Feeling lost in a sea of interview questions? Landed that dream interview for Cash Accounting Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Cash Accounting Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

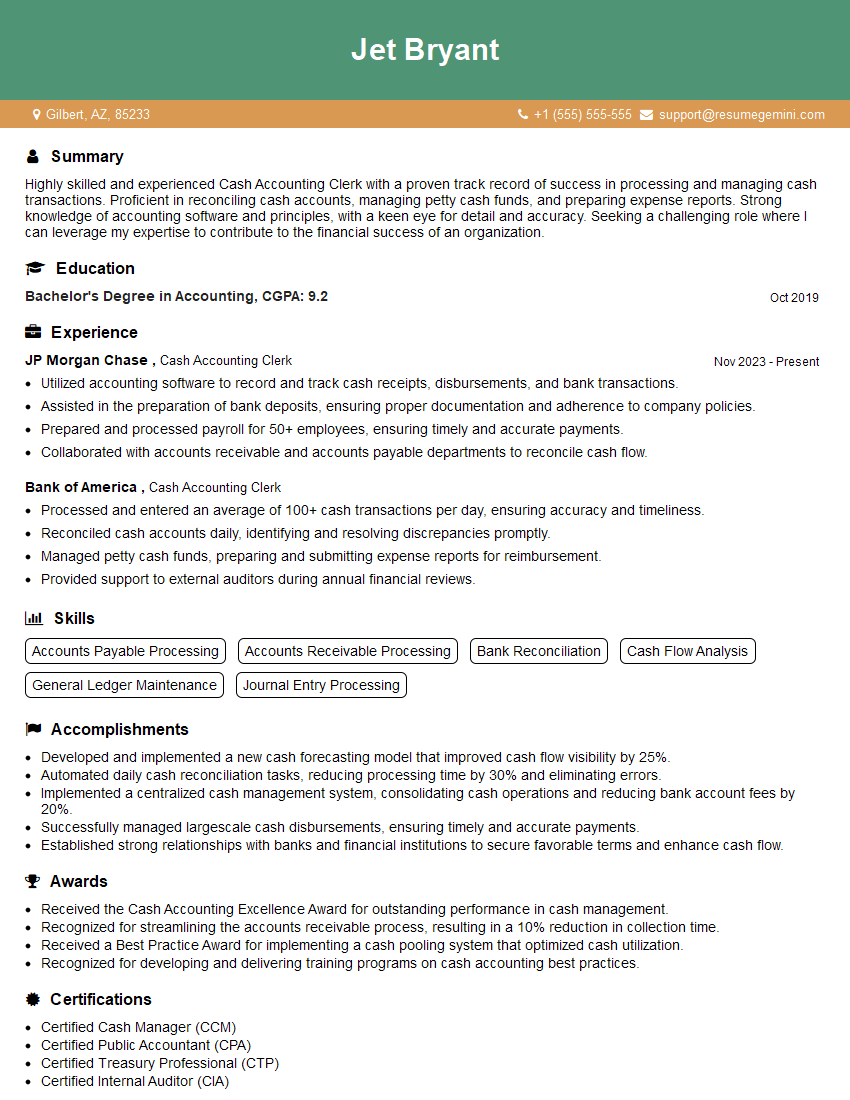

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cash Accounting Clerk

1. Explain the role of a Cash Accounting Clerk in a company’s financial management system.

In a company’s financial management system, a Cash Accounting Clerk plays a pivotal role in the accurate and timely recording and processing of cash transactions. Their responsibilities typically include:

- Recording cash receipts and disbursements

- Balancing cash accounts

- Preparing and reconciling bank statements

- Issuing checks and processing wire transfers

- Maintaining cash flow records

- Assisting with financial reporting and audits

2. Describe the steps involved in processing a cash receipt.

Handling Cash Receipts

- Receive and count cash payments

- Issue receipts and record transactions

- Deposit cash into bank accounts

Handling Checks Receipts

- Receive and endorse checks

- Record transactions in accounting system

- Deposit checks into bank accounts

3. How do you ensure the accuracy of cash transactions?

To ensure the accuracy of cash transactions, I adhere to the following principles:

- Maintaining dual control over cash handling

- Regularly reconciling bank statements

- Comparing cash receipts to sales records

- Investigating and resolving any discrepancies promptly

- Following established internal control procedures

4. Explain the process of preparing and reconciling a bank statement.

The process of preparing and reconciling a bank statement involves the following steps:

