Are you gearing up for a career in Accounting Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounting Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

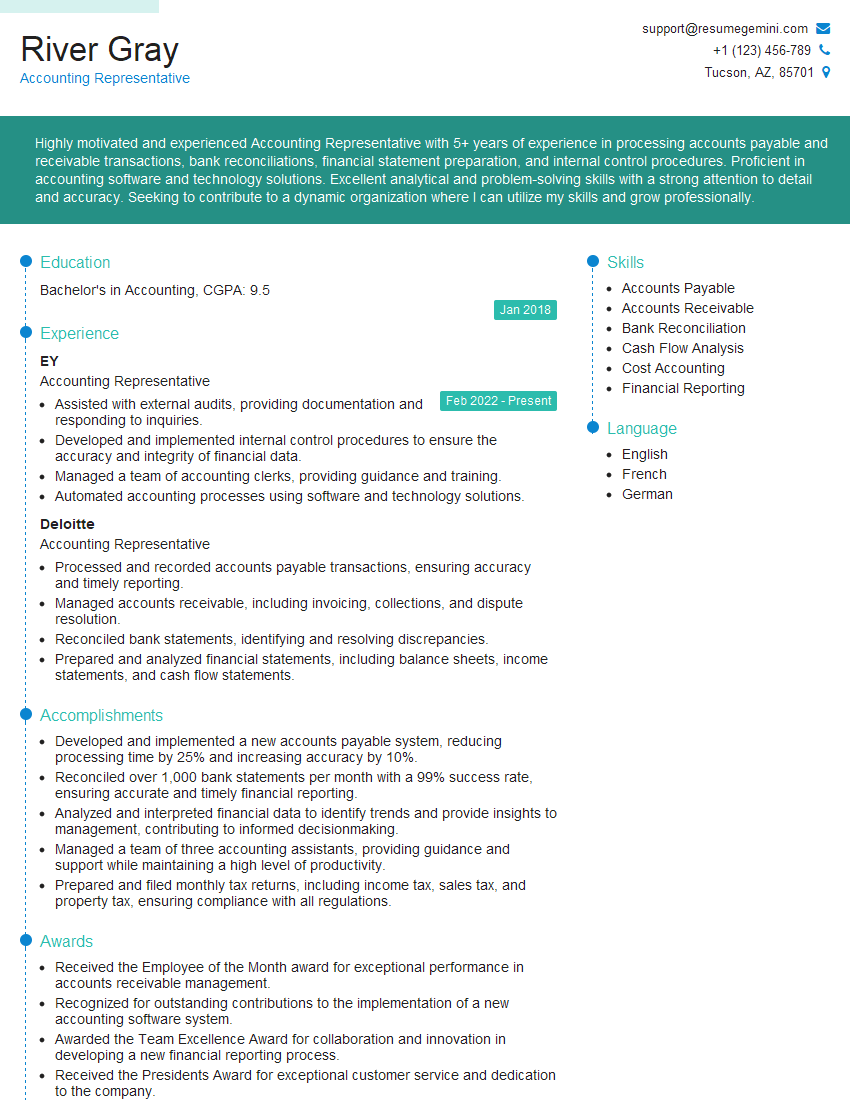

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Representative

1. What is the difference between an asset and a liability?

An asset is a resource that is owned by a company and has a future economic value, while a liability is a debt or obligation that a company owes to another entity. Assets are listed on the balance sheet as debits, while liabilities are listed as credits.

- Assets: Cash, accounts receivable, inventory, property, plant and equipment

- Liabilities: Accounts payable, notes payable, loans, bonds, deferred revenue

2. What are the different types of financial statements?

- Balance sheet: A snapshot of a company’s financial health at a specific point in time, showing its assets, liabilities, and equity.

- Income statement: A report of a company’s financial performance over a period of time, showing its revenues, expenses, and net income.

- Statement of cash flows: A report of a company’s cash inflows and outflows over a period of time.

