Are you gearing up for a career in Bookkeeping and Billing Machine Operator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bookkeeping and Billing Machine Operator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

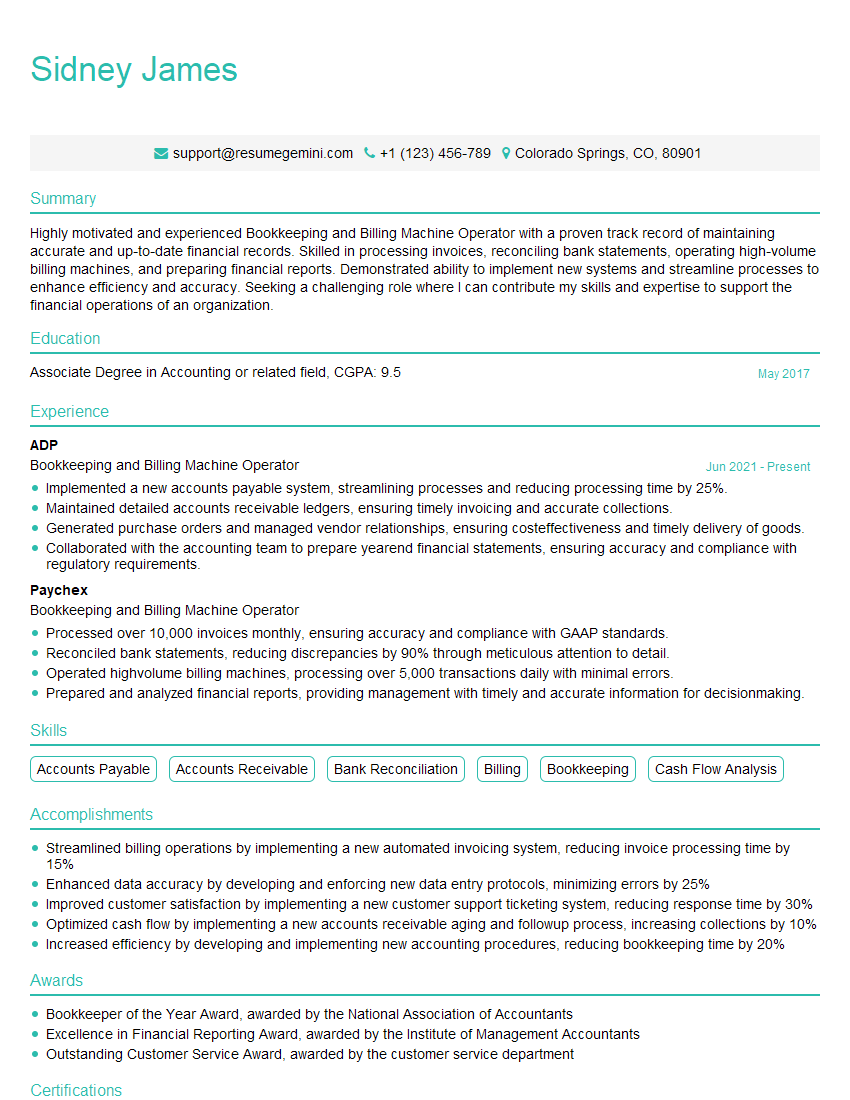

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeping and Billing Machine Operator

1. Explain the steps involved in the billing process?

During the billing process, I follow a detailed set of steps to ensure accuracy and efficiency:

- Data Entry: I meticulously enter customer information, order details, and pricing data into the billing system.

- Invoice Generation: I create and issue invoices that clearly outline the services or products provided, quantities, unit prices, and total amounts due.

- Payment Processing: I process customer payments promptly, whether through online banking, credit card, or check. I maintain accurate records of all transactions.

2. Describe your proficiency in using accounting software, specifically for accounts receivable and accounts payable?

I am highly proficient in using accounting software, particularly in managing accounts receivable and accounts payable:

Accounts Receivable

- I maintain detailed customer records, track invoices, and monitor outstanding balances.

- I perform regular reconciliations to ensure accuracy and prevent discrepancies.

Accounts Payable

- I process vendor invoices, ensuring proper coding and authorization.

- I manage payment schedules and ensure timely payments, maintaining strong vendor relationships.

3. How do you handle errors or discrepancies in billing or accounting records?

When I identify errors or discrepancies in billing or accounting records, I follow a systematic approach to rectify them efficiently:

- Error Identification: I thoroughly investigate the source of the error, whether it’s a data entry mistake, calculation error, or system issue.

- Error Correction: Once the error is identified, I make the necessary corrections in the system and update the affected records.

- Documentation: I document the error, the corrective actions taken, and the reason for the discrepancy to prevent future occurrences.

4. Can you explain the importance of reconciling bank statements and how you ensure accuracy?

Reconciling bank statements is crucial to ensure the accuracy of accounting records. I follow these steps to ensure meticulous reconciliation:

- Matching Transactions: I match transactions in the bank statement with those recorded in the accounting system.

- Investigating Discrepancies: I investigate any discrepancies between the two sets of records and resolve them promptly.

