Are you gearing up for an interview for a Credit Collections Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Collections Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

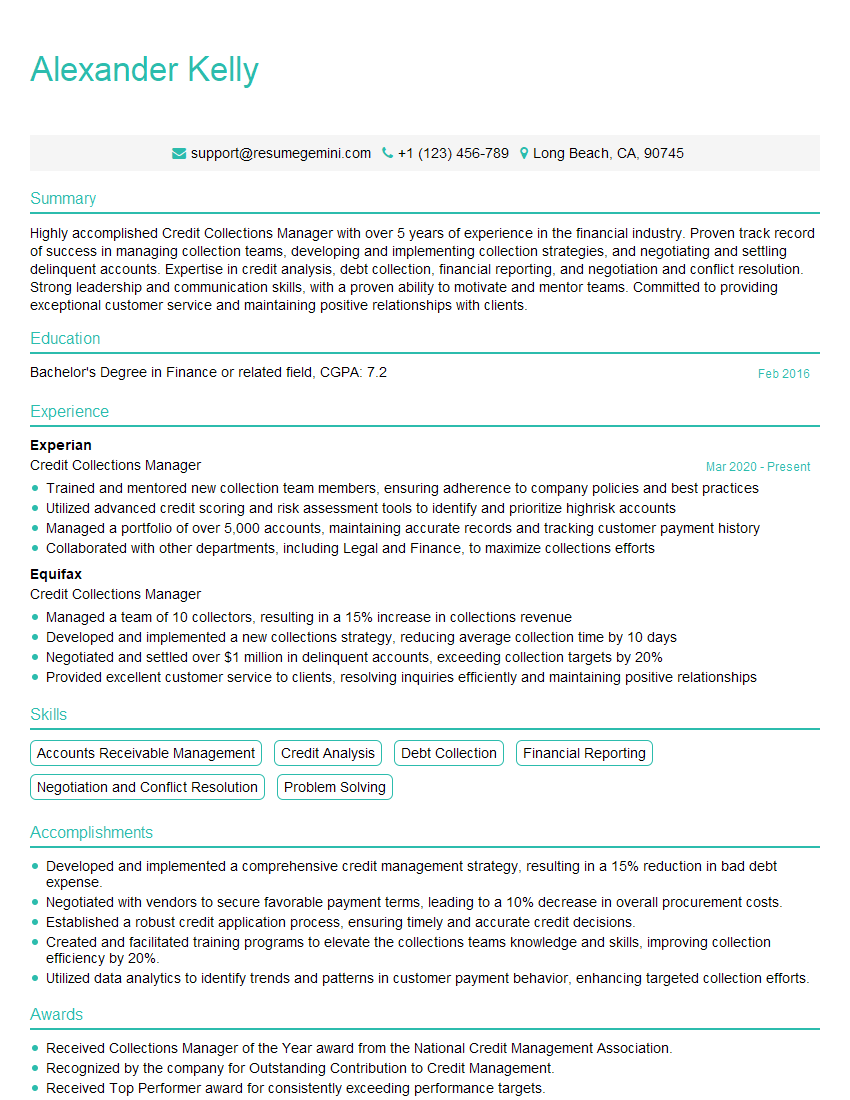

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Collections Manager

1. What are the key performance indicators (KPIs) you would use to measure the success of a credit collections team?

- Collection rate: This measures the percentage of delinquent accounts that are successfully collected.

- Average collection time: This measures the average number of days it takes to collect on a delinquent account.

- Cost of collection: This measures the total cost of collection efforts, including staff salaries, technology, and other expenses.

- Customer satisfaction: This measures the level of satisfaction that customers have with the collections process.

2. What are the common challenges faced by credit collections teams, and how would you overcome them?

Strategies to overcome collection challenges:

- Develop a strong collections policy: This policy should outline the company’s collections procedures, including the frequency of contact, the types of communication channels that will be used, and the consequences of non-payment.

- Train staff on effective collections techniques: Staff should be trained on how to communicate with delinquent customers, how to negotiate payment agreements, and how to use the company’s collections software.

- Use technology to streamline the collections process: There are a number of software solutions that can help credit collections teams to automate tasks, track progress, and improve communication with customers.

Common challenges in collection:

- Customers who are unable to pay: This can be due to a variety of factors, such as job loss, illness, or unexpected expenses.

