Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Policy Value Calculator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

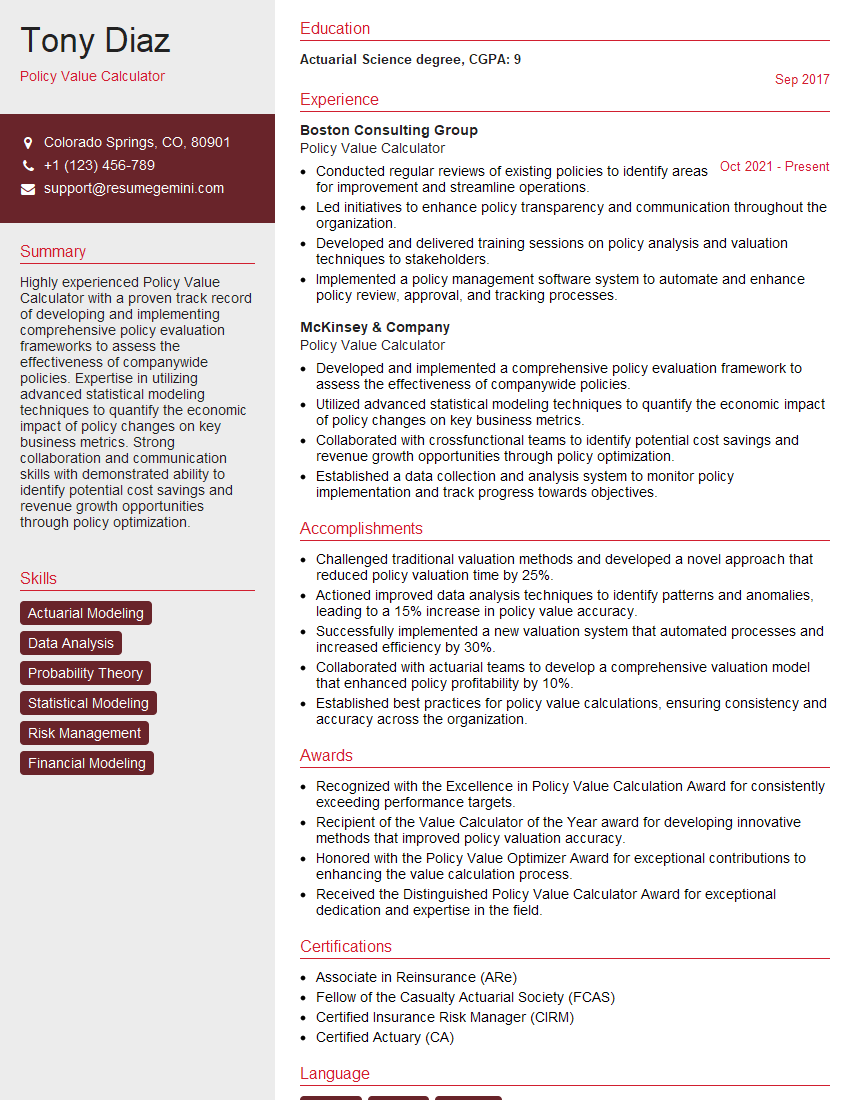

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Policy Value Calculator

1. How do you calculate the policy value of a life insurance policy?

To calculate the policy value of a life insurance policy, I would first need to gather information about the policy, such as the face amount, the premiums paid, the policy term, and the current interest rate. I would then use the following formula:

- Policy Value = Face Amount * (1 + Interest Rate)^Policy Term – Premiums Paid

2. What are the different factors that can affect the policy value of a life insurance policy?

Factors that can affect the policy value of a life insurance policy include:

- The face amount of the policy

- The policy term

- The interest rate

- The premiums paid

- The health and age of the insured

Riders and endorsements

- The type of policy (e.g., whole life, term life, universal life)

- Any riders or endorsements that have been added to the policy

3. How can policyholders increase the policy value of their life insurance policies?

Policyholders can increase the policy value of their life insurance policies by:

- Paying higher premiums

- Choosing a longer policy term

- Investing the policy’s cash value in a higher-yield investment

- Adding riders or endorsements to the policy that increase the death benefit or provide additional benefits

4. What are the different ways that policyholders can access the policy value of their life insurance policies?

Policyholders can access the policy value of their life insurance policies through:

- Policy loans

- Partial withdrawals

- Surrenders

5. What are the advantages and disadvantages of accessing the policy value of a life insurance policy?

Advantages of accessing the policy value of a life insurance policy include:

- Provides access to cash without having to surrender the policy

- Can be used for a variety of purposes, such as paying for education, medical expenses, or retirement

- Does not affect the death benefit of the policy

Disadvantages of accessing the policy value of a life insurance policy include:

- Can reduce the policy’s cash value and death benefit

- May incur fees or interest charges

- May affect the policy’s tax treatment

6. What are some of the ethical considerations that policy value calculators should be aware of?

Policy value calculators should be aware of the following ethical considerations:

- The need to provide accurate and unbiased information to policyholders

- The importance of avoiding conflicts of interest

- The need to respect the privacy of policyholders

- The importance of following all applicable laws and regulations

7. What are the different types of policy value calculators that are available?

There are two main types of policy value calculators:

- Basic policy value calculators: These calculators simply calculate the policy value based on the information provided by the policyholder. They do not take into account any additional factors, such as the policyholder’s health or the type of policy.

