Feeling lost in a sea of interview questions? Landed that dream interview for Payroll Bookkeeper but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Payroll Bookkeeper interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

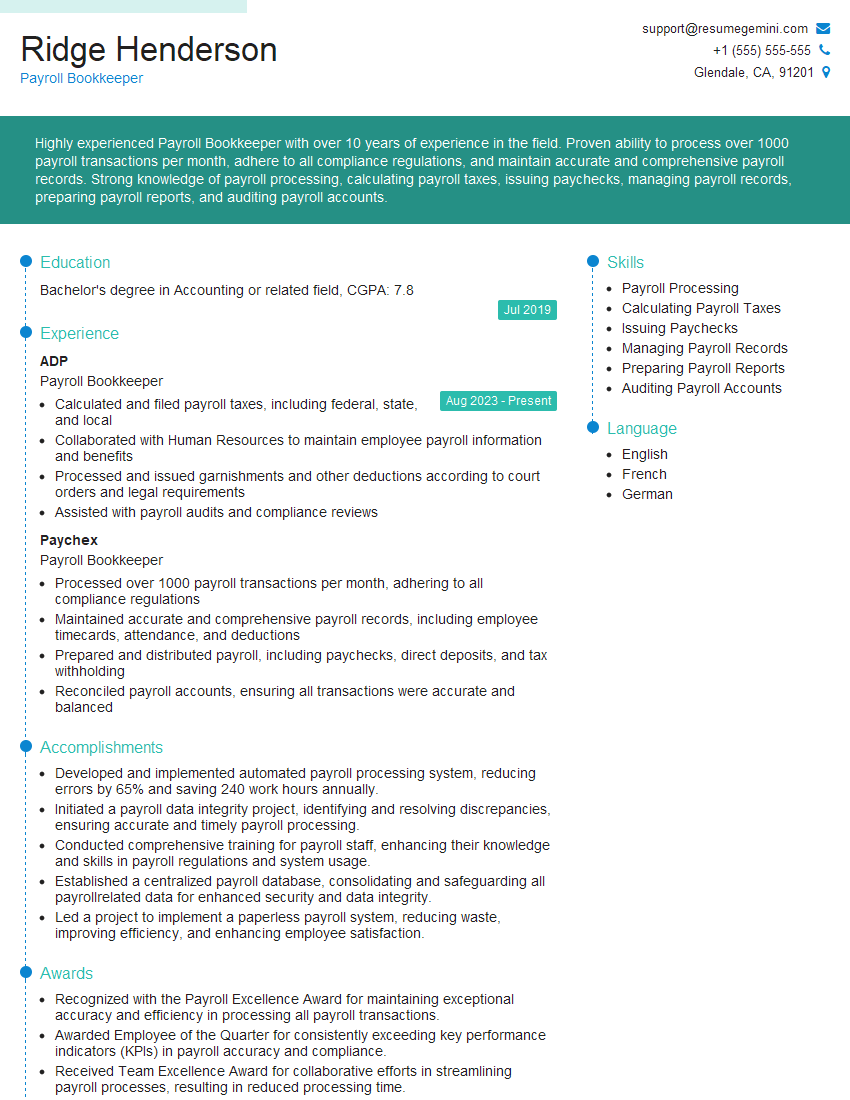

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Bookkeeper

1. Explain the payroll processing cycle in detail.

The payroll processing cycle involves several key steps:

- Data Collection: Gathering necessary employee information such as hours worked, earnings, and deductions.

- Calculation: Determining gross pay, withholding taxes, and other deductions based on employee data and applicable regulations.

- Deductions Processing: Withholding taxes, health insurance premiums, and other employee deductions are calculated and processed.

- Net Pay Calculation: Gross pay minus deductions results in net pay, which is the amount paid to employees.

- Payroll Distribution: Issuing paychecks or direct deposits to employees on a scheduled payday.

- Compliance Reporting: Preparing and submitting tax reports, such as Form W-2 and Form 941, to government agencies.

2. Describe the different methods of payroll processing.

- Manual Payroll: Calculations are performed manually using spreadsheets or calculators.

- Semi-Automated Payroll: Software is used to automate certain tasks, while others are still performed manually.

- Automated Payroll: Comprehensive software handles all payroll functions, from data entry to tax reporting.

3. What are the key laws and regulations that govern payroll processing?

- Fair Labor Standards Act (FLSA): Establishes minimum wage, overtime pay, and record-keeping requirements.

- Social Security Act: Governs payroll taxes, including Social Security and Medicare.

