Are you gearing up for an interview for a Audit Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Audit Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

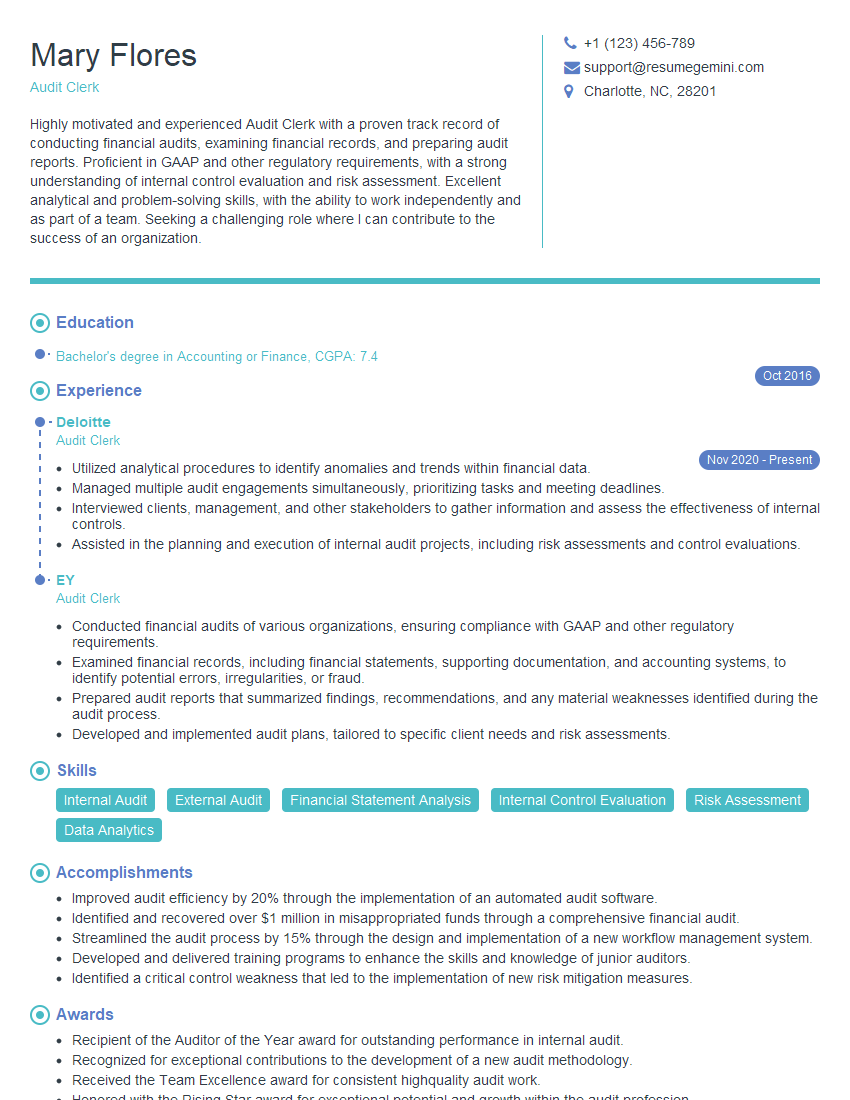

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Audit Clerk

1. Explain the key steps involved in performing an audit of a company’s cash and bank balances?

- Obtain a bank reconciliation from the client.

- Compare the bank reconciliation to the company’s books.

- Investigate any differences between the bank reconciliation and the company’s books.

- Perform analytical procedures on the cash and bank balances.

- Issue an audit report on the cash and bank balances.

2. Describe the role of an Audit Clerk in the audit process?

- Assists the auditor in planning and executing the audit.

- Performs audit procedures such as vouching, analytical procedures, and testing internal controls.

- Prepares audit working papers and other documentation.

- Communicates with clients and other members of the audit team.

- Helps to ensure that the audit is conducted in accordance with professional standards.

3. What are the key audit procedures that an Audit Clerk might perform when auditing a company’s accounts payable?

- Vouch a sample of invoices to supporting documentation such as purchase orders and receiving reports.

- Perform analytical procedures on the accounts payable balance, such as comparing it to prior periods and industry averages.

- Test the cutoff of accounts payable by examining transactions around the balance sheet date.

- Review the adequacy of the company’s internal controls over accounts payable.

- Prepare audit working papers and other documentation to support the audit.

4. How would you approach an audit of a company’s inventory?

- Obtain an understanding of the company’s inventory system.

- Perform analytical procedures on the inventory balances.