3. What are the key accounting principles?

- Accrual accounting: Transactions are recorded when they occur, regardless of when cash is received or paid.

- Going concern: The company is assumed to be a going concern, meaning it will continue to operate in the foreseeable future.

- Matching principle: Expenses are matched to the revenues they generate.

- Materiality: Only information that is material to the financial statements is disclosed.

4. What is the difference between a debit and a credit?

- Debit: An entry on the left side of an accounting equation that increases an asset or expense account or decreases a liability or equity account.

- Credit: An entry on the right side of an accounting equation that increases a liability or equity account or decreases an asset or expense account.

5. What is the purpose of a general ledger?

A general ledger is a collection of all the accounts used by a company to track its financial transactions. It is used to record all of the company’s debits and credits, and it provides a comprehensive view of the company’s financial position.

6. What are the different types of accounts receivable?

- Accounts receivable: The amount of money owed to a company by its customers.

- Notes receivable: A written promise to pay a sum of money on a specific date.

- Loans receivable: A loan that a company has made to another entity.

7. What are the different types of accounts payable?

- Accounts payable: The amount of money that a company owes to its suppliers.

- Notes payable: A written promise to pay a sum of money on a specific date.

- Bonds payable: A long-term debt that a company has issued to investors.

8. What are the different methods of depreciation?

- Straight-line depreciation: The cost of an asset is spread evenly over its useful life.

- Declining-balance depreciation: The cost of an asset is depreciated at a faster rate in the early years of its useful life.

- Units-of-production depreciation: The cost of an asset is depreciated based on the number of units produced.

9. What are the different types of inventory costing methods?

- First-in, first-out (FIFO): The oldest inventory is sold first.

- Last-in, first-out (LIFO): The newest inventory is sold first.

- Weighted average cost: The average cost of all inventory on hand is used to calculate the cost of goods sold.

10. What are the different types of financial ratios?

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations.

- Solvency ratios: Measure a company’s ability to meet its long-term obligations.

- Profitability ratios: Measure a company’s ability to generate profits.

- Efficiency ratios: Measure a company’s efficiency in using its assets and resources.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Accounting Representative is responsible for maintaining the accuracy and integrity of financial records, ensuring compliance with accounting standards and regulations, and providing financial support to various departments within the organization.

1. Accounts Payable

Process and record vendor invoices, reconcile bank statements, and prepare and issue payments.

2. Accounts Receivable

Manage customer accounts, issue invoices, track payments, and resolve billing issues.

3. General Ledger

Maintain the general ledger, record financial transactions, and prepare financial statements.

4. Financial Reporting

Analyze financial data, prepare reports, and provide financial insights to management.

Interview Preparation Tips

To ace the interview for an Accounting Representative position, candidates should follow these tips and prepare accordingly.

1. Research the Company and Position

Thoroughly research the company’s website, financial reports, and industry news to gain insights into its operations, financial performance, and industry trends.

2. Practice Accounting Concepts

Review basic accounting principles, including debits, credits, and financial statement analysis. Solve practice problems or take online quizzes to enhance your understanding.

3. Highlight Relevant Experience

Emphasize your experience in handling accounts payable, receivable, or general ledger responsibilities. Quantify your accomplishments with specific metrics, such as the number of invoices processed or accuracy rates.

4. Showcase Technology Proficiency

Highlight your proficiency in accounting software packages, such as QuickBooks, NetSuite, or Oracle. Demonstrate your ability to use these tools efficiently for data entry, reporting, and financial analysis.

5. Prepare for Behavioral Questions

Be prepared to answer questions about your communication, teamwork, and problem-solving skills. Use the STAR method (Situation, Task, Action, Result) to structure your responses and provide specific examples of your abilities.

6. Dress Professionally and Arrive Punctually

Make a good first impression by dressing appropriately and arriving on time for the interview. Your appearance and punctuality reflect your professionalism and respect for the hiring team.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accounting Representative role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.