- Advanced policy value calculators: These calculators take into account a variety of factors, such as the policyholder’s health, the type of policy, and the current interest rate. They can provide a more accurate estimate of the policy value.

8. What are the advantages and disadvantages of using a policy value calculator?

Advantages of using a policy value calculator include:

- Can help policyholders understand the value of their policies

- Can help policyholders make informed decisions about how to use their policies

- Can help policyholders avoid making costly mistakes

Disadvantages of using a policy value calculator include:

- Can be complex and difficult to use

- May not be accurate in all cases

- Can be biased towards certain types of policies

9. How can policyholders choose the right policy value calculator for their needs?

When choosing a policy value calculator, policyholders should consider the following factors:

- The type of policy: Some calculators are designed for specific types of policies, such as whole life or term life policies.

- The accuracy of the calculator: Policyholders should look for calculators that have been developed by reputable sources and that have been shown to be accurate.

- The ease of use: Policyholders should choose a calculator that is easy to use and understand.

- The cost of the calculator: Some calculators are free to use, while others require a subscription fee.

10. What are some of the common mistakes that policyholders make when using policy value calculators?

Some of the common mistakes that policyholders make when using policy value calculators include:

- Not providing accurate information: Policyholders should be sure to provide accurate information about their policies when using a calculator.

- Not understanding the results: Policyholders should take the time to understand the results of the calculator and what they mean for their policy.

- Making decisions based on the results of the calculator without consulting with a financial advisor: Policyholders should consult with a financial advisor before making any decisions about their policies based on the results of a calculator.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Policy Value Calculator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Policy Value Calculator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Policy Value Calculator is responsible for developing and maintaining actuarial models to calculate policy values, premiums, and reserves. They work closely with underwriters, product managers, and other stakeholders to ensure that the models are accurate and reliable.

1. Develop and maintain actuarial models to calculate policy values, premiums, and reserves.

Actuarial models are complex mathematical formulas used to calculate the financial value of insurance policies. Policy Value Calculators must have a strong understanding of actuarial science and be able to apply these models to a variety of insurance products.

- Develop and maintain actuarial models to calculate policy values, premiums, and reserves.

- Calibrate and validate models using historical data and industry benchmarks.

- Document and explain model assumptions and methodologies.

2. Work closely with underwriters, product managers, and other stakeholders to ensure that the models are accurate and reliable.

Policy Value Calculators must work closely with other departments within the insurance company to ensure that the models are meeting the needs of the business. They must be able to communicate complex technical information to non-technical stakeholders.

- Work with underwriters to understand the underwriting risk associated with different types of policies.

- Work with product managers to develop new insurance products and to price those products competitively.

- Work with other stakeholders, such as accountants and auditors, to ensure that the models are compliant with regulatory requirements.

3. Stay up-to-date on the latest actuarial trends and best practices.

The actuarial field is constantly evolving, so Policy Value Calculators must stay up-to-date on the latest trends and best practices. They should attend conferences, read industry publications, and network with other actuaries.

- Attend actuarial conferences and seminars.

- Read industry publications and research papers.

- Network with other actuaries.

4. Possess strong communication and interpersonal skills.

Policy Value Calculators must be able to communicate complex technical information to a variety of audiences. They must also be able to work effectively with others in a team environment.

- Communicate complex technical information to non-technical stakeholders.

- Work effectively with others in a team environment.

- Present findings and recommendations to senior management.

Interview Tips

Preparing for an interview for a Policy Value Calculator position can be daunting, but there are a few things you can do to increase your chances of success. Here are a few tips:

1. Research the company and the position.

This will help you to understand the company’s culture and the specific requirements of the position. You should also research the actuarial field and the latest trends and best practices.

- Visit the company’s website and read their annual report.

- Read industry publications and research papers.

- Network with other actuaries.

2. Practice your answers to common interview questions.

Here are a few common interview questions that you may be asked:

- Tell me about your experience with actuarial modeling.

- How do you stay up-to-date on the latest actuarial trends and best practices?

- What are your strengths and weaknesses as an actuary?

- Why are you interested in working for this company?

You can prepare for these questions by practicing your answers in front of a mirror or with a friend. You should also be prepared to discuss your experience and qualifications in detail.

3. Dress professionally and arrive on time for your interview.

First impressions matter, so it is important to dress professionally and arrive on time for your interview. You should also be polite and respectful to everyone you meet.

- Dress in a suit or business casual attire.

- Arrive on time for your interview.

- Be polite and respectful to everyone you meet.

4. Be yourself and be confident.

The most important thing is to be yourself and be confident in your abilities. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just be yourself and let your personality shine through.

- Be yourself and be confident in your abilities.

- Don’t try to be someone you’re not.

- Let your personality shine through.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Policy Value Calculator, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Policy Value Calculator positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.