Are you gearing up for an interview for a Commercial Teller position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Commercial Teller and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

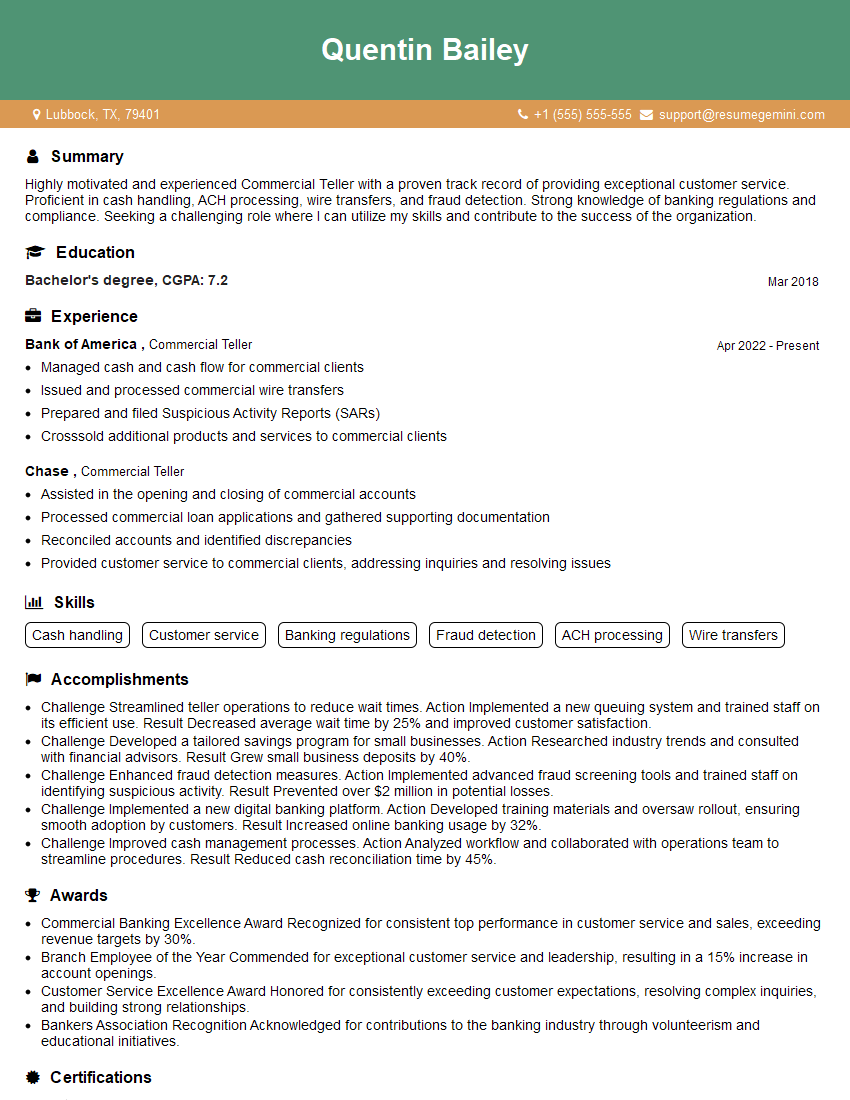

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Teller

1. Explain the process of cashing a check for a customer?

Sample Answer

- Verify the customer’s identification and check the signature against the ID.

- Examine the check for any alterations or irregularities.

- Check the balance in the customer’s account to ensure sufficient funds.

- Calculate the amount of cash to be dispensed, including any fees.

- Count the cash carefully and verify it with the customer.

- Process the transaction using the bank’s system and provide the customer with a receipt.

2. Describe the steps involved in opening a new account for a customer?

Account Verification

- Verify the customer’s identity and address.

- Check for any outstanding debts or negative credit history.

Account Selection

- Discuss the different types of accounts available.

- Help the customer choose the account that best meets their needs.

Account Setup

- Collect the necessary account information.

- Set up the account in the bank’s system.

- Issue the customer a welcome kit with account details and instructions.

3. How do you handle a customer who is angry or upset?

Sample Answer

- Stay calm and professional, even if the customer is being aggressive.

- Listen attentively to the customer’s concerns and empathize with their situation.

- Explain the bank’s policies and procedures clearly and patiently.

- Offer solutions or alternative options to address the customer’s issue.

- Provide updates and resolve the issue efficiently.

4. What are the key responsibilities of a Commercial Teller?

Sample Answer

- Perform cash and check transactions, including deposits, withdrawals, and exchanges.

- Open and close accounts, issue debit cards, and process loan applications.

- Provide customer service, answer questions, and resolve issues.

- Maintain a clean and organized work area.

- Follow bank policies and procedures to ensure compliance and security.

5. How do you prioritize multiple tasks and manage a busy workload?

Sample Answer

- Understand the urgency of different tasks.

- Organize and prioritize based on importance and deadlines.

- Delegate tasks to colleagues when appropriate.

- Stay focused and avoid distractions.

