Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Balance Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

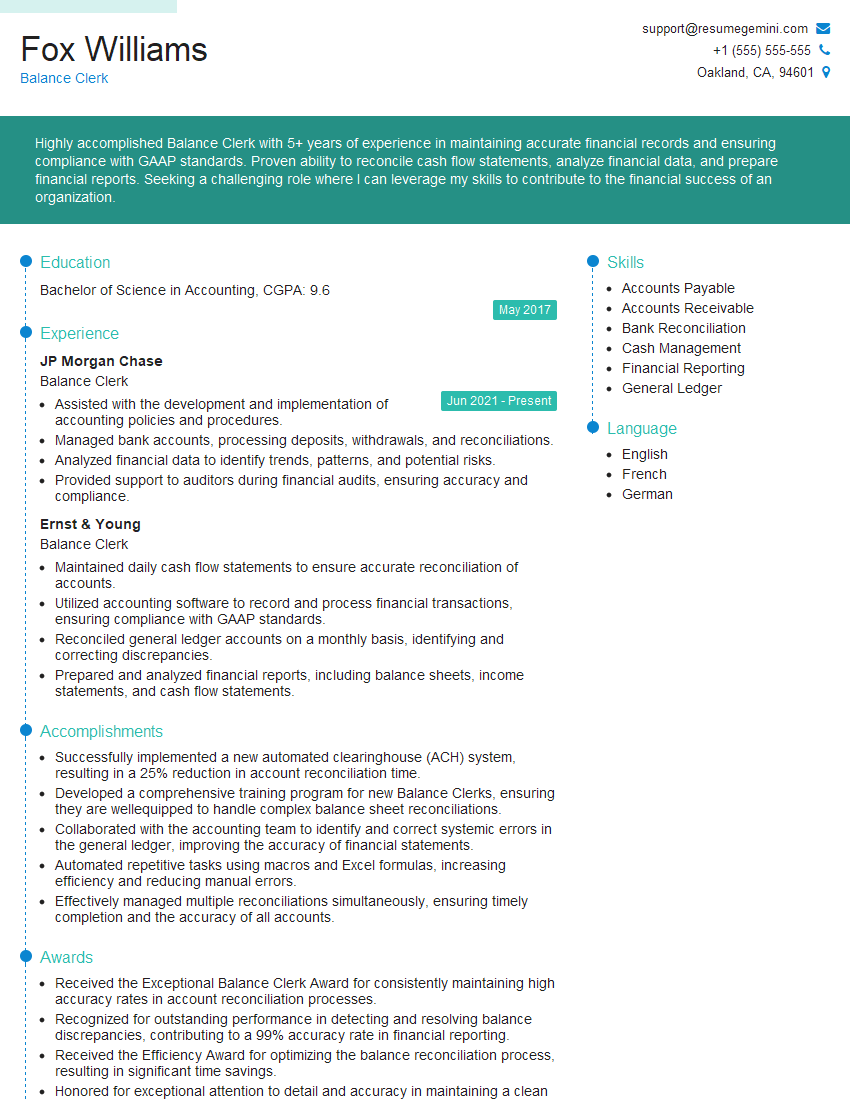

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Balance Clerk

1. Can you walk me through the process of reconciling bank accounts?

The process of reconciling bank accounts involves comparing the balances in the company’s accounting records with the balances reported on the bank statements. Discrepancies between the two balances must be investigated and resolved.

- Gather necessary documents including bank statements, accounting records, and supporting documentation.

- Compare the beginning balances on the bank statement and the accounting records.

- Review all transactions recorded in the accounting records and compare them to the transactions on the bank statement.

- Identify any outstanding deposits or checks that have not yet cleared the bank.

- Investigate any discrepancies between the two balances and make necessary adjustments to the accounting records.

- Prepare a reconciliation statement that explains the differences between the bank balance and the accounting balance.

2. How do you handle reconciling accounts with large volumes of transactions?

Automating Reconciliations

- Utilize reconciliation software or spreadsheets to automate the comparison process and reduce manual effort.

Streamlining Transactions

- Work with vendors and customers to consolidate payments and reduce the number of transactions.

- Encourage electronic payments and direct deposits to minimize paper-based transactions.

Prioritizing Exceptions

- Focus on reconciling accounts with significant balances or high transaction volumes.

- Set up alerts or reports to flag large or unusual transactions for immediate attention.

3. What is the importance of cutoff dates for bank reconciliations?

Establishing cutoff dates is crucial for bank reconciliations as it ensures that all transactions up to a specific point in time are included in the reconciliation process. This helps:

- Prevent duplicate or missed transactions.

- Facilitate timely identification and resolution of discrepancies.

- Ensure accurate financial reporting by capturing all transactions within the reporting period.

- Maintain compliance with accounting standards and internal control procedures.

4. How do you address material discrepancies during reconciliations?

- Investigate thoroughly: Examine supporting documentation, contact relevant parties, and analyze transaction details to determine the root cause.

- Document findings: Clearly record the results of the investigation, including any adjustments made to the accounting records.

- Communicate promptly: Inform the appropriate stakeholders about the discrepancy, the investigation findings, and any necessary actions.

- Implement corrective measures: Identify and address any underlying issues or process inefficiencies to prevent similar discrepancies in the future.

5. What methods do you use to ensure the accuracy of your reconciliations?

- Thorough review: Carefully examine all transactions, supporting documentation, and reconciliations for completeness and accuracy.

