Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the General Agent interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a General Agent so you can tailor your answers to impress potential employers.

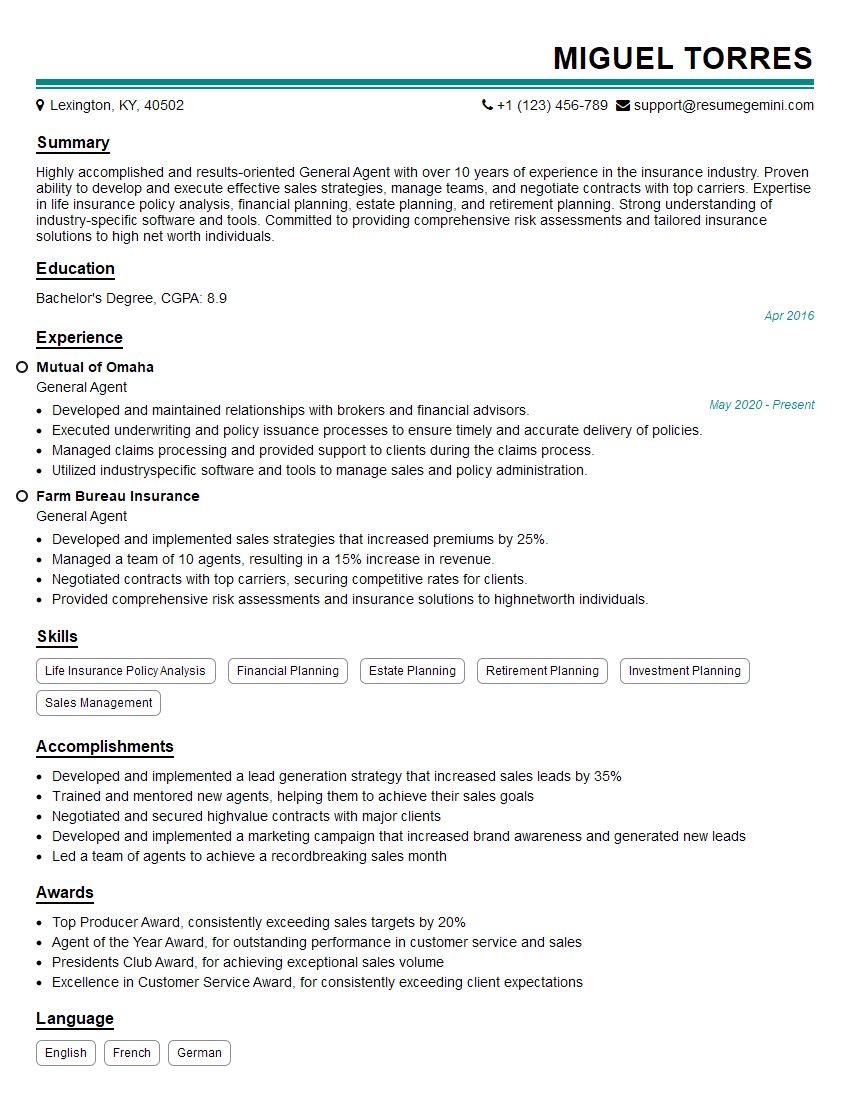

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For General Agent

1. What is the role of a General Agent in the insurance industry?

As a General Agent, my primary responsibility is to represent insurance companies and distribute their products to individuals and businesses within a specific territory. I act as an intermediary between the insurance carriers and their customers, providing guidance, support, and access to a wide range of insurance policies.

- Developing and maintaining relationships with insurance companies

- Analyzing client needs and recommending appropriate insurance solutions

- Underwriting, issuing, and servicing insurance policies

- Providing ongoing support and claims assistance to policyholders

2. How do you stay up-to-date on the latest insurance products and regulations?

Continuing Education

- Attending industry conferences and workshops

- Taking online courses and webinars

- Reading industry publications and trade journals

Networking and Collaboration

- Participating in professional organizations

- Connecting with other General Agents

- Seeking mentorship from experienced professionals

3. Can you describe your approach to developing and maintaining strong relationships with insurance carriers?

Building and maintaining strong relationships with insurance carriers is crucial to my success as a General Agent. I prioritize the following strategies:

- Regular Communication: Maintaining open and consistent communication channels with carrier representatives.

- Understanding Carrier Needs: Thoroughly understanding each carrier’s underwriting guidelines, product offerings, and customer service standards.

- Support and Advocacy: Providing proactive support to carriers by representing their interests to clients and resolving issues efficiently.

- Performance and Feedback: Continuously tracking and evaluating performance metrics, and providing feedback to carriers to enhance collaboration.

4. How do you evaluate and select the most appropriate insurance products for your clients?

To ensure that my clients receive the most suitable insurance coverage, I follow a comprehensive evaluation process:

- Needs Assessment: Conducting thorough needs assessments to identify clients’ unique risk exposures and financial objectives.

- Market Research: Researching and comparing different insurance products from multiple carriers to find the best fit.

- Comparative Analysis: Analyzing policies based on coverage, premiums, deductibles, and other relevant factors.

- Client Education: Clearly explaining the benefits, limitations, and exclusions of each policy to empower clients to make informed decisions.

5. How do you underwrite and issue insurance policies?

My underwriting process involves:

- Risk Assessment: Evaluating the client’s risk profile based on factors such as age, health, occupation, and lifestyle.

- Policy Selection: Determining the appropriate policy type and coverage limits based on the risk assessment.

- Premium Calculation: Calculating the premium amount based on the policy selected and the client’s risk factors.

- Policy Issuance: Preparing and issuing the insurance policy, ensuring accuracy and compliance with carrier guidelines.

