Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Car Repossessor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

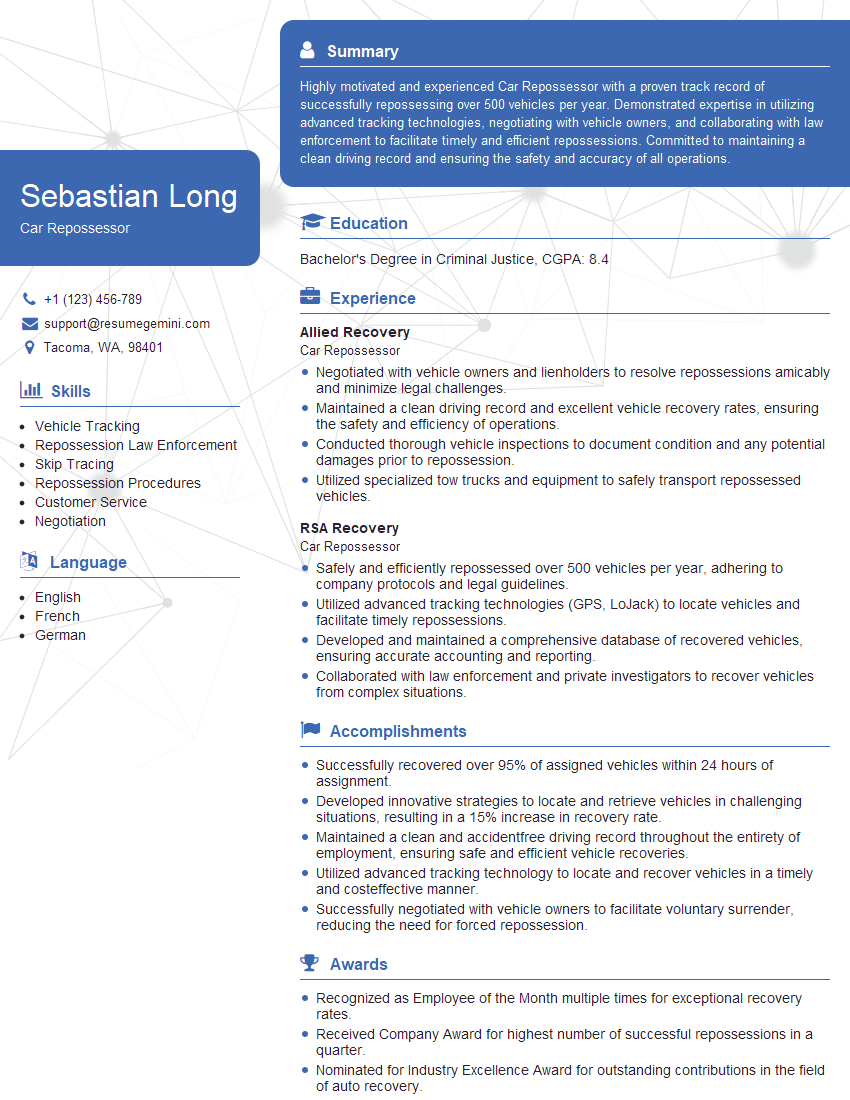

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Car Repossessor

1. Describe the steps involved in the repossession process

- Locate the vehicle

- Verify the identity of the vehicle

- Contact the debtor

- Negotiate a payment plan

- Repossess the vehicle

2. What are the legal requirements for repossessing a vehicle?

subheading of the answer

- The creditor must have a valid security interest in the vehicle

- The debtor must be in default on their loan agreement

- The creditor must provide the debtor with notice of the pending repossession

- The creditor must repossess the vehicle in a peaceful manner

subheading of the answer

- The creditor must store the vehicle in a secure location

- The creditor must notify the debtor of the location of the vehicle

- The creditor must sell the vehicle at a public auction

3. What are the different methods of repossessing a vehicle?

- Direct repossession

- Indirect repossession

- Voluntary repossession

4. What are the risks involved in repossessing a vehicle?

- The debtor may become violent

- The debtor may damage the vehicle

- The debtor may file a lawsuit against the creditor

5. How can you minimize the risks involved in repossessing a vehicle?

- Be prepared for violence

- Do not damage the vehicle

- Follow the law

6. What are some tips for repossessing a vehicle?

- Be polite and respectful

- Be firm but fair

- Be prepared to negotiate

- Be aware of your surroundings

7. What are some of the challenges you have faced as a repossessor?

- Dealing with angry and hostile debtors

- Repossessing vehicles in dangerous neighborhoods

- Staying within the law

8. What are your strengths as a repossessor?

- I am a strong and experienced repossessor with a proven track record of success

- I am able to remain calm and collected under pressure

- I am able to negotiate with debtors and resolve disputes amicably

- I am familiar with the law and I always follow the proper procedures

9. What are your weaknesses as a repossessor?

- I am not always able to repossess a vehicle without causing damage

- I am not always able to avoid conflict with debtors

- I am not always able to stay within the law

10. What are your goals as a repossessor?

- To be the best repossessor in the business

- To help creditors recover their losses

- To protect the rights of debtors

- To make a positive impact on the community

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Car Repossessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Car Repossessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Car Repossessors are responsible for retrieving vehicles from individuals who have defaulted on their auto loans. They must be able to work independently and follow instructions carefully. Some of the key responsibilities of a Car Repossessor include:

1. Locating and Identifying Vehicles

Car Repossessors use a variety of methods to locate vehicles, including GPS tracking, license plate lookups, and skip tracing. Once a vehicle has been located, the Repossessor must verify that it is the correct one by checking the vehicle identification number (VIN).

2. Recovering Vehicles

Once the vehicle has been identified, the Car Repossessor must recover it. This may involve using a tow truck or other methods to transport the vehicle to a secure location.

3. Completing Paperwork

Car Repossessors must complete a variety of paperwork, including repossession orders, vehicle condition reports, and lien releases. They must also keep accurate records of all repossessions.

4. Testifying in Court

In some cases, Car Repossessors may be required to testify in court about the repossession process. They must be able to clearly and accurately describe the events that led to the repossession.

Interview Tips

To prepare for a Car Repossessor interview, it is important to do your research and practice answering common interview questions. Here are some tips to help you ace your interview:

1. Research the company and the position

Before your interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and values, as well as the specific requirements of the job.

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is important to practice answering these questions in a clear and concise way.

3. Dress professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or dress pants and a button-down shirt or blouse. You should also make sure your shoes are clean and polished.

4. Be on time

Punctuality is important for any interview, but it is especially important for a Car Repossessor interview. This shows that you are reliable and respectful of the interviewer’s time.

5. Be prepared to talk about your experience

In your interview, you will be asked about your experience as a Car Repossessor. Be prepared to talk about the specific tasks you have performed and the challenges you have faced. You should also be able to discuss your successes and how you have helped your company.

6. Be prepared to answer questions about your background

In addition to your experience, you will also be asked about your background. This may include questions about your education, your previous jobs, and your military service. Be prepared to answer these questions honestly and thoroughly.

7. Follow up after the interview

After your interview, send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to reiterate your interest in the position.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Car Repossessor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Car Repossessor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.