- Customers who are unwilling to pay: This can be due to a variety of factors, such as disputes over the debt, poor customer service, or a lack of understanding of the consequences of non-payment.

- Customers who are difficult to contact: This can be due to a variety of factors, such as incorrect contact information, multiple phone numbers, or a lack of response to emails or letters.

3. How would you manage a team of credit collectors?

- Set clear goals and expectations.

- Provide regular feedback and coaching.

- Create a positive and supportive work environment.

- Empower your team to make decisions.

- Celebrate successes.

4. What are the ethical considerations that you would keep in mind when collecting on a debt?

- Treat customers with respect.

- Be honest and transparent.

- Avoid harassment and intimidation.

- Comply with all applicable laws and regulations.

5. What are your thoughts on using technology to automate the credit collections process?

- Technology can help to improve efficiency and productivity.

- Technology can help to reduce costs.

- Technology can help to improve customer service.

- However, it is important to use technology in a way that is ethical and compliant with all applicable laws and regulations.

6. What are the key trends that you are seeing in the credit collections industry?

- The use of technology to automate the collections process.

- The increasing use of data and analytics to improve collections strategies.

- The growing importance of customer service in the collections process.

7. What is your experience with managing large-scale collections campaigns?

- I have managed large-scale collections campaigns for a variety of clients.

- I have experience with a variety of collection strategies.

- I have a proven track record of success in recovering delinquent accounts.

8. What is your experience with working with third-party collection agencies?

- I have experience with working with third-party collection agencies.

- I know how to evaluate and select a third-party collection agency.

- I have experience with managing the relationship with a third-party collection agency.

9. What is your experience with developing and implementing credit policies?

- I have experience with developing and implementing credit policies.

- I know how to assess the creditworthiness of customers.

- I know how to set credit limits and terms.

10. What is your experience with training and developing credit collections staff?

- I have experience with training and developing credit collections staff.

- I know how to develop and deliver training programs.

- I know how to assess the training needs of staff.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Collections Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Collections Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Credit Collections Manager

A Credit Collections Manager plays a crucial role in maintaining the financial health of an organization by effectively managing overdue accounts and optimizing cash flow. Their responsibilities encompass:

1. Credit Risk Assessment and Management

Analyze customer creditworthiness and determine appropriate credit limits based on factors such as financial history, industry trends, and market conditions.

- Implement credit policies and procedures to minimize bad debts and maintain a healthy credit portfolio.

- Monitor changes in customer creditworthiness and take proactive steps to mitigate risks.

2. Account Receivable Management

Develop and implement strategies to reduce days sales outstanding (DSO) and improve cash flow.

- Establish clear payment terms and follow up on overdue invoices promptly.

- Negotiate payment arrangements with customers and ensure timely collection.

3. Collections Process Management

Develop and implement efficient collections processes to maximize recovery rates.

- Supervise and train collectors on effective collection techniques.

- Monitor collections performance and identify areas for improvement.

4. Reporting and Analysis

Create and analyze financial reports to track collection performance, identify trends, and make data-driven decisions.

- Provide timely and accurate reports to management on credit risk, collections status, and cash flow forecasts.

- Use data analysis to identify potential collection issues and develop proactive strategies.

Interview Preparation Tips for a Credit Collections Manager

To ace an interview for a Credit Collections Manager position, candidates should:

1. Research the Company and Position

Thoroughly research the organization, its industry, and the specific responsibilities of the role.

- Review the company website, news articles, and social media profiles.

- Study the job description and identify key qualifications and responsibilities.

2. Highlight Relevant Skills and Experience

Emphasize your skills and experience in credit analysis, collections management, and financial reporting.

- Quantify your accomplishments using specific metrics, such as reduction in DSO or increase in recovery rates.

- Discuss how you have used data analysis to improve collections processes or identify fraud.

3. Be Prepared to Discuss Challenges

Prepare for questions about potential challenges in credit and collections management.

- Discuss how you have handled difficult customers or negotiated complex payment arrangements.

- Share strategies for managing bad debts and minimizing write-offs.

4. Ask Insightful Questions

Prepare thoughtful questions that demonstrate your interest in the position and the organization.

- Inquire about the company’s credit policies and procedures.

- Ask about the current collections performance and goals.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Credit Collections Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Credit Collections Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.