- Observe the physical inventory count.

- Test the cutoff of inventory by examining transactions around the balance sheet date.

- Review the adequacy of the company’s internal controls over inventory.

5. What are the most common types of audit adjustments that you have encountered in your experience?

- Adjustments to correct errors in the financial statements.

- Adjustments to reflect changes in accounting policies.

- Adjustments to reflect the results of subsequent events.

- Adjustments to reflect the effects of misstatements.

- Adjustments to reflect the effects of fraud.

6. How do you stay up-to-date on the latest auditing standards and developments?

- Attending continuing education courses.

- Reading professional journals and publications.

- Participating in online forums and discussion groups.

- Networking with other auditors.

- Staying informed about the latest news and developments in the auditing profession.

7. What are your strengths and weaknesses as an Audit Clerk?

strengths

- I am a highly motivated and results-oriented individual.

- I have a strong understanding of auditing standards and procedures.

- I am proficient in the use of audit software.

- I am able to work independently and as part of a team.

- I am able to meet deadlines and work under pressure.

weaknesses

- I am relatively new to the auditing profession.

- I do not have any experience in auditing large or complex companies.

- I am not yet a CPA.

8. Why are you interested in working as an Audit Clerk for our firm?

- I am interested in working for your firm because it is a reputable and well-respected auditing firm.

- I believe that my skills and experience would be a valuable asset to your firm.

- I am eager to learn and grow as an auditor and I believe that your firm would provide me with the opportunity to do so.

- I am confident that I can make a significant contribution to your firm.

9. What are your salary expectations?

- My salary expectations are in line with the market rate for Audit Clerks with my level of experience.

- I am willing to negotiate my salary based on the firm’s budget and the responsibilities of the position.

10. Do you have any questions for me?

- What is the firm’s culture like?

- What are the opportunities for advancement within the firm?

- What is the firm’s commitment to training and development?

- What are the firm’s clients like?

- What is the firm’s busiest season?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Audit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Audit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Audit Clerk plays a vital role in the accounting and auditing department. Their primary duty is to assist Senior Auditors by performing various auditing tasks.

1. Data gathering and analysis

An Audit Clerk is responsible for gathering and analysing financial data. This includes extracting data from source documents, such as bank statements, invoices, and contracts, and then summarising and presenting it in a clear and concise manner.

- Extract financial data from invoices, receipts, and bank statements.

- Enter data into spreadsheets and audit software.

- Analyse data to identify trends and patterns.

2. Auditing procedures

Audit Clerks assist in conducting various audit procedures, such as testing the accuracy and completeness of financial records, and evaluating the effectiveness of internal controls.

- Perform account reconciliations.

- Review and analyse financial statements.

- Assess the risk of fraud and error.

3. Reporting

Audit Clerks prepare audit reports that summarise the findings of the audit and make recommendations for improvements.

- Draft audit reports.

- Proofread and edit audit reports.

- Present audit reports to clients.

4. Communication

Audit Clerks must be able to communicate effectively with a variety of stakeholders, including clients, auditors, and management.

- Communicate audit findings to clients.

- Respond to client enquiries.

- Work as part of an audit team.

Interview Tips

Interviews can be nerve-wracking, but there are a few things you can do to increase your chances of success, such as preparation and practice.

1. Research the company

Before you go to your interview, it is important to research the company. This will help you understand the company’s culture, values, and goals.

- Visit the company’s website.

- Read the company’s annual report.

- Check the company’s social media pages.

2. Practice your answers

Once you have researched the company, you should practice your answers to common interview questions. This will help you feel more confident and prepared during your interview.

- Use the STAR method to answer behavioural questions.

- Be prepared to talk about your skills and experience.

- Have questions ready to ask the interviewer.

3. Dress professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or dress pants and a button-down shirt. You should also make sure your shoes are clean and your hair is neat.

- Choose clothes that are clean and wrinkle-free.

- Make sure your shoes are polished.

- Style your hair neatly.

4. Be on time

Punctuality is important for any interview. Make sure you arrive on time for your interview. If you are running late, call the interviewer to let them know.

- Give yourself plenty of time to get to the interview.

- If you are running late, call the interviewer to let them know.

- Apologise for being late when you arrive.

5. Be yourself

The most important thing is to be yourself during your interview. Don’t try to be someone you’re not. The interviewer wants to get to know the real you.

- Be honest about your skills and experience.

- Be enthusiastic and passionate about the job.

- Let your personality shine through.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Audit Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!