Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commission Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

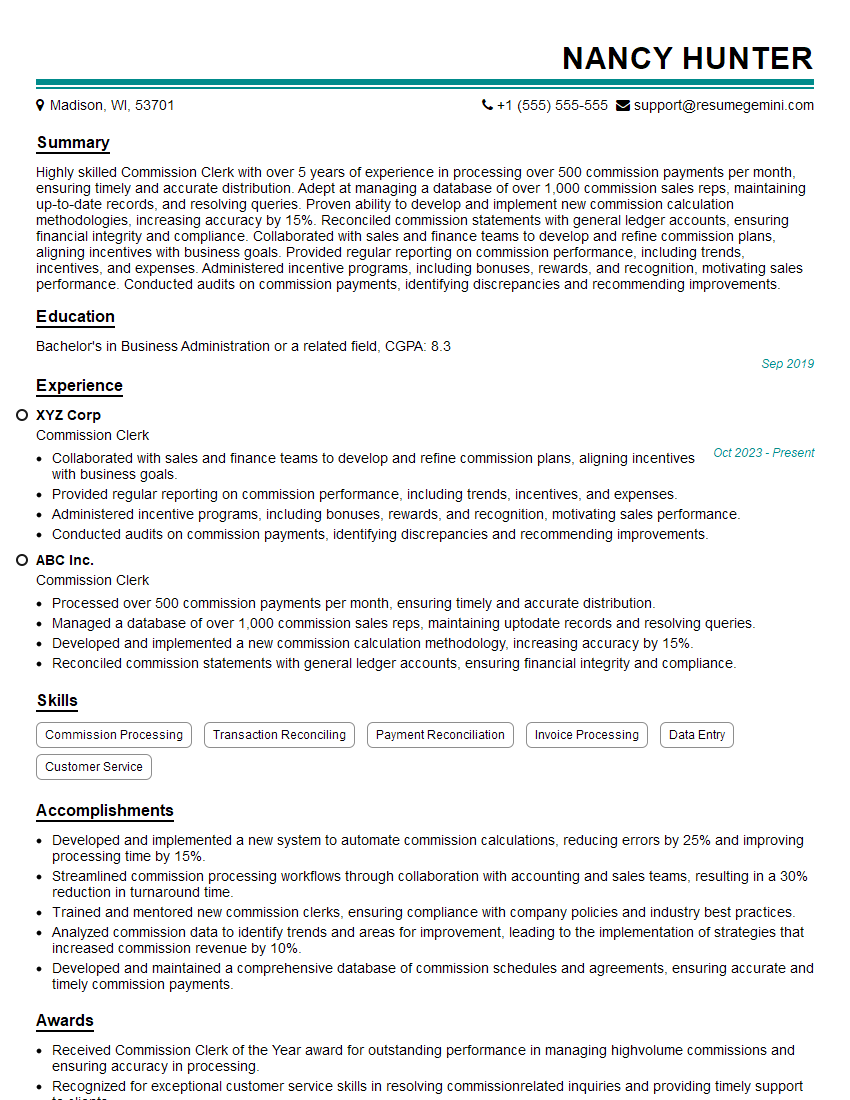

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commission Clerk

1. Describe the process of preparing and issuing a commission invoice?

The process of preparing and issuing a commission invoice typically involves the following steps:

- Identify the services provided by the commission agent and determine the commission rate.

- Calculate the commission amount based on the sales or revenue generated by the agent.

- Create an invoice that includes details such as the agent’s name, invoice date, invoice number, description of services, commission rate, commission amount, and payment terms.

- Review and approve the invoice for accuracy.

- Issue the invoice to the commission agent, either electronically or by mail.

- Maintain a record of all issued invoices for future reference.

2. Explain how you handle disputes or discrepancies related to commission payments?

Addressing Disputes

- Acknowledge the dispute promptly and gather all relevant information.

- Review the contract or agreement to verify the agreed-upon commission rate and terms.

- Discuss the issue with the commission agent to understand their perspective.

Resolving Discrepancies

- Identify the source of the discrepancy (e.g., calculation error, sales misreporting).

- Provide evidence to support the accuracy of the commission calculation.

- Negotiate a mutually acceptable resolution, if necessary.

- Document the resolution for future reference.

3. What is your understanding of the concept of “gross revenue” versus “net revenue” in the context of commission calculations?

Gross revenue refers to the total amount of sales generated by the commission agent, before deducting any expenses or discounts. Net revenue is the amount of revenue remaining after deducting expenses such as cost of goods sold, operating expenses, and discounts. Commission payments are typically calculated based on gross revenue, unless otherwise specified in the agreement.

