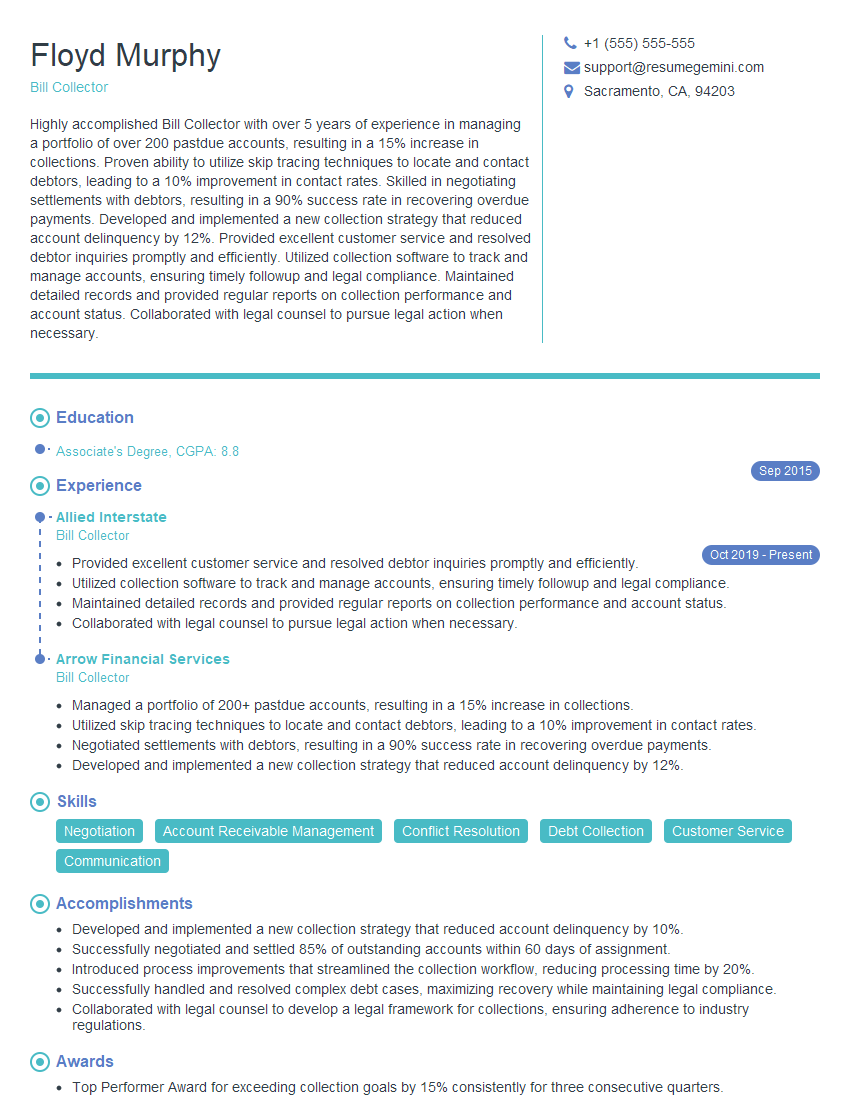

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bill Collector

1. What are the key responsibilities of a Bill Collector?

The key responsibilities of a Bill Collector include:

- Contacting customers who are past due on their bills

- Explaining the payment process and options

- Negotiating payment plans

- Collecting payments

- Following up with customers to ensure payments are made on time

2. What are the qualities of a successful Bill Collector?

- Excellent communication skills

- Strong negotiation skills

- Empathy and understanding

- Persistence and determination

- Knowledge of debt collection laws and regulations

3. How would you handle a customer who is angry or upset?

When dealing with an angry or upset customer, I would first try to remain calm and understanding. I would listen to their concerns and try to see the situation from their perspective. I would then explain the payment process and options in a clear and concise manner. I would be willing to negotiate a payment plan that works for both the customer and the company. I would also follow up with the customer to ensure that they are making payments on time.