- Federal Unemployment Tax Act (FUTA): Levies taxes on employers to provide unemployment benefits.

- Employee Retirement Income Security Act (ERISA): Regulates retirement plans and employee benefits.

- State and local payroll laws: May impose additional requirements, such as paid time off and sick leave.

4. Explain the importance of payroll accuracy.

- Ensures employees receive correct wages and benefits.

- Prevents overpayments and underpayments.

- Avoids penalties and fines for non-compliance with regulations.

- Maintains employee morale and trust.

5. Describe the role of technology in modern payroll processing.

- Automates calculations and reduces manual errors.

- Streamlines data entry and reduces processing time.

- Provides secure storage and retrieval of payroll data.

- Integrates with other HR systems for employee data management.

- Facilitates electronic paychecks and tax reporting.

6. How do you ensure confidentiality and privacy of payroll information?

I adhere to strict confidentiality protocols, including:

- Limiting access to payroll data to authorized personnel only.

- Securely storing and transmitting payroll information.

- Maintaining confidentiality during data processing and payroll distribution.

7. What are some best practices for managing payroll deductions?

- Obtain employee authorization for all deductions.

- Ensure deductions are compliant with legal and regulatory requirements.

- Clearly communicate deduction details to employees.

- Process deductions accurately and on a timely basis.

8. How do you handle payroll discrepancies and errors?

- Identify the error or discrepancy promptly.

- Research and gather necessary information.

- Correct the error and ensure its accuracy.

- Communicate with affected employees and relevant departments.

9. Describe your experience with different payroll software platforms.

I have experience with several payroll software platforms, including:

- ADP

- Paylocity

- Gusto

- QuickBooks Payroll

I am proficient in using these platforms for payroll processing, tax reporting, and compliance.

10. Explain how you stay up-to-date on changes in payroll regulations.

- Subscribe to industry publications and newsletters.

- Attend workshops and seminars.

- Refer to official government websites and resources.

- Network with other payroll professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Payroll Bookkeeper is accountable for managing payroll functions, ensuring compliance with legal regulations, and maintaining accurate financial records. Key job responsibilities include:

1. Payroll Processing

Process payroll on a timely basis, including calculating wages, deductions, and taxes.

- Review timecards, employee records, and other supporting documents.

- Calculate gross pay, deductions, and net pay for each employee.

2. Tax Reporting and Compliance

Comply with federal, state, and local tax regulations related to payroll.

- File payroll tax returns, such as Form 941 and Form 940.

- Maintain records of all payroll-related transactions.

3. Reconciliation and Reporting

Reconcile payroll expenses with bank statements and other financial records.

- Prepare payroll reports and summaries for management and external agencies.

- Assist with payroll audits and investigations.

4. Employee Benefits Administration

Administer employee benefits, such as health insurance, retirement plans, and paid time off.

- Process employee benefit deductions from payroll.

- Maintain records and file necessary reports related to employee benefits.

5. Communication and Customer Service

Communicate effectively with employees, managers, and external stakeholders regarding payroll-related matters.

- Respond to employee inquiries and resolve payroll issues promptly.

- Provide training and support to employees on payroll-related policies and procedures.

Interview Preparation Tips

To ace the interview for a Payroll Bookkeeper position, it is essential to prepare thoroughly. Here are some effective interview preparation tips:

1. Research the Company and Position

Familiarize yourself with the company’s industry, size, culture, and financial performance.

- Visit the company website, LinkedIn page, and any other relevant online resources.

- Read industry news and articles to stay up-to-date on current trends.

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to payroll bookkeeping, such as:

- Can you describe your experience with payroll processing and tax compliance?

- How do you stay updated on changes in payroll laws and regulations?

- Tell me about a time you resolved a complex payroll issue.

3. Showcase Your Skills and Experience

Highlight your relevant skills and experience in your resume and during the interview.

- Quantify your accomplishments using specific metrics and examples.

- Emphasize your strengths in payroll processing, tax compliance, and financial reporting.

4. Ask Thoughtful Questions

Ask insightful questions to demonstrate your interest in the position and the company.

- Inquire about the company’s payroll system and the challenges you may face.

- Ask about opportunities for professional development and career growth.

5. Dress Professionally and Be Confident

Make a positive impression by dressing professionally and arriving punctually for the interview.

- Choose appropriate business attire and ensure you are well-groomed.

- Maintain eye contact, speak clearly, and be confident in your abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Bookkeeper interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!