- Collecting supporting documents (bank statement, check register, deposit slips)

- Matching bank statement transactions to recorded transactions

- Investigating and resolving any discrepancies (e.g., outstanding checks, deposits in transit)

- Adjusting accounting records as necessary

- Preparing a reconciliation report that summarizes the differences

5. How do you handle cash flow management for a company?

My approach to cash flow management involves the following steps:

- Forecasting cash flows based on historical data and projections

- Monitoring cash inflows and outflows regularly

- Identifying potential cash flow shortfalls and surpluses

- Recommending strategies to optimize cash flow (e.g., adjusting payment terms, seeking financing)

- Collaborating with other departments to ensure timely invoicing and collections

6. What are the key accounting principles related to cash accounting?

The key accounting principles related to cash accounting include:

- Revenue is recognized when cash is received

- Expenses are recognized when cash is paid

- Assets and liabilities are recorded at their cash value

- Financial statements are prepared on a cash basis (i.e., only cash transactions are recorded)

7. How do you stay updated on changes in accounting standards and regulations?

To stay updated on changes in accounting standards and regulations, I regularly engage in the following activities:

- Attending industry conferences and workshops

- Reading professional publications and online resources

- Participating in continuing education programs

- Consulting with accountants and auditors

- Monitoring regulatory announcements and updates

8. What software applications are you proficient in for cash accounting?

I am proficient in the following software applications for cash accounting:

- QuickBooks

- Sage 50cloud Accounting

- NetSuite

- Microsoft Excel

- SAP Business One

9. How do you handle and prevent fraud in cash transactions?

To prevent and handle fraud in cash transactions, I implement the following measures:

- Establishing clear policies and procedures for cash handling

- Enforcing dual control over cash transactions

- Reconciling cash accounts regularly

- Investigating and reporting any suspicious activities

- Training staff on fraud prevention techniques

10. How do you prioritize your workload and manage deadlines in a fast-paced environment?

To prioritize my workload and manage deadlines in a fast-paced environment, I use the following techniques:

- Creating a daily or weekly to-do list and prioritizing tasks based on importance and urgency

- Breaking down large tasks into smaller, manageable chunks

- Delegating tasks to others when appropriate

- Using technology and automation tools to streamline processes

- Communicating regularly with colleagues and supervisors to stay on track and meet deadlines

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cash Accounting Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cash Accounting Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cash Accounting Clerks are responsible for managing cash flow and handling transactions, ensuring the accuracy and efficiency of financial records.

1. Cash Management

Maintaining proper cash flow, managing bank accounts, and reconciling bank statements.

- Receiving and processing cash payments, deposits, and withdrawals

- Disbursing funds through checks, electronic transfers, or petty cash

2. Accounts Receivable and Payable

Managing invoices, processing payments, and reconciling accounts receivable and payable.

- Sending invoices to customers and following up on outstanding payments

- Processing customer payments and applying them to accounts receivable

3. General Ledger Maintenance

Recording and maintaining transactions in the general ledger, ensuring accuracy and completeness.

- Posting journal entries and updating financial statements

- Preparing trial balances and other financial reports

4. Other Responsibilities

Performing other related tasks, such as auditing, customer service, or assisting with payroll.

- Assisting with month-end closing and financial reporting

- Providing customer service and resolving inquiries

Interview Tips

Preparing for a Cash Accounting Clerk interview requires understanding the role and demonstrating your skills and experience.

1. Research and Knowledge

Research the company, its industry, and the specific role you are applying for.

- Review the job description and identify keywords to highlight in your resume and answers

- Become familiar with the industry and accounting principles relevant to the position

2. Highlight Your Experience

Quantify your experience and provide specific examples of your skills and accomplishments.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences

- Focus on quantifying your results, such as reducing errors or improving cash flow

3. Practice Your Answers

Practice answering common interview questions, especially those related to cash accounting and financial management.

- Prepare for questions about your experience in managing cash, reconciling accounts, and maintaining financial records

- Consider asking the interviewer questions about the company and the role to show your interest and engagement

4. Be Professional and Presentable

Dress professionally and arrive on time for your interview.

- Maintain a positive and confident attitude throughout the interview

- Be prepared to provide references and follow up after the interview

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Cash Accounting Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.