Feeling lost in a sea of interview questions? Landed that dream interview for Collections Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Collections Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

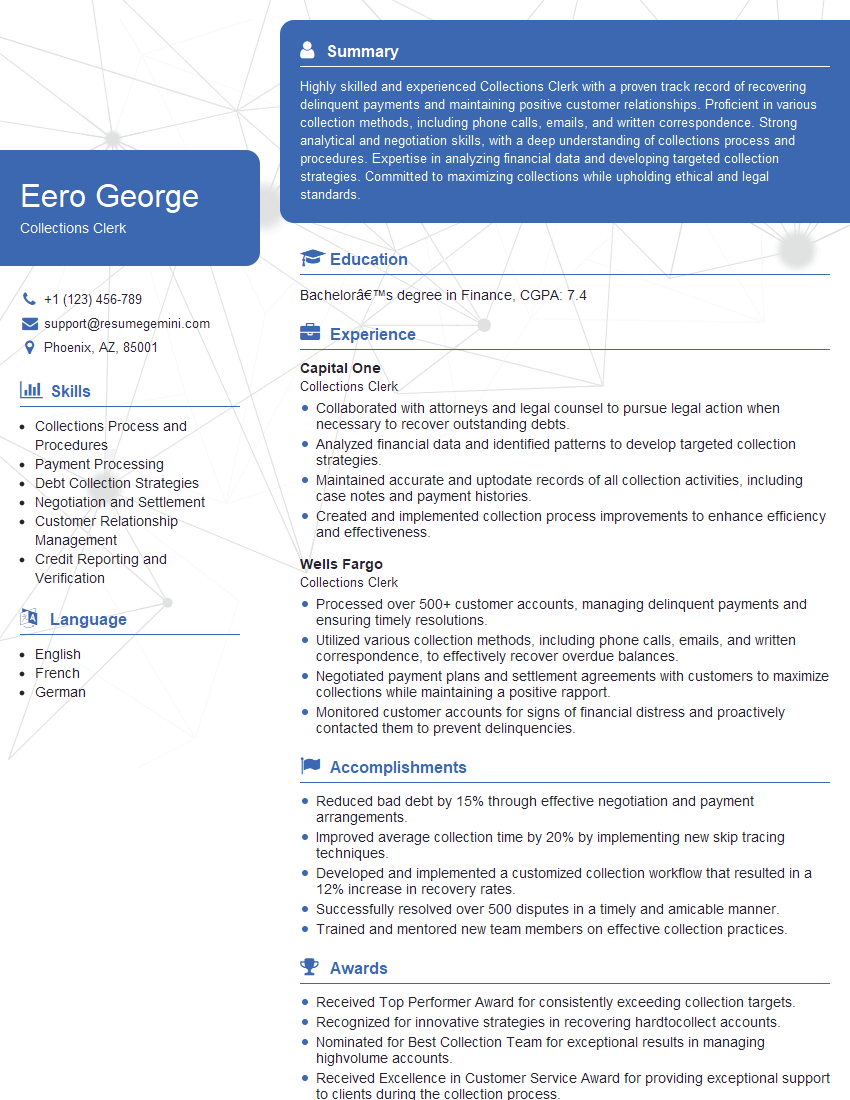

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collections Clerk

1. Describe your understanding of the role and responsibilities of a Collections Clerk?

As a collections clerk, I am responsible for collecting overdue payments, managing customer accounts, and maintaining accurate records. My key responsibilities include:

- Contacting customers via phone, email, or mail to collect overdue payments

- Investigating and resolving customer disputes

- Updating customer accounts and payment records

- Preparing and sending out payment reminders and collection notices

- Compiling reports and providing data on collection activities

2. What techniques do you use to effectively communicate with customers during the collections process?

Empathy and Active Listening:

- Emphasize with customers’ situations and listen attentively to understand their perspectives

- Use respectful language and avoid confrontational or accusatory tone

Negotiation and Payment Arrangements:

- Propose flexible payment plans and negotiate mutually acceptable terms

- Explore alternative payment methods and assist customers in finding solutions that meet their financial constraints

3. How do you prioritize and manage your workload when dealing with multiple accounts?

I prioritize my workload by:

