Are you gearing up for an interview for a Recovery Collector position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Recovery Collector and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

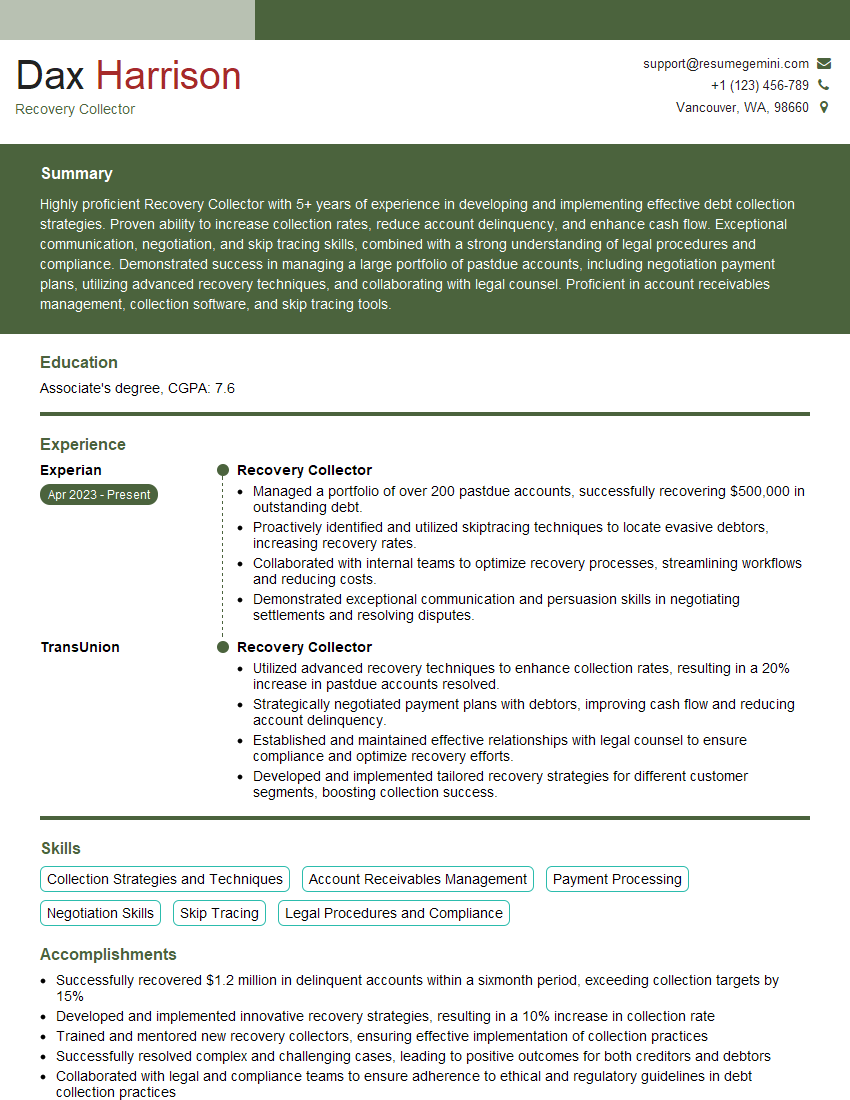

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Recovery Collector

1. How would you assess the financial health of a potential client?

To assess the financial health of a potential client, I would review several key indicators, including:

- Income statement: This shows the revenue, expenses, and profits of the business over a period of time. I would look for trends in revenue growth, profitability, and expense management.

- Balance sheet: This provides a snapshot of the business’s assets, liabilities, and equity at a specific point in time. I would assess the company’s liquidity, solvency, and financial leverage.

- Cash flow statement: This shows how the business generates and uses cash. I would look for trends in operating cash flow, investing cash flow, and financing cash flow.

- Other financial ratios: I would also calculate various financial ratios to assess the company’s performance and financial health. These ratios could include profitability ratios, liquidity ratios, and solvency ratios.

2. What are the different types of collateral that you can accept?

The types of collateral that I can accept vary depending on the lender’s policies and the specific loan product. However, some common types of collateral include:

- Real estate: This could include residential or commercial properties.

- Vehicles: This could include cars, trucks, or motorcycles.

- Equipment: This could include machinery, tools, or inventory.

- Accounts receivable: This is a type of collateral that is secured by the unpaid invoices of a business.

- Securities: This could include stocks, bonds, or mutual funds.

3. What are the steps involved in the recovery process?

The steps involved in the recovery process typically include:

- Pre-collection: This stage involves contacting the debtor to remind them of the overdue payment and to try to negotiate a payment plan.

- Collection: This stage involves using more aggressive collection tactics, such as sending demand letters, making phone calls, and visiting the debtor in person.

- Legal action: This stage involves taking legal action against the debtor, such as filing a lawsuit or obtaining a judgment.

