Are you gearing up for an interview for a Credit Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

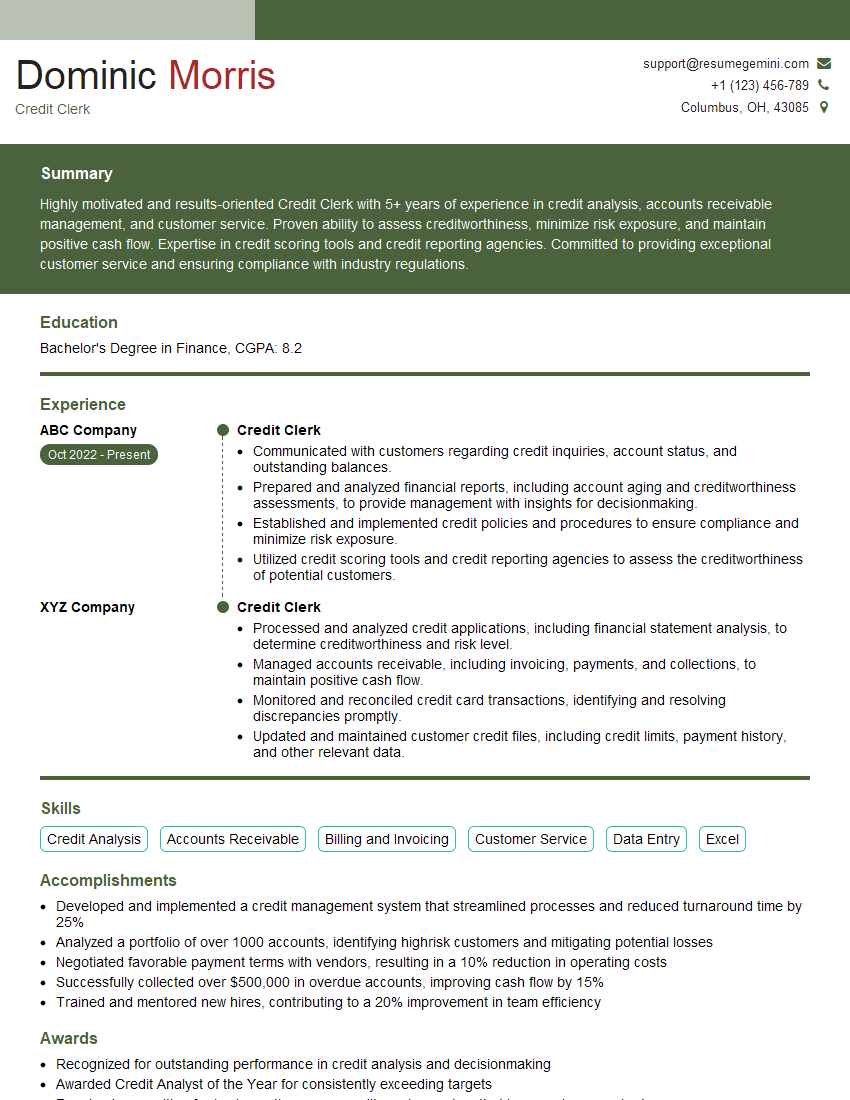

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Clerk

1. What are the key elements involved in credit analysis?

- Assess the borrower’s financial statements

- Evaluate the borrower’s industry and market

- Review the borrower’s management team

- Consider the borrower’s legal and regulatory environment

- Make a credit decision

2. What are the different types of credit reports?

Consumer credit reports

- Provide information about an individual’s credit history

- Used by lenders to assess an individual’s creditworthiness

Commercial credit reports

- Provide information about a business’s credit history

- Used by lenders to assess a business’s creditworthiness

3. What are the different types of credit scores?

- FICO score

- VantageScore

- Equifax score

- Experian score

4. What are the benefits of using a credit score?

- Helps lenders to make more informed credit decisions

- Allows consumers to track their credit history and progress

- Can help consumers to qualify for lower interest rates on loans

5. What are the factors that affect a credit score?

- Payment history

- Amount of debt

- Length of credit history

- New credit inquiries

- Credit mix

6. What are the steps involved in the credit approval process?

- Review the credit application

- Obtain a credit report

- Calculate the applicant’s credit score

- Make a decision on whether to approve the application

7. What are the different types of credit terms?

- Interest rate

- Loan term

- Repayment schedule

- Collateral

8. What are the different types of credit risk?

- Default risk

- Interest rate risk

- currency risk

- Concentration risk

9. How can you mitigate credit risk?

- Diversification

- Collateralization

- Guarantees

- Credit insurance

10. What are the ethical considerations involved in credit analysis?

- Confidentiality

- Objectivity

- Accuracy

- Fairness

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Clerk is responsible for a wide range of tasks that are essential to the efficient operation of a business. These tasks include:

1. Processing and Maintaining Customer Accounts

This involves creating and maintaining customer accounts, processing invoices and payments, and reconciling accounts.

- Creating and maintaining customer accounts

- Processing invoices and payments

- Reconciling accounts

2. Managing Credit Limits

This involves assessing customer creditworthiness, setting credit limits, and monitoring customer accounts for any signs of financial distress.

- Assessing customer creditworthiness

- Setting credit limits

- Monitoring customer accounts for any signs of financial distress

3. Collecting Overdue Payments

This involves contacting customers who are overdue on their payments, negotiating payment plans, and taking appropriate action to collect outstanding debts.

- Contacting customers who are overdue on their payments

- Negotiating payment plans

- Taking appropriate action to collect outstanding debts

4. Preparing Financial Reports

This involves preparing financial reports, such as balance sheets, income statements, and cash flow statements, to provide management with a clear understanding of the company’s financial performance.

- Preparing balance sheets

- Preparing income statements

- Preparing cash flow statements

Interview Tips

Preparing for an interview for a Credit Clerk position can be daunting, but there are a few key tips that can help you ace the interview and land the job.

1. Research the Company and the Position

Take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and goals, and it will also help you tailor your answers to the specific requirements of the job.

- Visit the company’s website

- Read the job description carefully

- Talk to people who work at the company (if possible)

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why do you want to work for this company?” It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Write out your answers to common interview questions

- Practice saying your answers out loud

- Get feedback from a friend or family member

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your previous work experience, your education, and any relevant certifications or training.

- Highlight your experience in credit and finance

- Quantify your accomplishments whenever possible

- Be prepared to talk about your strengths and weaknesses

4. Be Enthusiastic and Professional

First impressions matter, so it is important to be enthusiastic and professional throughout the interview. Dress appropriately, arrive on time, and be polite and respectful to the interviewer.

- Dress professionally

- Arrive on time

- Be polite and respectful

- Maintain eye contact

- Ask thoughtful questions

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.