Feeling lost in a sea of interview questions? Landed that dream interview for Statement Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Statement Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

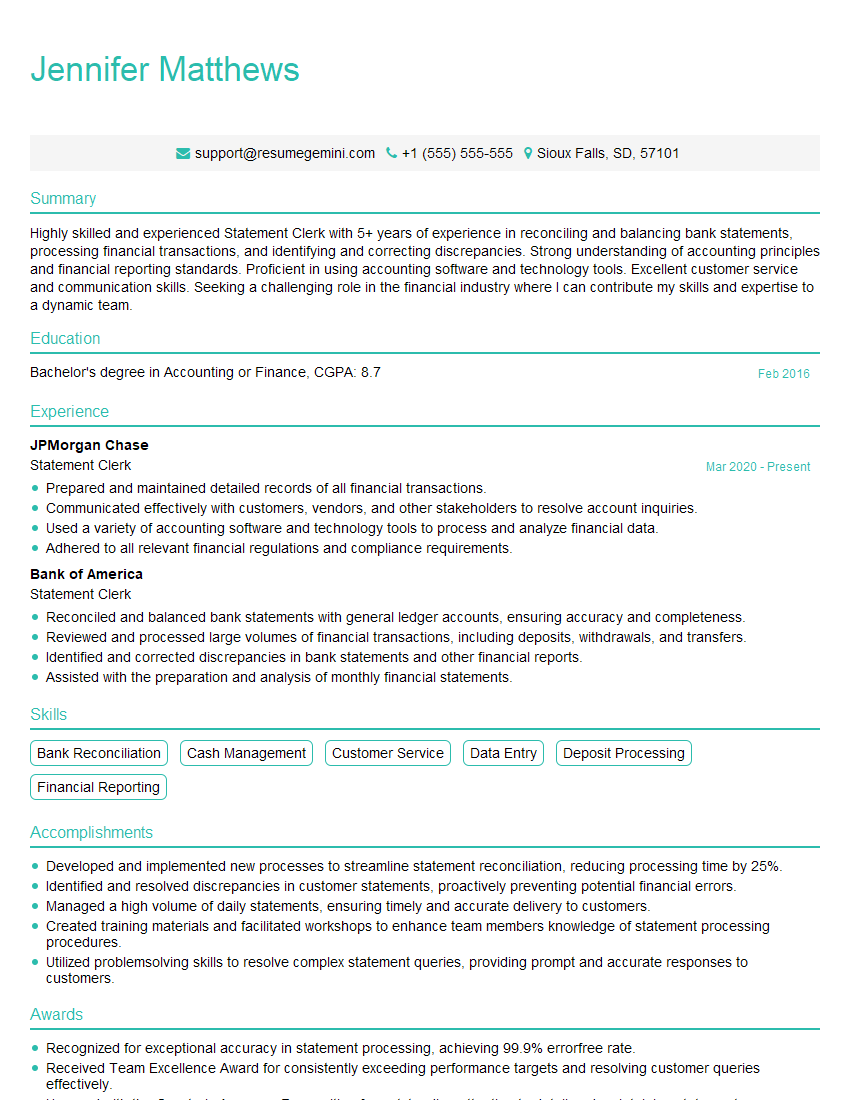

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Statement Clerk

1. What is the role of a Statement Clerk in a banking environment?

As a Statement Clerk, my primary responsibilities would include generating, processing, and reconciling bank statements for a wide range of customers.

- Preparing accurate and timely statements that reflect all transactions and account activity

- Monitoring and processing customer requests for statement copies or adjustments

2. What are the key technical skills and knowledge required for this role?

Statement Generation and Reconciliation:

- Expertise in statement preparation, including formatting, data extraction, and reconciliation

- Knowledge of banking regulations and compliance requirements related to statement accuracy

Customer Service:

- Strong communication and interpersonal skills for handling customer inquiries and resolving issues

- Ability to provide clear and concise explanations regarding statements and account activity

3. How do you ensure the accuracy and completeness of bank statements?

I follow a meticulous process to ensure statement accuracy:

- Cross-checking transactions with source documents and account records

- Performing reconciliation processes to identify and correct any discrepancies

- Adhering to internal control procedures and quality assurance measures

4. What software or systems are you familiar with for statement processing?

I am proficient in various statement processing software and systems, including:

- Banking core systems (e.g., Oracle FLEXCUBE, Fiserv Precision)

- Statement generation and reconciliation platforms (e.g., Adobe Acrobat, Microsoft Excel)

5. How do you handle customer inquiries or complaints regarding bank statements?

When handling customer inquiries, I prioritize the following steps:

- Actively listening to the customer’s concerns and gathering necessary information

- Thoroughly reviewing the statement and account records to identify the root cause of the issue

- Communicating clearly and empathetically to explain the findings and resolution

6. What are some common errors or challenges you have encountered in statement processing and how do you address them?

Some common challenges I have successfully addressed include:

