Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Cost Recorder position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

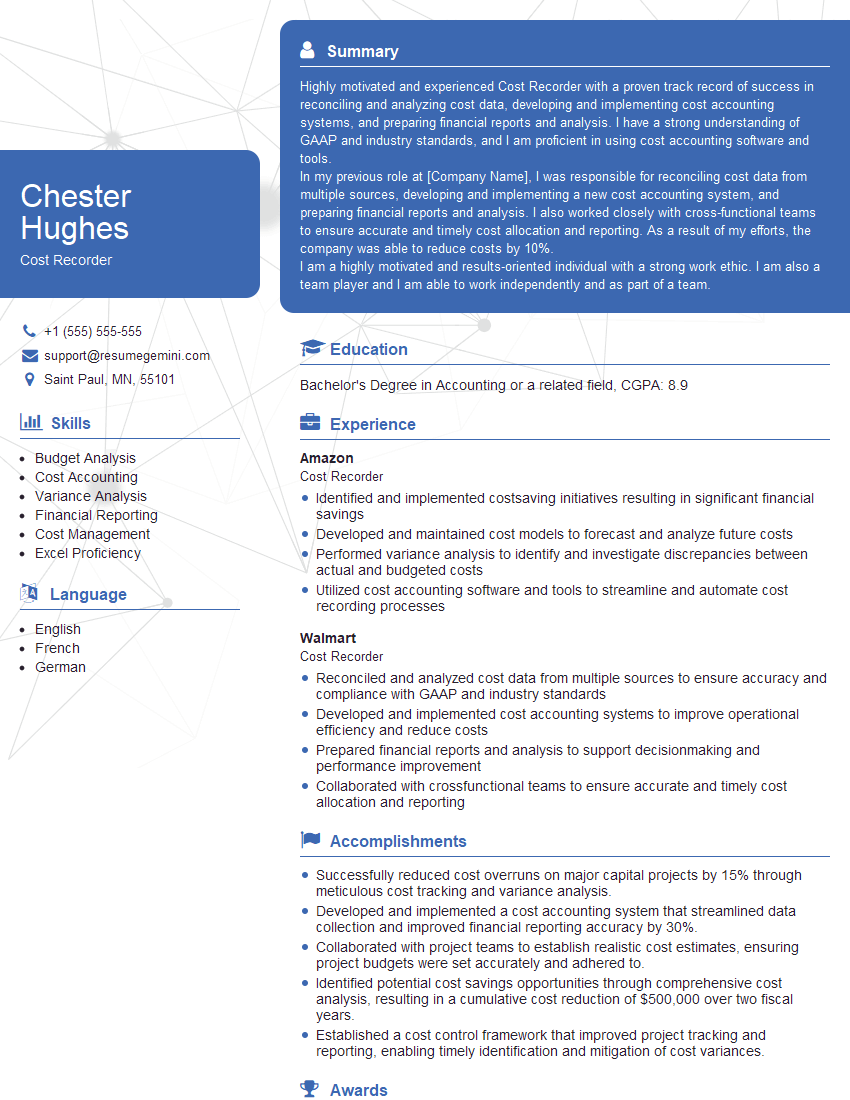

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cost Recorder

1. Can you explain the fundamental principles of cost accounting, specifically focusing on cost behavior, classification, and allocation?

Cost accounting principles provide a framework for recording, classifying, and analyzing costs to determine their impact on a business’s financial performance. Here are the key principles:

- Cost behavior: Costs are classified as variable, fixed, or semi-variable based on their relationship with changes in activity levels. Variable costs change in proportion to activity, while fixed costs remain constant within a relevant range of activity. Semi-variable costs have both fixed and variable components.

- Cost classification: Costs are categorized according to their nature (e.g., direct vs. indirect) or function (e.g., manufacturing vs. administrative). Direct costs can be traced directly to a specific cost object, while indirect costs cannot be easily assigned to a particular cost object.

- Cost allocation: Indirect costs are allocated to cost objects using various methods, such as the activity-based costing (ABC) method. The allocation method should be appropriate for the nature of the cost and the cost object.

2. Describe your experience in using cost accounting software to manage cost data.

Specific Software Knowledge

- Proficient in using industry-standard cost accounting software, such as SAP, Oracle E-Business Suite, or Microsoft Dynamics NAV.

- Demonstrated ability to navigate the software, input data, generate reports, and analyze cost information.

- Understanding of software modules related to cost accounting, such as general ledger, accounts payable, and cost centers.

Data Management

- Experience in managing large volumes of cost data, ensuring accuracy and completeness.

- Ability to identify and correct data errors or inconsistencies.

- Understanding of data security and confidentiality protocols.

3. How do you ensure the accuracy and reliability of cost data?

- Adhering to established accounting standards and guidelines (e.g., GAAP, IFRS).

- Implementing data validation and verification procedures.

- Regularly reconciling cost data with other financial records.

- Conducting internal audits to ensure compliance and accuracy.

- Seeking feedback from key stakeholders to identify potential errors or discrepancies.

4. Explain the process of preparing cost reports and how you ensure that they are informative and useful for decision-making.

