Feeling lost in a sea of interview questions? Landed that dream interview for Reconciliation Machine Operator but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Reconciliation Machine Operator interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

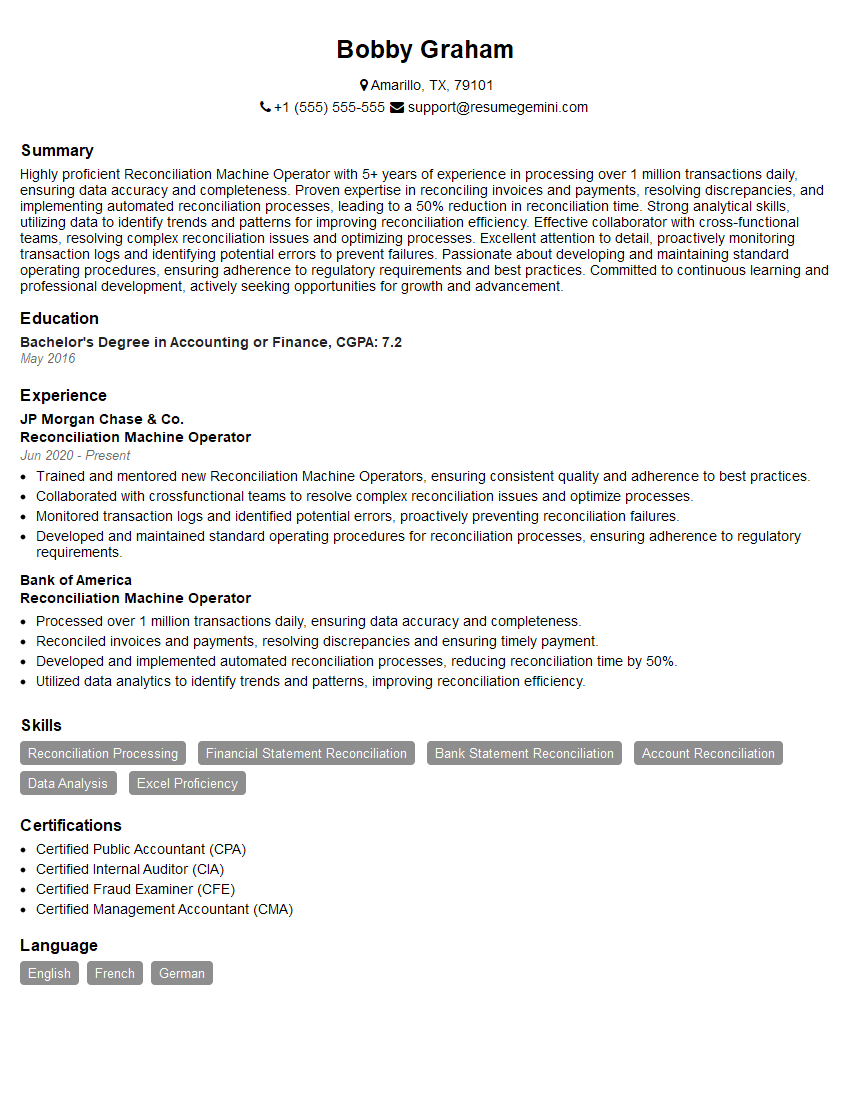

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Reconciliation Machine Operator

1. Describe the process of reconciling machine data with other data sources.

- Begin by gathering data from all relevant sources, including machines, sensors, and databases.

- Clean and prepare the data to ensure consistency and accuracy.

- Match and merge the data from different sources based on common identifiers.

- Identify and resolve any discrepancies between the data sources.

- Create a reconciled dataset that combines the data from all sources.

- Validate the reconciled dataset to ensure its completeness and accuracy.

2. What types of challenges have you faced in reconciling machine data?

Troubleshooting data quality issues

- Missing or incomplete data

- Inconsistent data formats

- Data errors and anomalies

Handling large volumes of data

- Data storage and processing limitations

- Slow performance and scalability issues

Dealing with data from multiple sources

- Data integration challenges

- Data governance and security concerns

3. How do you ensure the accuracy and reliability of reconciled data?

- Establish data quality standards and procedures.

- Use data validation techniques to identify and correct errors.

- Implement data governance policies to ensure data integrity.

- Regularly monitor and review reconciled data for anomalies.

- Seek feedback from users and stakeholders to validate data accuracy.

4. How do you prioritize and manage multiple reconciliation tasks?

- Determine the criticality and urgency of each task.

- Establish clear timelines and deadlines.

- Use a task management system to track progress and stay organized.

- Delegate responsibilities to team members when necessary.

- Communicate regularly with stakeholders to keep them informed.