- Identifying and correcting mismatched or duplicate transactions

- Resolving discrepancies between statement balances and account balances

- Working closely with other departments to obtain supporting documentation or investigate suspected fraudulent activity

7. How do you stay updated with changes in banking regulations and industry best practices?

To maintain my knowledge and expertise, I regularly engage in the following activities:

- Attending industry conferences and webinars

- Reading industry publications and regulatory updates

- Participating in training programs and certification courses

8. What are your strengths and how do they align with the requirements of this role?

My strengths that align well with the Statement Clerk position include:

- Exceptional accuracy and attention to detail

- Strong analytical and problem-solving abilities

- Excellent communication and interpersonal skills

9. Can you describe a situation where you had to handle a challenging customer and how you resolved it?

In a previous role, a customer disputed a large transaction on their statement. After thoroughly reviewing the account records and supporting documentation, I discovered that the transaction was legitimate and due to an automated payment the customer had forgotten about. I patiently explained the situation to the customer, providing evidence to support my findings. The customer ultimately understood the error and was satisfied with the resolution.

10. Why are you interested in working as a Statement Clerk in our bank?

I am eager to contribute my skills and experience to your esteemed bank. I believe that my technical expertise and customer-centric approach would make me a valuable asset to your team. Furthermore, I am particularly interested in the reputation of your bank for providing exceptional customer service, which aligns well with my own values and goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Statement Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Statement Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Statement Clerk is responsible for managing and processing financial statements for customers and clients of an organization. They play a key role in ensuring the accuracy, integrity, and timely delivery of statements, while maintaining excellent customer relationships.

1. Statement Generation and Distribution

The primary responsibility of a Statement Clerk is to generate and distribute financial statements to customers and clients. This involves extracting data from various sources, such as account balances, transaction records, and customer information, and compiling it into clear and concise statements. The statements may include monthly or quarterly summaries, transactional details, or other customized reports.

- Gather and verify data from multiple sources.

- Prepare and review statements for accuracy and completeness.

- Distribute statements through various channels, such as mail, email, and online platforms.

2. Customer Relationship Management

Statement Clerks serve as the primary point of contact for customers and clients regarding their financial statements. They respond to inquiries, resolve discrepancies, and provide guidance on statement interpretation and account management. Excellent communication and interpersonal skills are essential for building and maintaining positive customer relationships.

- Answer customer inquiries via phone, email, and written correspondence.

- Resolve issues related to statement accuracy and account balances.

- Provide guidance on statement understanding and financial management.

3. Reconciliation and Troubleshooting

Statement Clerks are responsible for reconciling statements with other financial records, such as account ledgers and transaction logs. This involves identifying and correcting any discrepancies or errors that may arise. They also troubleshoot account issues and work with other departments or external parties to resolve complex problems.

- Reconcile statements with account ledgers and transaction records.

- Investigate and resolve discrepancies and errors.

- Collaborate with other departments or external parties to resolve complex account issues.

4. Data Management and Security

Statement Clerks handle sensitive financial information and are responsible for protecting customer data. They implement and follow data security protocols to ensure the confidentiality and integrity of information, including secure storage, limited access, and regular audits.

- Implement and follow data security protocols.

- Maintain confidentiality of customer financial information.

- Participate in regular audits to ensure compliance.

Interview Tips

Preparing for an interview as a Statement Clerk requires a combination of technical knowledge, attention to detail, and customer service skills. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s profile, financial services offerings, and industry trends. Understand the company’s mission, values, and how the Statement Clerk role aligns with its objectives.

- Visit the company website.

- Read news and articles about the company and industry.

- Review the company’s social media pages.

2. Highlight Your Technical Skills

Emphasize your proficiency in financial statement preparation, data analysis, and reconciliation. Showcase your ability to handle large volumes of information accurately and efficiently. Highlight any experience or qualifications related to financial software, such as spreadsheets and accounting systems.

- Quantify your accomplishments with specific examples.

- Discuss your experience in handling financial data and statements.

- Mention any certifications or training you have in financial statement preparation.

3. Demonstrate Your Customer Service Skills

Interviewers will be interested in your customer-facing skills. Highlight your ability to communicate clearly and effectively, both verbally and in writing. Describe your experience in resolving customer inquiries and building positive relationships.

- Share examples of how you have resolved customer issues.

- Discuss your experience in working with customers in a professional and friendly manner.

- Emphasize your ability to handle challenges and maintain composure under pressure.

4. Practice Common Interview Questions

Prepare for common interview questions related to your experience, skills, and the Statement Clerk role. Practice answering these questions concisely and confidently. Consider using the STAR method (Situation, Task, Action, Result) to structure your responses.

- Tell me about your experience in financial statement preparation.

- Describe a time when you resolved a complex customer issue.

- How do you prioritize tasks and manage your workload in a fast-paced environment?

5. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally for the interview and arrive on time. This shows respect for the interviewer and demonstrates your attention to detail.

- Choose neutral colors and tailored clothing.

- Ensure your clothes are clean and pressed.

- Plan your route and allow ample time for travel.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Statement Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!