4. How do you ensure that commission payments are processed accurately and on time?

- Establish clear timelines and deadlines for issuing invoices and making payments.

- Use a reliable accounting system to track sales data and calculate commissions.

- Implement a system of checks and balances to verify the accuracy of calculations.

- Communicate regularly with commission agents to ensure they have received their payments.

5. Describe your experience in managing multiple commission structures and how you handle the complexities involved?

- Demonstrate an understanding of different commission structures (e.g., tiered commissions, percentage-based commissions, flat fees).

- Explain how you track and calculate commissions based on different structures.

- Describe your ability to manage the complexities, such as varying sales targets, product categories, and payment schedules.

6. How do you ensure compliance with relevant laws and regulations related to commission payments?

- Stay up-to-date on industry regulations and legal requirements.

- Review contracts and agreements to ensure compliance.

- Maintain accurate records of all commission transactions.

- Seek legal advice when necessary to ensure compliance.

7. How do you handle situations where commission payments are tied to performance targets?

- Establish clear and measurable performance targets.

- Monitor and track agent performance regularly.

- Provide regular feedback to agents on their progress.

- Adjust commission payments based on achievement of targets.

8. Describe your experience in using technology tools to automate commission calculations and streamline the process?

- Demonstrate proficiency in using accounting software, CRM systems, or commission management tools.

- Explain how technology helps improve accuracy, efficiency, and timeliness of commission payments.

- Discuss any challenges faced and solutions implemented.

9. How do you handle cases where commission payments may involve multiple levels of agents or intermediaries?

- Establish clear commission structures and agreements for each level of agent.

- Track and calculate commissions accurately, accounting for multiple levels.

- Communicate effectively with agents to ensure transparency and understanding.

10. Describe your strengths and weaknesses as a Commission Clerk?

Strengths:

- Strong attention to detail and accuracy in calculations.

- Understanding of different commission structures and payment methods.

- Ability to handle multiple tasks and meet deadlines.

- Proficient in using accounting software and technology tools.

Weaknesses:

- Lack of experience in managing international commission payments.

- Areas where I can improve include enhancing my communication skills and developing a deeper understanding of legal and regulatory aspects related to commission payments.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commission Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commission Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Commission Clerk is responsible for a wide range of duties that contribute to the smooth functioning of the organization. They play a crucial role in maintaining records, processing transactions, and providing support to the sales team and customers.

1. Commission Calculation and Payment

One of the primary responsibilities of a Commission Clerk is to accurately calculate and process sales commissions for the sales team. This involves reviewing sales records, applying commission rates, and ensuring timely payments to the sales representatives.

- Calculate sales commissions based on established company policies.

- Verify sales data and ensure accuracy before processing payments.

2. Record Keeping and Reporting

Commission Clerks are responsible for maintaining accurate and detailed records of commission transactions. They track sales performance, prepare reports, and ensure compliance with company regulations.

- Maintain commission records in a secure and organized manner.

- Prepare reports on commission payments, sales performance, and other relevant metrics.

3. Sales Support

Commission Clerks provide support to the sales team by assisting with commission-related inquiries, resolving issues, and ensuring smooth communication.

- Respond to inquiries and provide support to sales representatives regarding commissions.

- Resolve any discrepancies or issues related to commission payments.

4. Customer Support

In some cases, Commission Clerks may also provide customer support by answering questions, resolving issues, and providing updates on commission payments.

- Handle customer inquiries related to commissions and sales incentives.

- Resolve customer complaints and ensure satisfaction with commission payments.

Interview Tips

Preparing for an interview for a Commission Clerk position requires thorough research, practice, and a solid understanding of the role’s responsibilities. Here are some tips:

1. Research the Company and Role

Familiarize yourself with the company’s industry, products/services, and culture. Research the specific role you’re applying for, including its responsibilities and qualifications.

2. Highlight Relevant Skills and Experience

Emphasize your skills in commission calculation, record keeping, and customer support. If you have experience in a similar role, quantify your achievements using specific metrics.

3. Prepare Example Answers

Anticipate common interview questions and prepare well-structured answers. Use the STAR method (Situation, Task, Action, Result) to describe your experiences and demonstrate your abilities.

4. Practice Active Listening

During the interview, pay attention to the interviewer’s questions and respond thoughtfully. Ask clarifying questions to ensure understanding and show your engagement.

5. Be Enthusiastic and Professional

Show your enthusiasm for the role and the company. Maintain a positive attitude and dress professionally to make a favorable impression.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commission Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!