- Assessing the urgency and severity of each account

- Using a customer relationship management (CRM) system or spreadsheet to track progress

- Setting clear deadlines and sticking to a schedule

- Delegating tasks and seeking assistance from colleagues when necessary

4. Describe your experience in using collection software or tools.

I am proficient in using [Collection Software Name], a comprehensive collection management platform. This software enables me to:

- Track customer accounts and payment histories

- Automate payment reminders and collection notices

- Generate reports and analyze collection performance

- Communicate with customers via integrated messaging and email features

5. How do you handle challenging customers or those who are resistant to paying?

I approach challenging customers with empathy and patience. I actively listen to their concerns and try to understand their motivations.

- I present the facts and legal implications of non-payment clearly

- I remain calm and professional, even when faced with hostility

- I seek support or guidance from my supervisor when necessary

6. How do you stay up-to-date on industry best practices and regulations related to collections?

I stay updated on industry best practices and regulations through:

- Attending industry conferences and webinars

- Subscribing to trade magazines and online forums

- Participating in professional development courses and certifications

7. What is your approach to resolving customer disputes?

I approach customer disputes with an open mind and a willingness to find a mutually acceptable solution. My steps include:

- Listening attentively to the customer’s complaint

- Investigating the issue thoroughly and gathering evidence

- Proposing fair and reasonable solutions

- Documenting the resolution and following up with the customer

8. How do you measure your success as a Collections Clerk?

I measure my success by:

- Meeting or exceeding collection targets

- Improving customer satisfaction and reducing complaints

- Adhering to ethical and regulatory guidelines

- Receiving positive feedback from supervisors and colleagues

- Continuously improving my skills and knowledge

9. What are your strengths and weaknesses as a Collections Clerk?

Strengths:

- Excellent communication and negotiation skills

- Strong understanding of collection laws and regulations

- Ability to prioritize and manage multiple accounts

- Proven track record of meeting or exceeding collection targets

Weaknesses:

- I sometimes find it challenging to remain empathetic while dealing with difficult customers

- I am still developing my expertise in using advanced collection software features

10. Why are you interested in joining our company?

I am eager to join your company because I am impressed by your commitment to customer service and ethical collections practices. Your company’s reputation for innovation and employee development aligns well with my career goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collections Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collections Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collections Clerk is responsible for collecting payments on delinquent accounts and maintaining accurate records of collections activities. Key job responsibilities include:

1. Contacting customers

Initiating and maintaining contact with customers to collect payments and resolve disputes.

- Making phone calls, sending emails, and writing letters to customers with overdue accounts.

- Negotiating payment plans and arrangements with customers.

2. Processing payments

Processing payments received from customers and applying them to their accounts.

- Recording payments in the company’s accounting system.

- Issuing receipts to customers.

3. Maintaining records

Maintaining accurate records of all collections activities and customer interactions.

- Tracking the status of delinquent accounts.

- Documenting all contacts with customers.

4. Reporting

Preparing and submitting reports on collections activities.

- Providing management with information on the status of delinquent accounts.

- Identifying trends in collections performance.

Interview Tips

To ace a Collections Clerk interview, it is important to highlight your communication, negotiation, and problem-solving skills. Here are some tips to help you prepare for the interview:

1. Research the company and the role

Before the interview, take some time to research the company and the specific role you are applying for. This will help you understand the company’s culture, values, and expectations. It will also help you tailor your answers to the specific requirements of the role.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this role?” and “What are your strengths and weaknesses?”. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

3. Be prepared to discuss your experience and skills

The interviewer will want to know about your experience and skills in collections. Be prepared to discuss your accomplishments in detail, and highlight the skills that you have that are relevant to the role. For example, you might discuss your experience in negotiating payment plans, resolving disputes, or maintaining accurate records.

4. Ask questions

Asking questions at the end of the interview shows that you are engaged and interested in the role. It also gives you an opportunity to learn more about the company and the position. Some good questions to ask include “What are the biggest challenges facing the collections department right now?” and “What are the opportunities for advancement within the company?”

5. Follow up

After the interview, be sure to send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and consideration. You can also use the thank-you note to reiterate your interest in the role and highlight any additional skills or experience that you think would be valuable to the company.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Collections Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Collections Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.