Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commodity Loan Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

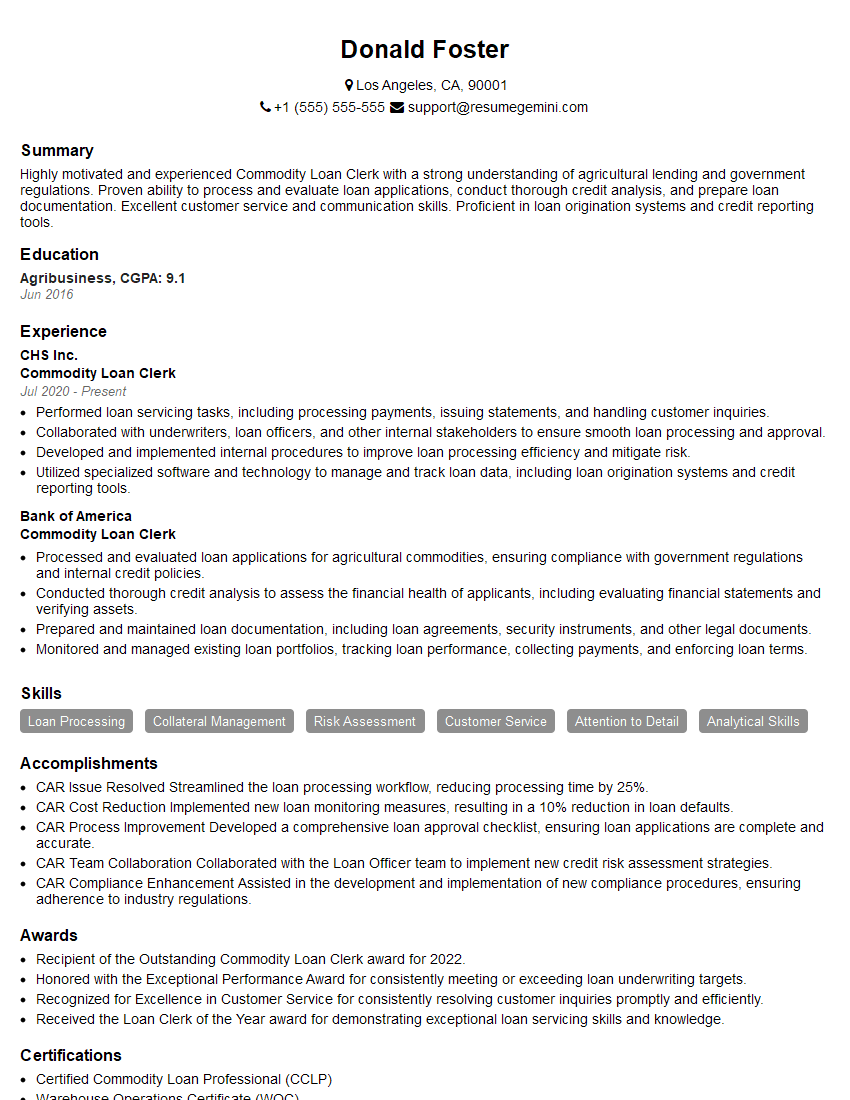

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commodity Loan Clerk

1. What are the key responsibilities of a Commodity Loan Clerk?

As a Commodity Loan Clerk, I would be responsible for:

- Processing and disbursing commodity loans

- Maintaining loan records and ensuring compliance with regulations

- Analyzing loan applications and determining creditworthiness

- Collaborating with other departments to ensure smooth loan operations

- Providing excellent customer service to loan applicants and borrowers

2. Can you describe the loan application process for a commodity loan?

Loan Application

- Review and analyze loan applications

- Verify applicant’s identity and eligibility

- Collect and assess financial statements and other supporting documents

Loan Analysis

- Determine applicant’s creditworthiness

- Assess collateral value and risk

- Calculate loan amount and terms

Loan Approval

- Submit loan recommendation to management

- Obtain loan approval

- Prepare and execute loan documents

3. What are the different types of collateral that can be used to secure a commodity loan?

- Agricultural commodities

- Inventory

- Equipment

- Real estate

- Other approved assets

4. What factors do you consider when determining the interest rate on a commodity loan?

- Applicant’s credit history and risk profile

- Loan amount and term

- Collateral value and marketability

- Current market interest rates

- Bank’s loan policies

5. What are the consequences of defaulting on a commodity loan?

- Loss of collateral

- Damage to credit score

- Legal action, such as foreclosure or bankruptcy

6. How do you track and manage loan collateral?

- Conduct regular inspections of collateral

- Monitor commodity prices and market conditions

- Maintain accurate records of collateral location and value

- Coordinate with warehouse or storage facilities

7. What software and databases do you use in your daily work?

- Loan processing software

- Credit scoring systems

- Commodity market databases

- Warehouse management systems

8. How do you maintain confidentiality and security in your role?

- Adhere to bank confidentiality policies

- Restrict access to sensitive information

- Use encryption and other security measures

- Follow proper document handling procedures

- Attend regular security training

9. What are the common challenges faced by Commodity Loan Clerks?

- Fluctuating commodity prices

- Managing loan risk

- Meeting regulatory compliance requirements

- Processing high-volume loan applications

- Providing exceptional customer service

10. How do you stay updated on industry best practices and regulations?

- Attend industry conferences and webinars

- Read trade publications and professional journals

- Participate in online forums and networking groups

- Complete professional development courses

- Consult with industry experts and regulators

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commodity Loan Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commodity Loan Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Commodity Loan Clerk plays a crucial role in managing and processing commodity loans within an organization. Their primary responsibilities include:

1. Loan Application Processing:

Receiving and reviewing loan applications, ensuring completeness and accuracy of the submitted documents.

- Checking for required documentation, such as financial statements, collateral information, and production records.

- Verifying the applicant’s eligibility for the loan program.

2. Loan Documentation:

Preparing and maintaining loan documents, including loan agreements, security agreements, and loan closing documents.

- Ensuring proper execution and recording of loan documents.

- Coordinating with legal counsel to review and approve loan documentation.

3. Collateral Management:

Evaluating and assessing collateral offered to secure loans, including warehouses, inventory, and equipment.

- Inspecting collateral to verify its condition and value.

- Monitoring collateral values and taking appropriate action to protect the lender’s interest.

4. Loan Disbursement:

Disbursing loan funds to borrowers based on the terms of the loan agreement.

- Ensuring that funds are disbursed in a timely and accurate manner.

- Monitoring loan payments and ensuring timely collection.

5. Loan Servicing:

Providing ongoing customer service and support to borrowers throughout the loan period.

- Answering borrower inquiries and providing loan-related information.

- Processing payments, adjustments, and modifications to loan terms.

6. Compliance:

Ensuring compliance with all applicable laws, regulations, and organizational policies related to commodity loans.

- Maintaining accurate records and documentation to support compliance.

- Staying informed of changes in loan programs and compliance requirements.

Interview Preparation Tips

To ace the interview for a Commodity Loan Clerk position, consider the following tips:

1. Research the Company and Industry:

Thoroughly research the company you are applying to, including their history, operations, and financial performance. Research the commodity loan industry to understand market trends and recent developments.

2. Highlight Your Skills and Experience:

Tailor your resume and cover letter to the specific requirements of the job. Quantify your accomplishments whenever possible, using specific metrics to demonstrate your contributions.

3. Practice the STAR Method:

When answering interview questions, use the STAR method to provide structured and comprehensive responses. Describe the Situation, Task, Action you took, and Result of your actions.

4. Prepare for Common Interview Questions:

Research common interview questions for Commodity Loan Clerks and prepare your answers in advance. Practice answering questions related to your experience, skills, and industry knowledge.

5. Ask Questions:

At the end of the interview, ask thoughtful questions to demonstrate your interest and engagement. Ask about the company’s loan programs, compliance initiatives, or future plans.

6. Dress Professionally and Arrive on Time:

First impressions matter. Dress professionally and arrive on time for your interview to show respect for the interviewer and the company.

7. Stay Confident and Enthusiastic:

Throughout the interview, maintain a confident and enthusiastic demeanor. This will convey your eagerness for the role and your belief in your qualifications.

8. Follow Up:

Within 24 hours of the interview, send a thank-you note to the interviewer. Express your appreciation for their time and reiterate your interest in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commodity Loan Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!