6. Describe your experience in servicing and managing insurance policies.

I provide ongoing support and policy management services to my clients, including:

- Policy Maintenance: Updating policies based on changes in clients’ circumstances or carrier updates.

- Endorsement Processing: Facilitating endorsements to modify or add coverage to existing policies.

- Claims Assistance: Assisting clients in filing and managing insurance claims promptly and efficiently.

- Premium Collection and Billing: Managing premium payments, issuing invoices, and resolving billing inquiries.

7. How do you stay organized and manage multiple clients and policies?

I utilize a combination of technology and organizational strategies to manage my workload:

- CRM System: Using a customer relationship management (CRM) system to track client information, policies, and interactions.

- Calendar Management: Scheduling appointments, deadlines, and follow-ups effectively.

- File Organization: Maintaining organized digital and physical files for each client and policy.

- Delegation: Delegating administrative tasks to support staff to enhance efficiency and focus on client-facing activities.

8. How do you handle objections and concerns from clients?

When addressing client objections and concerns, I follow these steps:

- Active Listening: Listening attentively to the client’s concerns and validating their feelings.

- Problem Identification: Clearly identifying the root cause of the objection or concern.

- Solution Presentation: Presenting tailored solutions that address the client’s specific needs and concerns.

- Benefits Explanation: Explaining the benefits and value of the proposed solutions.

- Reassurance: Providing reassurance and support to build trust and confidence.

9. How do you measure your success as a General Agent?

- Client Retention: Maintaining a high client retention rate demonstrates the quality of service and customer satisfaction.

- Sales Volume: Consistently exceeding sales targets indicates strong production and revenue generation.

- Carrier Relationships: Building and maintaining strong relationships with multiple carriers ensures access to diverse insurance products and support.

- Industry Recognition: Receiving awards or recognition from industry organizations highlights exceptional performance.

- Client Feedback: Positive client testimonials and referrals indicate a high level of satisfaction and trust.

10. What are the ethical considerations you prioritize as a General Agent?

- Client Confidentiality: Maintaining strict confidentiality of client information and respecting their privacy.

- Fair Treatment: Treating all clients fairly and equitably, regardless of their background or circumstances.

- Transparency: Providing clear and transparent communication to clients about insurance products, fees, and policies.

- Avoiding Conflict of Interest: Disclosing any potential conflicts of interest and acting in the best interests of clients.

- Compliance: Adhering to all applicable laws, regulations, and industry standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for General Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the General Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A General Agent is a critical role within the insurance industry, responsible for managing a team of insurance agents and overseeing the sales and distribution of insurance products. Their primary duties include:

1. Sales Management

General Agents are tasked with leading and motivating a team of insurance agents. They set sales targets, provide training and support, and track agent performance to ensure the team meets its goals.

- Recruiting, hiring, and training new agents

- Establishing sales goals and developing strategies to achieve them

- Monitoring agent performance and providing feedback

2. Product Development and Distribution

General Agents work closely with insurance companies to develop and distribute insurance products that meet the needs of the target market. They are responsible for ensuring that products are compliant with regulations and that agents are properly trained on the products they sell.

- Identifying market opportunities and developing new products

- Working with insurance companies to negotiate contracts and pricing

- Distributing products to agents and ensuring they have the necessary training and support

3. Customer Service and Claims Processing

General Agents are responsible for providing excellent customer service to policyholders. They handle inquiries, complaints, and claims, and work to resolve issues promptly and efficiently.

- Answering customer inquiries and providing policy information

- Processing claims and ensuring timely payments

- Resolving customer complaints and maintaining positive relationships

4. Compliance and Regulatory Oversight

General Agents must be knowledgeable about insurance regulations and compliance requirements. They are responsible for ensuring that their agents operate ethically and professionally, and that all sales and claims activities are in compliance with applicable laws and regulations.

- Staying up-to-date on insurance regulations and compliance requirements

- Monitoring agent activities to ensure compliance

- Reporting any non-compliance issues to the insurance company

Interview Tips

To ace an interview for a General Agent position, candidates should prepare thoroughly and showcase their skills and experience in the following areas:

1. Knowledge of the Insurance Industry

Candidates should have a strong understanding of the insurance industry, including different types of insurance products, industry regulations, and market trends. They should be able to articulate their knowledge clearly and demonstrate how it would benefit the organization.

- Research the insurance industry and the specific company you are interviewing with

- Be prepared to discuss your knowledge of different types of insurance products and regulations

- Share examples of how your industry knowledge has helped you succeed in previous roles

2. Sales and Leadership Skills

General Agents need to be strong leaders and motivators. They should have a proven track record of success in sales and be able to build and maintain strong relationships with agents and clients. Candidates should highlight their sales and leadership skills in the interview.

- Provide specific examples of your sales accomplishments and how you achieved them

- Describe your leadership style and how you motivate and inspire others

- Share examples of how you have built and maintained strong relationships with clients and colleagues

3. Customer Service Orientation

General Agents must be able to provide excellent customer service. They should be empathetic, patient, and have a strong problem-solving ability. Candidates should emphasize their customer service skills in the interview.

- Share examples of how you have provided excellent customer service in previous roles

- Describe your approach to resolving customer complaints and issues

- Highlight your empathy, patience, and problem-solving skills

4. Compliance and Regulatory Knowledge

General Agents must be knowledgeable about insurance regulations and compliance requirements. They should be able to demonstrate their understanding of these requirements and how they would ensure compliance within their team.

- Research the insurance regulations and compliance requirements that apply to the role

- Describe your understanding of these requirements and how you would ensure compliance

- Share examples of how you have ensured compliance in previous roles

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the General Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!