Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Foreign Banknote Teller position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

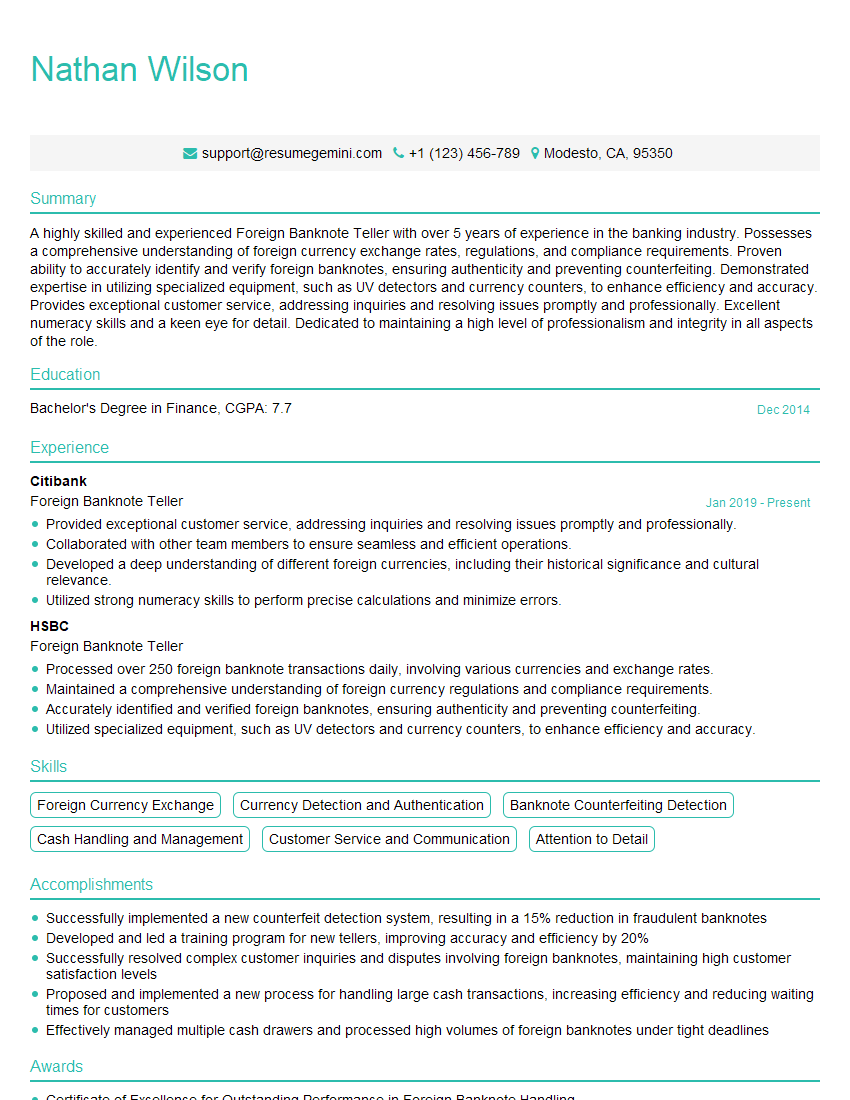

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Banknote Teller

1. How would you authenticate foreign banknotes?

- Examining security features such as watermarks, security threads, and holograms.

- Checking the thickness, texture, and quality of the paper.

- Verifying the accuracy of the printing and colors.

- Using ultraviolet or infrared light to detect hidden features.

- Consulting reference materials and databases for authentication.

2. What are the key factors to consider when valuing foreign banknotes?

Condition

- Circulated or uncirculated

- Presence of tears, folds, or stains

Rarity

- Limited print runs or special editions

- Commemorative or historical significance

Market demand

- Popularity among collectors or investors

- Economic factors influencing currency values

3. How do you handle counterfeit banknotes?

- Mark the note as “counterfeit” and isolate it from genuine banknotes.

- Notify the bank or authorities immediately.

- Cooperate with law enforcement in any investigations.

- Document the incident thoroughly, including details about the suspected counterfeit note.

- Review security procedures and enhance authentication measures to prevent future incidents.

4. What are the ethical guidelines you follow in your role?

- Maintain confidentiality and protect customer information.

- Adhere to anti-money laundering and terrorist financing regulations.

- Avoid conflicts of interest and personal gain.

- Act with integrity and honesty in all transactions.

