Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bookkeeping Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bookkeeping Clerk so you can tailor your answers to impress potential employers.

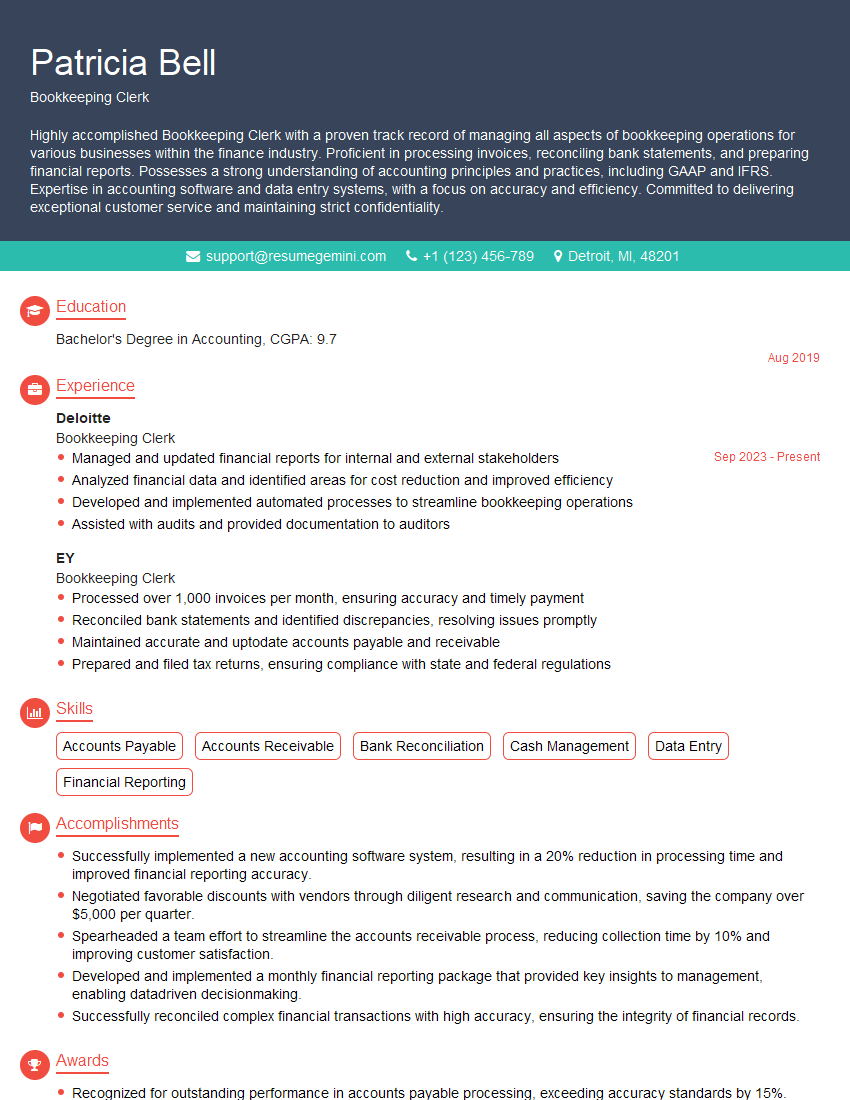

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeping Clerk

1. What are the key responsibilities of a Bookkeeping Clerk?

- Record and process financial transactions.

- Prepare and maintain financial records.

- Reconcile bank statements and identify discrepancies.

- Prepare and file tax returns.

- Collaborate with accountants and auditors.

2. Describe your experience with using accounting software.

Knowledge of Accounting Software

- Proficient in QuickBooks and Microsoft Excel.

- Experience with other accounting software, such as NetSuite and SAP.

Data Entry Skills

- Accurate and efficient data entry skills.

- Attention to detail and ability to follow instructions.

3. How do you handle errors in financial data?

- Identify the error and determine its source.

- Correct the error and make necessary adjustments.

- Document the error and the corrective action taken.

- Communicate the error and its resolution to the appropriate parties.

4. Can you explain the process of reconciling bank statements?

- Compare the bank statement to the company’s records.

- Identify any discrepancies and investigate their causes.

- Make necessary adjustments to the company’s records.

- Prepare a reconciliation report that details the process and any adjustments made.

5. What are some of the ethical considerations that are important for Bookkeeping Clerks?

- Confidentiality of financial information.

- Accuracy and integrity of financial records.

- Compliance with laws and regulations.

- Avoiding conflicts of interest.

6. Describe your experience with preparing and filing tax returns.

- Knowledge of tax laws and regulations.

- Ability to prepare and file various types of tax returns.

- Experience with tax software, such as TurboTax or TaxSlayer.

7. What are your strengths and weaknesses as a Bookkeeping Clerk?

Strengths

- Strong attention to detail and accuracy.

- Proficient in accounting software and data entry.

- Excellent communication and interpersonal skills.

Weaknesses

- Limited experience with complex accounting principles.

- Need to improve time management skills.

8. How do you stay up to date on changes in accounting regulations and standards?

- Attend industry conferences and workshops.

- Read industry publications and newsletters.

- Participate in online forums and discussion groups.

9. What are your salary expectations for this role?

Research industry benchmarks and consider your experience and qualifications.

10. Do you have any questions for me about the role or the company?

This is an opportunity for you to learn more about the position and the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeping Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeping Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Bookkeeping Clerk plays a vital role in the financial management of an organization. Key responsibilities include:

1. Data Entry and Management

Accurately recording and maintaining financial data, such as transactions, invoices, and payments.

- Ensuring completeness and accuracy of financial records.

- Managing accounts receivable and payable accounts, including invoicing and payment processing.

2. Bank Reconciliation

Matching bank statements with accounting records to ensure accuracy and identify any discrepancies.

- Comparing bank statements to general ledger accounts.

- Investigating and resolving bank reconciliation differences.

3. Financial Reporting

Preparing and presenting financial reports, such as balance sheets and income statements.

- Generating reports for internal and external stakeholders.

- Ensuring accuracy and compliance with reporting standards.

4. Cash Flow Management

Monitoring cash flow patterns and assisting in developing strategies to optimize cash flow.

- Preparing cash flow forecasts and budgets.

- Tracking cash flow and identifying potential cash flow issues.

5. Customer Service

Interacting with customers to resolve billing issues, answer inquiries, and provide support.

- Maintaining positive customer relationships.

- Resolving customer disputes and providing satisfactory solutions.

Interview Tips

To ace the interview for a Bookkeeping Clerk position, here are some tips:

1. Research the Company

Demonstrate interest in the company and its financial management practices by researching their industry, financial performance, and company culture.

- Check the company website, social media, and news articles.

- Identify the company’s financial goals and challenges.

2. Highlight relevant skills and experiences

Emphasize your proficiency in accounting principles, bookkeeping software, and data analysis techniques.

- Quantify your accomplishments and highlight how you have contributed to the success of previous organizations.

- Prepare examples of how you have automated processes, improved efficiency, or resolved financial discrepancies.

3. Prepare financial case study questions

Be prepared to answer case study questions that test your problem-solving and financial analysis abilities.

- Develop scenarios based on your research about the company.

- Practice analyzing financial statements, identifying trends, and recommending solutions.

4. Show enthusiasm and attention to detail

Demonstrate your passion for bookkeeping and your commitment to accuracy and efficiency.

- Express your interest in learning about the company’s specific bookkeeping practices.

- Ask questions that show your curiosity and desire to contribute to the team.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bookkeeping Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.