4. What are the ethical considerations of being a Bill Collector?

As a Bill Collector, it is important to be ethical and respectful in all interactions with customers. I would never use abusive or threatening language. I would always be truthful and honest with customers. I would also respect their privacy and confidentiality.

5. What are the different types of collection strategies?

There are a variety of collection strategies that can be used, depending on the specific situation. Some common strategies include:

- Negotiation

- Payment plans

- Wage garnishment

- Bankruptcy

6. What are the legal limits of debt collection?

There are a number of legal limits on debt collection, including:

- The Fair Debt Collection Practices Act (FDCPA)

- The Telephone Consumer Protection Act (TCPA)

- The Truth in Lending Act (TILA)

7. What are the consequences of violating debt collection laws?

Violating debt collection laws can result in a number of consequences, including:

- Fines

- Imprisonment

- Loss of license

8. How do you stay up-to-date on the latest debt collection laws and regulations?

I stay up-to-date on the latest debt collection laws and regulations by reading industry publications, attending conferences, and taking continuing education courses.

9. What is your experience with using debt collection software?

I have experience using a variety of debt collection software, including [list of software]. I am proficient in using these software programs to manage my caseload, track payments, and generate reports.

10. What are your strengths and weaknesses as a Bill Collector?

Strengths

- Excellent communication skills

- Strong negotiation skills

- Empathy and understanding

- Persistence and determination

- Knowledge of debt collection laws and regulations

Weaknesses

- I can be a bit too persistent at times

- I can be a bit too empathetic at times

- I am not always the most organized person

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bill Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bill Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bill collectors are responsible for recovering debts owed to a company or organization. They may work for a collection agency or for the company itself. Key job responsibilities include:

1. Contacting customers

Bill collectors will contact customers by phone, email, or letter to discuss their outstanding debts. They will try to determine why the customer has not paid and will work with them to develop a payment plan.

- Discussing payment options with customers

- Negotiating payment plans

- Collecting payments

2. Investigating accounts

Bill collectors will investigate accounts to determine if the customer is actually responsible for the debt. They will also verify the amount of the debt and the terms of the payment plan.

- Reviewing customer records

- Verifying debts

- Investigating disputes

3. Reporting and documentation

Bill collectors will report on their collection activities to their supervisors. They will also document all contacts with customers and any agreements that are made.

- Preparing collection reports

- Maintaining customer files

- Documenting all collection activity

4. Collections techniques

Bill collectors use a variety of techniques to collect debts. These techniques may include:

- Persuasion

- Negotiation

- Legal action

Interview Tips

Preparing for a bill collector interview can help you make a strong impression and increase your chances of getting the job. Here are a few tips to help you ace your interview:

1. Research the company

Before your interview, take some time to research the company you are applying to. This will show the interviewer that you are interested in the position and that you have taken the time to learn about the company’s culture and values.

- Visit the company’s website

- Read articles about the company

- Check out the company’s social media pages

2. Practice your answers to common interview questions

There are a few common interview questions that you are likely to be asked in a bill collector interview. These questions may include:

- Why are you interested in working as a bill collector?

- What are your strengths and weaknesses?

- How do you handle difficult customers?

Take some time to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Dress professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire. Make sure your clothes are clean and pressed, and that you are well-groomed.

4. Be on time

Punctuality is important for any job interview, but it is especially important for a bill collector interview. This will show the interviewer that you are reliable and that you respect their time.

5. Be prepared to talk about your experience

If you have any experience in collections, be sure to highlight it in your interview. This will show the interviewer that you have the skills and knowledge necessary to be successful in the role.

- Describe your experience in collections

- Discuss your successes and challenges

- Explain how your experience has prepared you for the role

6. Ask questions

At the end of the interview, be sure to ask the interviewer any questions that you have about the position or the company. This will show the interviewer that you are engaged and that you are interested in the opportunity.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bill Collector role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.