- Data collection: Gathering relevant cost data from various sources, such as accounting systems, production records, and time sheets.

- Data analysis: Analyzing cost data to identify trends, patterns, and areas of concern.

- Report design: Designing reports that are clear, concise, and tailored to the needs of specific users.

- Report distribution: Distributing reports to relevant stakeholders in a timely manner.

- Feedback and evaluation: Seeking feedback on the usefulness of reports and making adjustments as necessary.

5. How do you use cost accounting information to make informed decisions about pricing, product mix, and process improvement?

- Pricing: Determining appropriate pricing strategies based on cost analysis, including target profit margins and competitive market conditions.

- Product mix: Analyzing cost data to identify profitable products and optimize product offerings.

- Process improvement: Identifying areas for cost reduction and efficiency improvements by analyzing production processes and identifying bottlenecks.

6. Describe your experience in developing and implementing cost control systems.

- Budgeting: Establishing cost budgets and monitoring actual costs against the budget.

- Variance analysis: Identifying and analyzing deviations from budgeted costs.

- Cost reduction initiatives: Developing and implementing strategies to reduce costs, such as negotiation with vendors and process optimization.

- Performance evaluation: Monitoring cost performance and evaluating the effectiveness of cost control measures.

7. How do you stay up-to-date on the latest cost accounting practices and industry trends?

- Attending industry conferences and seminars.

- Reading professional journals and publications.

- Participating in online forums and discussion groups.

- Seeking continuing education opportunities, such as certifications or workshops.

8. Explain the concept of activity-based costing (ABC) and its benefits.

Activity-based costing (ABC) is a cost accounting method that assigns costs to activities and then to cost objects based on the resources consumed by each activity. The benefits of ABC include:

- Improved cost accuracy: ABC provides more accurate cost information by considering the specific activities that drive costs.

- Better decision-making: ABC helps managers understand the cost structure of their products and services, leading to better decisions about pricing, product design, and process improvement.

- Enhanced operational efficiency: ABC can identify non-value-added activities and inefficiencies, allowing for targeted improvements.

9. Describe the role of cost accounting in strategic planning.

- Providing insights into the cost structure of the business, enabling informed strategic decisions.

- Identifying opportunities for cost reduction and efficiency improvements.

- Supporting the development of cost-effective strategies for growth and expansion.

- Evaluating the financial implications of strategic initiatives.

10. Can you share an example of a successful cost accounting implementation that you have been involved in?

In a previous role, I was part of a team that implemented an activity-based costing system for a manufacturing company. The implementation involved gathering detailed data on activities and their resource consumption, developing cost pools, and allocating costs to products and services using ABC methodology. The successful implementation resulted in improved cost accuracy, better decision-making, and significant cost savings for the company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cost Recorder.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cost Recorder‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cost Recorders play a vital role by accurately recording and analyzing cost data within an organization, providing valuable insights that contribute towards informed decision-making. Their key job responsibilities include:

1. Data Collection and Recording

Thoroughly collect cost-related data from various sources, such as invoices, purchase orders, time sheets, and expense reports.

- Ensure accuracy and completeness of data entry.

- Maintain detailed records of all cost transactions.

2. Cost Analysis

Analyze collected cost data to identify trends, patterns, and anomalies.

- Develop reports and presentations to communicate cost analysis findings.

- Provide insights and recommendations for cost optimization.

3. Budget Monitoring

Track actual costs against established budgets and identify deviations.

- Prepare variance reports to highlight areas of overspending or underspending.

- Monitor project budgets and provide timely alerts for potential overruns.

4. Compliance and Reporting

Ensure compliance with internal cost accounting policies and external regulations.

- Prepare financial reports for internal and external stakeholders.

- Maintain accurate and auditable cost records.

Interview Tips

Preparing thoroughly for a Cost Recorder interview is crucial to showcase your qualifications and make a positive impression. Here are some tips and hacks to help you ace the interview:

1. Research the Company

Familiarize yourself with the company’s industry, business model, and financial performance. This knowledge will demonstrate your interest and prepare you to answer questions about the company’s cost management practices.

- Visit the company’s website and review their annual reports.

- Read industry news and articles to gain insights into their market position.

2. Practice Your Answers

Prepare for common interview questions related to your experience in cost recording and analysis. Practice your answers to articulate your skills and knowledge effectively.

- Consider the STAR method (Situation, Task, Action, Result) to structure your answers.

- Use specific examples from your past experiences to highlight your abilities.

3. Highlight Your Analytical Skills

Emphasize your ability to analyze cost data, identify trends, and draw meaningful conclusions. Showcase your proficiency in using analytical tools and techniques.

- Share examples where you used data analysis to improve cost efficiency or reduce expenses.

- Demonstrate your understanding of cost accounting principles and their application.

4. Showcase Your Communication Skills

Effective communication is essential for Cost Recorders. Practice presenting your findings and recommendations clearly and persuasively.

- Prepare examples of reports or presentations you have delivered in previous roles.

- Highlight your ability to communicate complex financial information in a straightforward manner.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Cost Recorder interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!