- Communicate with supervisors and team members to ensure smooth workflow.

6. Describe a time when you had to use your problem-solving skills to resolve a customer issue?

Sample Answer

- Describe the specific situation and the issue encountered.

- Explain the steps taken to analyze the problem and identify potential solutions.

- Highlight the solution chosen and its effectiveness.

- Emphasize your problem-solving abilities and the positive outcome.

7. How do you stay up-to-date on industry regulations and best practices in banking?

Sample Answer

- Attend industry conferences and webinars.

- Read financial and banking publications.

- Participate in training programs and workshops.

- Network with other banking professionals.

- Monitor changes in laws and regulations.

8. What are the most important qualities of a successful Commercial Teller?

Sample Answer

- Customer service skills

- Attention to detail

- Accuracy and efficiency

- Problem-solving ability

- Knowledge of banking products and services

9. How do you handle discrepancies in cash transactions?

Sample Answer

- Recount the cash carefully.

- Check the transaction details and customer information.

- Contact the supervisor for support and guidance.

- Document the discrepancy and follow bank procedures for resolving cash issues.

10. Describe your experience in handling high-value transactions?

Sample Answer

- Explain your responsibilities and processes for handling large amounts of cash or checks.

- Highlight your understanding of security measures and risk management protocols.

- Provide examples of successful completion of high-value transactions.

- Emphasize your attention to detail and ability to work under pressure.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Tellers play a crucial role in facilitating financial transactions for businesses. Their responsibilities include:

1. Customer Service

Provide exceptional customer service by greeting customers promptly, addressing their inquiries, and resolving their concerns efficiently.

- Process cash, check, and electronic transactions accurately and promptly.

- Cash and order checks, traveler’s checks, and foreign currency.

- Maintain a clean and organized work area.

- Follow all bank policies and procedures.

2. Cash Management

Handle cash transactions securely, including receiving, counting, and verifying large amounts of currency. Ensure the accuracy and integrity of all cash transactions.

- Operate and maintain cash drawers, ATMs, and other teller equipment.

- Balance cash drawers and reconcile transactions at the end of each shift.

3. Transaction Processing

Process a wide range of transactions, including deposits, withdrawals, loan payments, and wire transfers. Verify customer information, check for proper documentation, and ensure compliance with bank regulations.

- Enter transaction details accurately and efficiently.

- Follow AML (Anti-Money Laundering) and KYC (Know Your Customer) guidelines.

- Identify and report suspicious transactions or activities.

4. Cross-Selling

Promote and cross-sell bank products and services to customers, such as savings accounts, checking accounts, loans, and investments. Provide information and answer customer questions about these products.

- Build relationships with customers and understand their financial needs.

- Meet or exceed sales targets for cross-selling products.

Interview Tips

Preparing thoroughly for a Commercial Teller interview can increase your chances of success. Here are some valuable tips to help you ace the interview:

1. Research the Bank and Position

Familiarize yourself with the bank’s website, mission, and values. Research the Commercial Teller position and its specific responsibilities within the bank.

- Tailor your answers to the specific bank and position you are applying for.

- Example: “I am particularly interested in the Commercial Teller position at your bank because of its focus on providing exceptional customer service and its commitment to financial literacy.”

2. Highlight Customer Service Skills

Commercial Tellers are responsible for providing excellent customer service. In the interview, emphasize your ability to interact with customers professionally, resolve their issues effectively, and maintain a positive attitude.

- Share specific examples of how you have handled challenging customer interactions.

- Example: “In my previous role, I dealt with a customer who was upset about a transaction. By listening attentively, empathizing with their concerns, and providing a clear explanation, I was able to resolve the issue and maintain a positive relationship with the customer.”

3. Emphasize Accuracy and Attention to Detail

Accuracy and attention to detail are crucial for Commercial Tellers. In the interview, demonstrate your strong numerical skills, ability to follow procedures meticulously, and commitment to ensuring the integrity of financial transactions.

- Provide examples of your experience handling large amounts of cash or processing complex transactions.

- Example: “In my previous role, I was responsible for balancing cash drawers and reconciling transactions at the end of each shift. I consistently maintained accuracy and met all deadlines.”

4. Prepare for Common Interview Questions

Research common interview questions for Commercial Tellers and prepare your answers in advance. Practice delivering your answers clearly and confidently.

- Be prepared to answer questions about your experience, skills, and why you are interested in the position.

- Example: “I am confident that my customer service skills, attention to detail, and experience in cash handling make me an ideal candidate for the Commercial Teller position at your bank.”

5. Be Professional and Enthusiastic

Dress professionally, arrive on time for the interview, and maintain a positive and enthusiastic demeanor throughout the process. Your professionalism and enthusiasm will make a lasting impression on the interviewers.

- Prepare questions to ask the interviewers at the end of the interview.

- Example: “I am curious about the bank’s commitment to employee development. Can you provide me with some information about the training and advancement opportunities available to Commercial Tellers?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Teller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!