- Respect and comply with bank policies and procedures.

5. How do you stay up-to-date with changes in foreign currency markets?

- Monitor financial news and market reports.

- Attend industry conferences and workshops.

- Subscribe to trade publications and research materials.

- Network with other professionals in the field.

- Utilize online resources and databases.

6. What software or systems do you use in your daily operations?

- Currency exchange software

- Banknote authentication systems

- Anti-money laundering and compliance tools

- Customer relationship management systems

- Reporting and auditing software

7. How do you handle difficult customers or situations?

- Remain calm and professional.

- Listen attentively to the customer’s concerns.

- Empathize with their perspective.

- Explain policies and procedures clearly.

- Offer solutions or alternatives whenever possible.

8. What are the challenges you face in this role?

- Authenticating foreign banknotes accurately and efficiently.

- Keeping up with changes in currency markets and regulations.

- Handling suspicious transactions and potential fraud.

- Providing excellent customer service in a fast-paced environment.

- Maintaining a high level of security and compliance.

9. Why are you interested in this role?

- Passion for foreign currency and exchange markets.

- Desire to contribute to the international business community.

- Interest in developing expertise in foreign banknote authentication.

- Strong attention to detail and accuracy.

- Excellent customer service and communication skills.

10. What are your career goals?

- Advance to a senior position in foreign exchange operations.

- Become a certified foreign exchange specialist.

- Develop a deep understanding of international finance and economics.

- Contribute to the growth and success of the financial institution.

- Mentor and train junior tellers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Banknote Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Banknote Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Foreign Banknote Tellers are responsible for handling foreign banknotes in a banking environment. They play a crucial role in providing exceptional customer service while ensuring accurate and efficient foreign currency transactions.

1. Customer Service

Provide excellent customer service by assisting individuals with foreign currency exchange, check cashing, and other related transactions.

- Greet customers courteously, answer their inquiries, and resolve their concerns.

- Process foreign currency transactions accurately and promptly, ensuring compliance with bank policies.

2. Foreign Banknote Handling

Handle and verify foreign banknotes, ensuring their authenticity and condition.

- Identify and count foreign banknotes using specialized equipment and knowledge.

- Maintain a safe and secure environment while handling large sums of money.

3. Cash Operations

Perform cash operations related to foreign currency, including counting, sorting, and verifying.

- Reconcile daily transactions and maintain accurate cash records.

- Comply with all applicable laws and regulations governing foreign currency transactions.

4. Compliance and Reporting

Adhere to bank policies and regulatory guidelines related to foreign currency transactions.

- Report suspicious transactions or activities in accordance with anti-money laundering laws.

- Maintain confidentiality and protect sensitive customer information.

Interview Tips

Preparing thoroughly for an interview is essential to showcase your skills and impress the hiring manager. Here are some tips to help you ace your Foreign Banknote Teller interview:

1. Research the Bank and Position

Learn about the bank’s reputation, services, and foreign currency operations. Research the specific role and its responsibilities to demonstrate your understanding of the position.

- Visit the bank’s website and read any available information.

- Network with professionals in the industry to gain insights.

2. Highlight Your Foreign Currency Knowledge

Emphasize your knowledge and experience in handling foreign banknotes. Showcase your ability to identify, verify, and count currencies accurately.

- Discuss any relevant training or certifications you have obtained.

- Describe situations where you have successfully handled foreign currency transactions.

3. Demonstrate Attention to Detail

Foreign Banknote Tellers must be highly detail-oriented. Highlight your ability to count and verify currency precisely, maintain accurate records, and follow bank procedures meticulously.

- Provide examples of how you have managed large sums of money with precision.

- Explain how you handle discrepancies and resolve errors efficiently.

4. Emphasize Customer Service Skills

Exceptional customer service is vital for Foreign Banknote Tellers. Demonstrate your ability to interact professionally, provide clear and accurate information, and resolve customer concerns effectively.

- Share examples of how you have exceeded customer expectations in previous roles.

- Discuss your approach to handling challenging customer situations.

5. Showcase Your Compliance and Security Awareness

Foreign Banknote Tellers are responsible for adhering to strict compliance and security guidelines. Highlight your understanding of anti-money laundering laws, know-your-customer principles, and bank security protocols.

- Describe how you have ensured compliance with regulations in your previous roles.

- Explain your procedures for handling suspicious transactions or activities.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Foreign Banknote Teller, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Foreign Banknote Teller positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.