- Documentation: I document the reconciliation process and keep a record of any adjustments made.

- Regular Reviews: I perform regular reconciliations to maintain the integrity of financial data.

5. How do you prioritize your workload when managing multiple billing and accounting tasks?

To effectively prioritize my workload when managing multiple billing and accounting tasks, I follow these strategies:

- Task Assessment: I evaluate the importance and urgency of each task.

- Deadline Management: I set realistic deadlines and allocate time accordingly to ensure timely completion.

- Delegation: If appropriate, I delegate tasks to colleagues to optimize efficiency.

- Communication: I communicate my workload and progress to ensure alignment with team goals.

6. What are the key internal controls you implement to maintain the integrity of financial data?

To maintain the integrity of financial data, I implement the following key internal controls:

- Separation of Duties: I ensure that different individuals handle various aspects of the billing and accounting process.

- Authorization and Approval: I require authorization and approval for significant transactions to prevent unauthorized access.

- Regular Audits: I conduct regular internal audits to identify and address potential weaknesses.

7. How do you stay up-to-date with changes in accounting regulations and industry best practices?

To stay up-to-date with changes in accounting regulations and industry best practices, I actively engage in the following:

- Continuing Education: I attend workshops, webinars, and training programs to enhance my knowledge.

- Professional Development: I pursue industry certifications to demonstrate my commitment to excellence.

- Research: I regularly review accounting publications, articles, and online resources.

8. Describe your experience in managing accounts receivable and how you have improved collections?

In my previous role, I was responsible for managing accounts receivable and implemented strategies to improve collections:

- Proactive Communication: I established regular communication with customers to discuss payment arrangements and prevent overdue accounts.

- Payment Incentives: I introduced early payment discounts and loyalty programs to encourage timely payments.

- Automated Reminders: I set up automated email and SMS reminders to prompt customers about upcoming due dates.

9. How do you handle customer inquiries and resolve billing disputes?

When handling customer inquiries and resolving billing disputes, I follow these steps to maintain positive customer relationships:

- Active Listening: I attentively listen to the customer’s concerns to fully understand the issue.

- Thorough Investigation: I conduct a comprehensive investigation to gather all relevant information.

- Clear Communication: I explain the findings of my investigation and discuss potential solutions with the customer.

- Resolution: I work collaboratively with the customer to find a mutually acceptable resolution.

10. How do you contribute to the overall financial health of the organization?

As a Bookkeeping and Billing Machine Operator, I contribute to the overall financial health of the organization through the following:

- Accurate Financial Records: I maintain accurate and up-to-date financial records, providing the basis for informed decision-making.

- Efficient Billing: My efficient billing processes ensure timely and accurate invoicing, maximizing revenue collection.

- Effective Accounts Receivable Management: I closely monitor accounts receivable and implement strategies to minimize bad debts.

- Compliance: I adhere to all relevant accounting regulations and ethical standards, ensuring the integrity of financial reporting.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeping and Billing Machine Operator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeping and Billing Machine Operator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bookkeeping and Billing Machine Operator is responsible for a wide range of tasks related to bookkeeping, billing, and data entry. They may also perform other duties as assigned by their supervisor.

1. Bookkeeping

Bookkeeping tasks may include:

- Recording financial transactions in a timely and accurate manner

- Balancing accounts and reconciling records

- Preparing financial reports and statements

- Maintaining a filing system for financial documents

2. Billing

Billing tasks may include:

- Creating and sending invoices to customers

- Processing payments and recording receipts

- Maintaining customer accounts and records

- Resolving billing disputes

3. Data Entry

Data entry tasks may include:

- Entering data into a computer system from source documents

- Verifying the accuracy of data entered

- Backing up data and maintaining data security

4. Other Duties

Other duties may include:

- Assisting with the preparation of tax returns

- Answering customer inquiries

- Performing other administrative tasks as needed

Interview Tips

To prepare for an interview for a Bookkeeping and Billing Machine Operator position, it is important to:

1. Research the Company

Learn about the company’s history, culture, and products or services. This will help you to answer questions about the company and to demonstrate your interest in the position.

2. Review the Job Description

Make sure that you understand the key responsibilities of the position and the qualifications that are required. This will help you to tailor your answers to the interviewer’s questions.

3. Practice Your Answers

Think about the questions that you are likely to be asked and practice your answers. This will help you to feel more confident and prepared during the interview.

4. Dress Professionally

First impressions matter, so make sure that you dress professionally for your interview. This shows the interviewer that you are serious about the position and that you are respectful of the company.

5. Be Polite and Respectful

Be polite and respectful to the interviewer and to the other people that you meet during the interview process. This will create a positive impression and make you more likely to be hired.

Example Outline

Here is an example outline of questions that you may be asked in an interview for a Bookkeeping and Billing Machine Operator position:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with bookkeeping and billing?

- What is your experience with data entry?

- What are your salary expectations?

- Do you have any questions for me?

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bookkeeping and Billing Machine Operator, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bookkeeping and Billing Machine Operator positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.