- Independent verification: Have another individual independently review the reconciliation process to identify any errors or omissions.

- Use of technology: Leverage reconciliation software or spreadsheets to automate the process and minimize manual errors.

- Regular monitoring: Periodically review reconciliation results and investigate any unusual trends or patterns to ensure ongoing accuracy.

6. How do you handle reconciling intercompany transactions?

Reconciling intercompany transactions requires coordination and collaboration with other entities within the organization. key steps include:

- Establish clear communication: Set up regular communication channels and protocols to ensure timely and accurate exchange of information.

- Use consistent accounting practices: Ensure that all intercompany transactions are recorded using the same accounting policies and procedures.

- Review supporting documentation: Obtain and review supporting documentation such as invoices, purchase orders, and remittance advices to verify the accuracy of transactions.

- Reconcile on a timely basis: Regularly reconcile intercompany accounts to identify and resolve any discrepancies promptly.

7. What is the role of internal controls in the bank reconciliation process?

Internal controls are crucial in ensuring the accuracy and reliability of the bank reconciliation process. Key internal controls include:

- Segregation of duties: Separate individuals should be responsible for reconciling bank accounts and authorizing transactions.

- Review and approval: Reconciliations should be reviewed and approved by a supervisor or manager to ensure accuracy and completeness.

- Documentation: Detailed documentation should be maintained to support the reconciliation process, including supporting documentation for adjustments made.

- Regular monitoring: The bank reconciliation process should be regularly monitored to ensure it is functioning effectively and that internal controls are being followed.

8. How do you stay updated on changes in accounting standards and regulations related to bank reconciliations?

- Attend industry conferences and seminars: Participate in events that provide updates on accounting standards and regulations.

- Subscribe to professional journals and newsletters: Stay informed through industry publications that cover relevant topics.

- Utilize online resources: Access websites and databases that provide information on accounting standards and regulations.

- Network with other professionals: Engage with colleagues, auditors, and industry experts to exchange knowledge and insights.

9. What are some common challenges you have faced in bank reconciliations and how did you resolve them?

Challenge: Identifying and resolving large or complex discrepancies

- Resolution: Conduct thorough investigations, review supporting documentation, and collaborate with relevant departments or external parties to determine the root cause and implement corrective actions.

Challenge: Dealing with high volumes of transactions

- Resolution: Utilize reconciliation software or spreadsheets to automate the process, prioritize high-risk or material transactions, and implement efficient review procedures.

Challenge: Coordinating with multiple stakeholders

- Resolution: Establish clear communication channels, set expectations, and involve relevant parties throughout the reconciliation process to ensure timely and accurate information exchange.

10. How do you ensure that your reconciliations are completed in a timely and efficient manner?

- Prioritize tasks: Identify and focus on reconciling accounts with significant balances or high transaction volumes.

- Utilize technology: Leverage reconciliation software or spreadsheets to automate the process and reduce manual effort.

- Establish a regular schedule: Set specific deadlines for completing reconciliations to ensure timely completion.

- Delegate and collaborate: When necessary, delegate tasks to capable team members and collaborate with colleagues to streamline the process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Balance Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Balance Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Balance Clerk is responsible for managing financial accounts and ensuring that expenses match revenue to maintain financial balance within an organization. Their daily functions include:

1. Reconciling Accounts

Balance Clerks meticulously compare bank statements, credit card statements, and other records to identify discrepancies and ensure that the accounts are reconciled.

- Analyzing cash flows, bank transactions, and invoices

- Investigating and resolving discrepancies between records

2. Maintaining General Ledgers

They are responsible for maintaining general ledgers and ensuring the accuracy and completeness of financial records.

- Recording and posting financial transactions

- Creating and distributing financial reports

3. Processing Invoices and Payments

Balance Clerks handle the processing of invoices and payments, ensuring timely and accurate payments to vendors and collection from customers.

- Verifying invoices and purchase orders

- Issuing payments and reconciling accounts payable

4. Managing Accounts Receivable and Payable

They manage accounts receivable and payable, ensuring timely payments and accurate records of outstanding amounts.

- Monitoring customer balances and issuing statements

- Collecting payments and managing accounts receivable aging

- Maintaining vendor relationships and processing payments

Interview Tips

To ace the interview for a Balance Clerk position, candidates should prepare thoroughly and showcase their skills and experience. Here are some tips to help candidates succeed:

1. Research the Company and Role

Candidates should research the company and the specific role to gain insights into the company’s culture, industry, and the responsibilities of the Balance Clerk.

- Visit the company’s website and social media pages

- Read industry news and articles

2. Highlight Relevant Skills and Experience

Candidates should emphasize their skills and experience relevant to the job. They should tailor their resume and cover letter to highlight their proficiency in financial management, attention to detail, and problem-solving abilities.

- Quantify accomplishments using specific metrics

- Provide specific examples of how they have managed financial accounts and resolved discrepancies

3. Practice Answering Common Interview Questions

Candidates should prepare for common interview questions by practicing their answers. This will help them speak confidently and clearly during the interview.

- Prepare answers to questions about their experience in account reconciliation, general ledger maintenance, and invoice processing

- Practice answering questions about their strengths and weaknesses

4. Dress Professionally and Arrive on Time

Candidates should dress professionally and arrive on time for the interview. This will convey respect for the interviewer and the company.

- Choose appropriate business attire

- Arrive a few minutes early to allow time to settle in and prepare

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Balance Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!