5. Describe the tools and technologies you are proficient in for machine data reconciliation.

- Data integration tools (e.g., Informatica, Talend)

- Data quality tools (e.g., DataCleaner, Informatica Data Quality)

- Data analytics tools (e.g., Tableau, Power BI)

- Cloud-based data reconciliation platforms (e.g., AWS Glue, Azure Data Factory)

- Programming languages (e.g., Python, Java)

6. How do you stay up-to-date with the latest trends and best practices in machine data reconciliation?

- Attend industry conferences and webinars.

- Read technical articles and white papers.

- Network with other professionals in the field.

- Participate in online forums and discussion groups.

- Seek opportunities for professional development.

7. Describe a situation where you used your reconciliation skills to solve a complex business problem.

- Identified and resolved data inconsistencies that were preventing accurate reporting.

- Developed a data reconciliation process that automated tasks and improved efficiency.

- Used data reconciliation to gain insights into customer behavior and improve marketing campaigns.

- Collaborated with cross-functional teams to implement a data governance strategy that ensured data integrity.

8. How do you handle exceptions and errors during the reconciliation process?

- Identify and classify exceptions based on their severity and impact.

- Develop automated rules to handle common exceptions.

- Investigate and resolve complex exceptions manually.

- Communicate exceptions to stakeholders and provide clear explanations.

- Monitor and analyze exceptions to identify trends and improve the reconciliation process.

9. What are the key performance indicators (KPIs) you use to measure the effectiveness of your reconciliation efforts?

- Data completeness and accuracy

- Timeliness of reconciliation

- Number of exceptions and errors

- User satisfaction with reconciled data

- Impact on business decision-making

10. How do you ensure compliance with data privacy and security regulations in your reconciliation process?

- Implement data encryption and access controls.

- Follow data retention and disposal policies.

- Comply with industry standards and certifications (e.g., GDPR, ISO 27001).

- Conduct regular security audits and assessments.

- Train employees on data privacy and security best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Reconciliation Machine Operator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Reconciliation Machine Operator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Reconciliation Machine Operator is responsible for operating and maintaining reconciliation machines, which are used to match transactions and identify discrepancies in financial data. This ensures the accuracy and integrity of financial records and helps prevent fraud and errors.

1. Operating Reconciliation Machines

Operate reconciliation machines to compare data from multiple sources, such as bank statements, invoices, and purchase orders.

- Set up and calibrate reconciliation machines according to established procedures.

- Load data from various sources into the reconciliation machine.

- Monitor the reconciliation process for errors or discrepancies.

2. Identifying and Resolving Discrepancies

Identify and resolve discrepancies in financial data, such as incorrect account balances or missing transactions.

- Analyze data to locate and identify discrepancies.

- Research and gather additional information to resolve discrepancies.

- Document and report all resolved discrepancies to management.

3. Maintaining Reconciliation Machines

Maintain reconciliation machines by performing regular maintenance and repairs to ensure optimal performance.

- Clean and inspect reconciliation machines regularly.

- Perform basic repairs and troubleshooting on reconciliation machines.

- Order and replace parts as needed.

4. Compliance and Reporting

Adhere to company policies and procedures related to reconciliation and financial reporting.

- Follow established reconciliation procedures and guidelines.

- Prepare and maintain reconciliation reports for management and external auditors.

- Assist with internal and external audits related to reconciliation.

Interview Tips

To ace the interview for a Reconciliation Machine Operator position, here are some tips and preparation hacks:

1. Research the Company and Position

Thoroughly research the company you are applying to and the specific Reconciliation Machine Operator position. This will help you understand the company’s culture, values, and expectations for the role.

- Visit the company’s website and social media pages.

- Read industry news and articles about the company.

- Identify the skills and experience required for the position.

2. Practice Your Answers

“Practice makes perfect.” Take time to practice answering common interview questions related to reconciliation, data analysis, and problem-solving. This will help you develop clear and concise responses.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Provide specific examples of your skills and experience.

- Quantify your accomplishments whenever possible.

3. Highlight Your Attention to Detail

Reconciliation requires a high level of attention to detail. During the interview, emphasize your ability to focus on accuracy and identify even the smallest discrepancies.

- Describe situations where you successfully identified and resolved errors.

- Explain how you ensure data integrity and accuracy in your work.

- Share examples of your meticulous nature and commitment to quality.

4. Emphasize Your Technical Skills

Familiarity with reconciliation machines and related software is crucial. Highlight your proficiency in operating and maintaining these systems.

- List the specific reconciliation software and machines you have experience with.

- Describe your understanding of reconciliation processes and methodologies.

- Explain how you troubleshoot and resolve technical issues.

5. Dress Professionally and Arrive Early

First impressions matter. Dress professionally for the interview and arrive on time to show respect for the interviewer and the company.

- Choose business formal or business casual attire.

- Plan your route and allow extra time for unexpected delays.

- Be polite and respectful to everyone you meet.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Reconciliation Machine Operator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.