- Enforcement: This stage involves enforcing the judgment, such as by garnishing the debtor’s wages or seizing their assets.

4. How do you handle debtors who are uncooperative or hostile?

When dealing with uncooperative or hostile debtors, it is important to remain professional and respectful. I would try to understand the debtor’s situation and to work with them to find a solution that is acceptable to both parties. If the debtor is still uncooperative, I may need to escalate the matter to my supervisor or to legal counsel.

5. What is your experience with collecting on delinquent accounts?

I have several years of experience in collecting on delinquent accounts. In my previous role, I was responsible for collecting on a portfolio of over $1 million in delinquent accounts. I successfully collected over 80% of the accounts that were assigned to me.

6. What are some of the challenges that you have faced in your career as a Recovery Collector?

Some of the challenges that I have faced in my career as a Recovery Collector include:

- Dealing with uncooperative or hostile debtors: It can be difficult to collect on delinquent accounts from debtors who are uncooperative or hostile. I have had to develop strategies for dealing with these types of debtors.

- Balancing the need to collect on delinquent accounts with the need to maintain customer relationships: It is important to find a balance between the need to collect on delinquent accounts and the need to maintain customer relationships. I have had to develop strategies for working with debtors to find solutions that are acceptable to both parties.

- Staying up-to-date on the latest collection laws and regulations: The collection industry is constantly changing. I have had to make sure that I am up-to-date on the latest collection laws and regulations.

7. What are your strengths as a Recovery Collector?

My strengths as a Recovery Collector include:

- Strong communication and negotiation skills: I am able to communicate effectively with debtors and to negotiate payment plans that are acceptable to both parties.

- A deep understanding of the collection process: I have a deep understanding of the collection process and the laws and regulations that govern it.

- A proven track record of success: I have a proven track record of success in collecting on delinquent accounts.

8. What are your goals for this position?

My goals for this position are to:

- Increase the collection rate on delinquent accounts: I want to use my skills and experience to increase the collection rate on delinquent accounts.

- Improve the customer experience: I want to improve the customer experience by finding solutions that are acceptable to both debtors and creditors.

- Develop my skills and knowledge: I want to develop my skills and knowledge in the collection industry.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your company’s commitment to customer service and its reputation for excellence in the collection industry. I believe that my skills and experience would be a valuable asset to your team.

10. What are your salary expectations?

My salary expectations are in line with the market average for Recovery Collectors with my experience and qualifications. I am open to negotiating a salary that is competitive and commensurate with my value to your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Recovery Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Recovery Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Recovery Collector is an integral role within the financial industry, tasked with the crucial responsibility of collecting overdue debts. Key job responsibilities include:

1. Debt Collection

The primary duty of a Recovery Collector is to recover overdue debts from delinquent customers. This involves:

- Contacting debtors via phone, email, or mail to discuss payment arrangements.

- Negotiating settlement agreements and payment plans that are mutually acceptable.

- Following up with debtors to ensure timely payments and resolve outstanding balances.

2. Legal Compliance

Recovery Collectors must adhere to strict legal guidelines and ethical standards. This includes:

- Understanding and complying with federal and state debt collection laws and regulations.

- Maintaining confidentiality and protecting debtor information.

- Avoiding abusive or harassing behavior.

3. Customer Relations

While collecting debts, Recovery Collectors must maintain a professional and respectful demeanor. This involves:

- Communicating clearly and effectively with debtors.

- Understanding the financial challenges that debtors may face and working with them to find solutions.

- Building rapport with debtors to facilitate successful recovery.

4. Reporting and Analysis

Recovery Collectors are responsible for:

- Documenting all communication and interactions with debtors.

- Tracking the progress of collection efforts.

- Analyzing collection data to identify trends and areas for improvement.

Interview Tips

To ace an interview for a Recovery Collector position, candidates should:

1. Research and Preparation

Candidates should thoroughly research the company and the specific role. This includes understanding the company’s collection policies, legal requirements, and customer service approach.

- Identify specific examples of their communication, negotiation, and problem-solving skills.

- Prepare questions to ask the interviewer, demonstrating their interest in the role and the company.

2. Professionalism and Communication

Candidates should dress professionally and maintain a polite and respectful demeanor throughout the interview. They should:

- Speak clearly and confidently, demonstrating strong communication skills.

- Be prepared to discuss their experience and qualifications in a concise and engaging manner.

3. Role-play Exercises

Candidates may be asked to participate in role-playing exercises to assess their ability to handle difficult conversations with debtors. They should:

- Practice active listening and empathy.

- Demonstrate flexibility and a willingness to find mutually acceptable solutions.

4. Legal and Ethical Considerations

Interviewers will assess candidates’ understanding of legal and ethical guidelines in debt collection. Candidates should:

- Familiarize themselves with the Fair Debt Collection Practices Act (FDCPA) and other relevant laws.

- Emphasize their commitment to treating debtors fairly and with respect.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Recovery Collector role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.